Former Goldman Sachs Executive Says ‘Clear’ Bull Trend About To Manifest for Crypto and Technology Stocks

Real Vision founder and macro expert Raoul Pal is doubling down on his stance that crypto and tech assets are setting up for explosive bull runs.

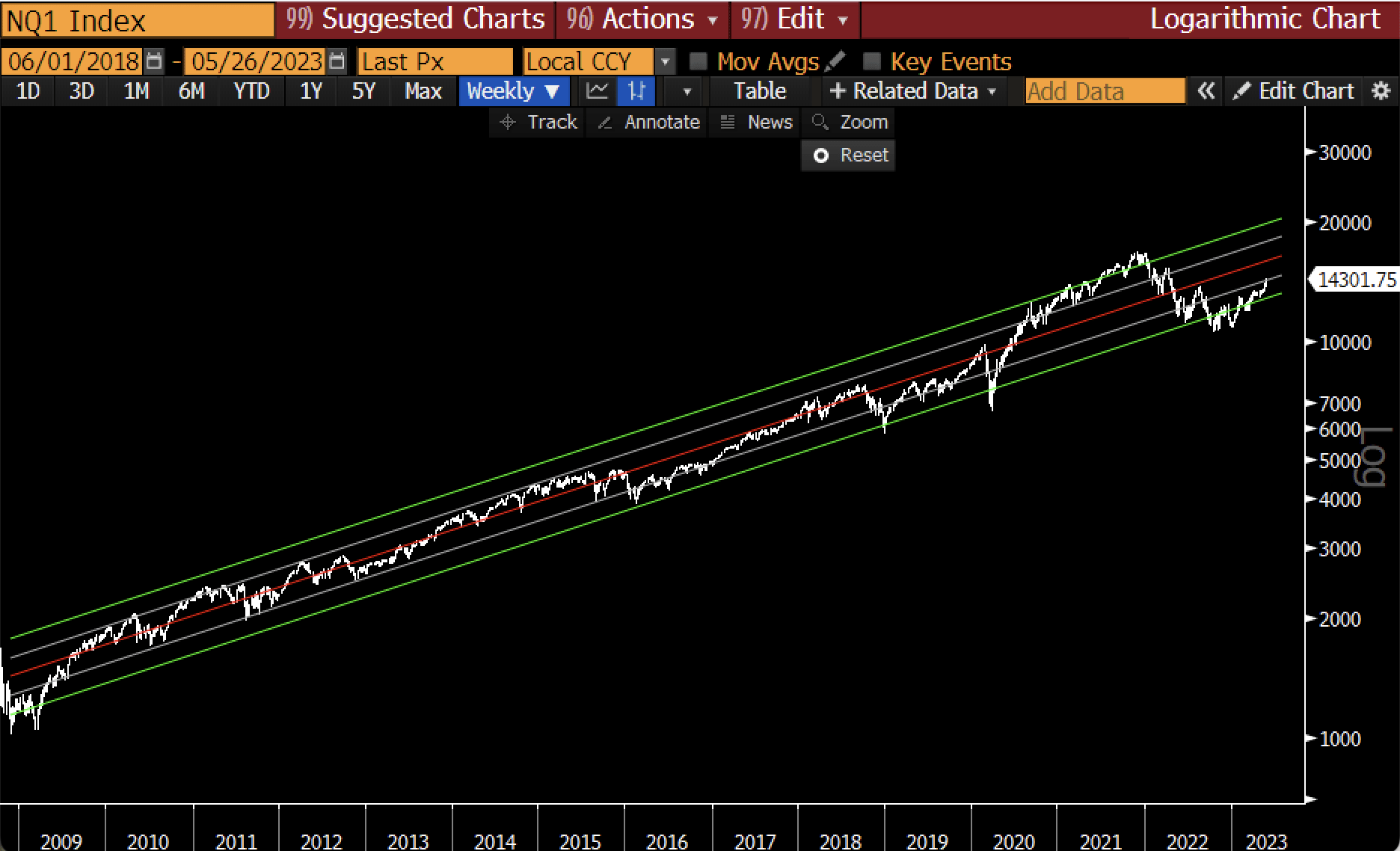

Pal tells his 995,000 Twitter followers that the Nasdaq, which indexes mainly technology companies, is an example of a nonstop macro uptrend that always catches traders off guard.

Pal’s chart suggests the Nasdaq 100 index (NDX) is trading well at a discount and likely destined for much higher prices.

“The biggest and most persistent macro trend on Earth is the one that gets the most pushback from many…

The Exponential Age of technology.

It can’t be clearer (NDX).”

Source: Raoul Pal/Twitter

The former Goldman Sachs executive also says that Bitcoin (BTC) is another example of a clear uptrend in innovative technology.

“…It really can’t be clearer (BTC):”

Source: Raoul Pal/Twitter

The secular bull trend in technology, which Pal calls “The Exponential Age” will, according to him, be partially led by crypto assets.

“Remember in ‘The Exponential Age’ thesis, assets with a secular adoption trend (crypto and tech) outperform the global liquidity cycle and ALL other assets…

There will be corrections and all dips are to be bought.”

Besides Bitcoin, Pal has previously called for a new leg higher for Ethereum (ETH) rival Solana (SOL)

“Solana looks like it’s getting ready to make its next move higher after a period of consolidation following the inverse head and shoulders breakout in April. Solana was a big bet at GMI (Global Macro Investor) this year and is up nearly 150% year-to-date…”

Source: Raoul Pal/Twitter

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Litecoin

Litecoin  Hedera

Hedera  Zcash

Zcash  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Pax Dollar

Pax Dollar  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD