Research: Bitcoin long-term holders remain bullish despite losses

Bitcoin’s (BTC) year-long decline has left several holders with unrealized losses, including long-term holders (LTH) who have held the coin for at least six months.

However, CryptoSlate’s analysis of Glassnode data showed that this group of investors remains bullish on the flagship digital asset.

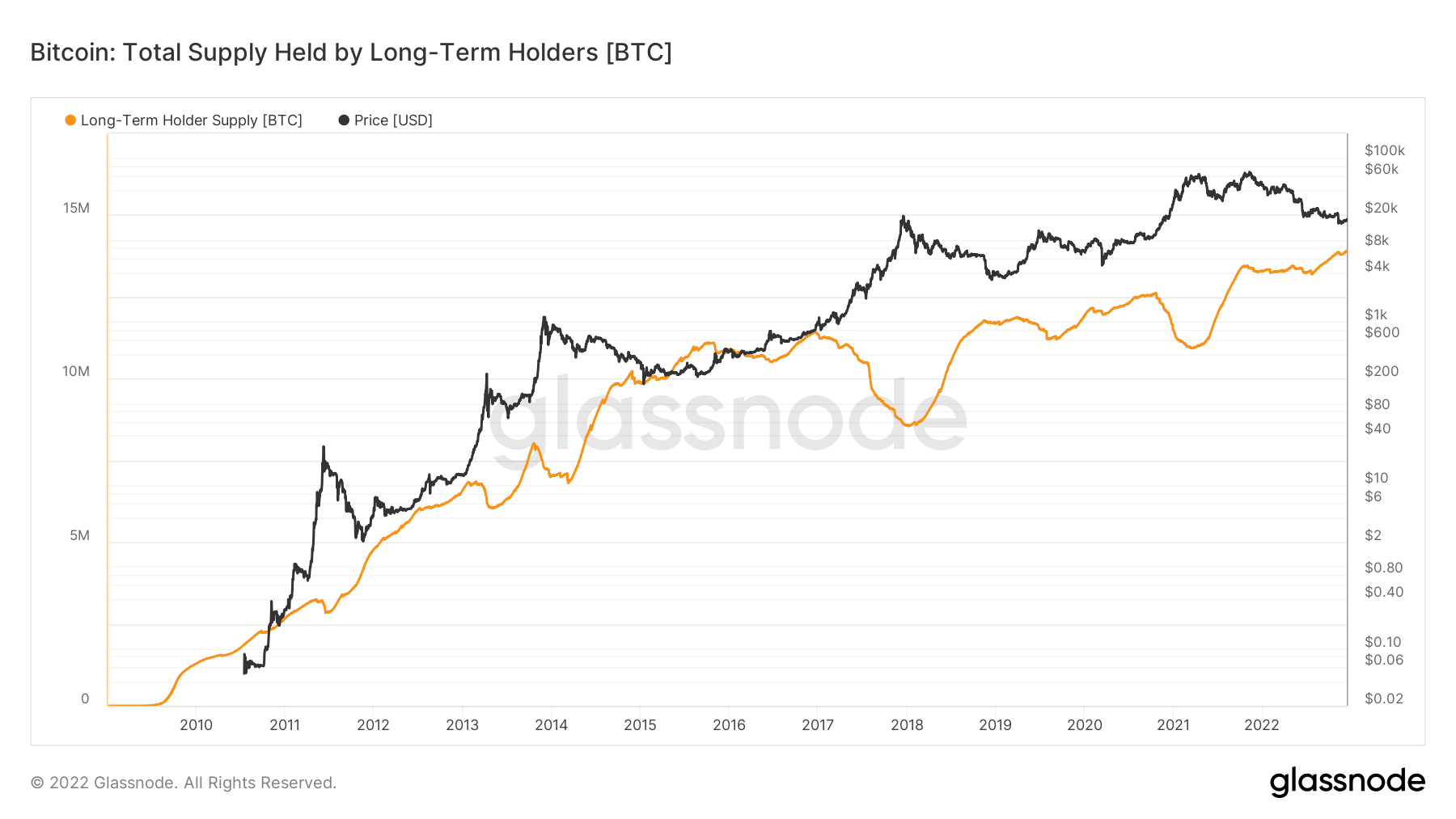

According to Glassnode data, the cohort holds a record-high amount of Bitcoin –13.8 million. The group is also considered the smart money of the Bitcoin ecosystem because they usually accumulate during bear markets and sell during bull runs.

For context, long-term holders added around 1 million BTC to their holdings in November. This was because LUNA’s crash in May triggered a significant dip in price that allowed traders to accumulate the asset. Those that bought Bitcoin at the time are now part of this cohort, as they have held for the last six months.

Long-term holders at ATH despite Nov. capitulation

Meanwhile, the recent FTX collapse led to a minor capitulation among LTH, causing their supply to drop slightly in early November. Despite this, the Glassnode data chart below shows that long-term holders’ supply is still at an all-time high.

For many, that’s bullish because investors are not capitulating. Ark Investment shares this view, as it said the data point indicates the cohort’s “long-term focus and high conviction, despite recent events.”

6 million BTCs held at a loss by long-term holders

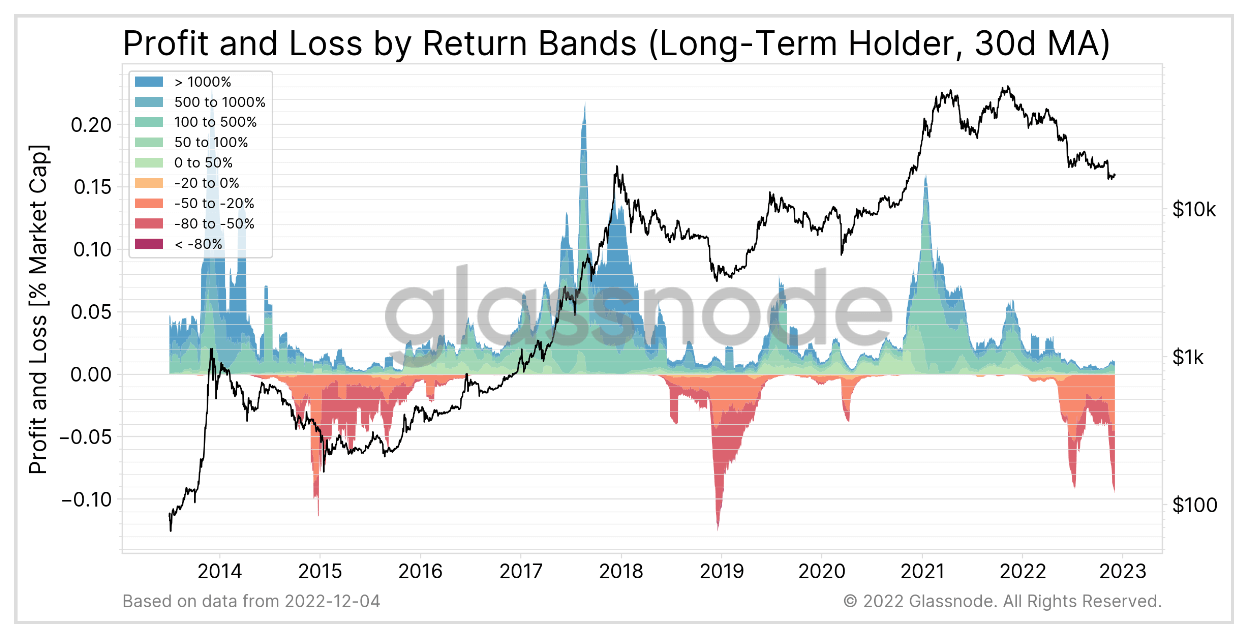

Glassnode data, as analyzed by CryptoSlate, showed that long-term holders might be holding their Bitcoin because they stand to incur substantial losses if they sell.

According to the data, around 6 million BTC held by long-term holders is currently at a loss –the highest ever.

» />

The last time the group had this much-unrealized losses was in 2015, 2019, and 2020 when they held over 5 million BTC.

This cycle’s long-term holders recorded the two biggest losses

Further analysis by CryptoSlate showed that long-term holders recorded two of the biggest losses in history during this market cycle.

According to Glassnode data, this cycle’s long-term holders lost 0.09% of BTC’s market cap per day in June and November when the industry reeled from the collapse of Terra’s ecosystem and FTX’s crash. This was only surpassed by losses recorded in 2015 and 2019.

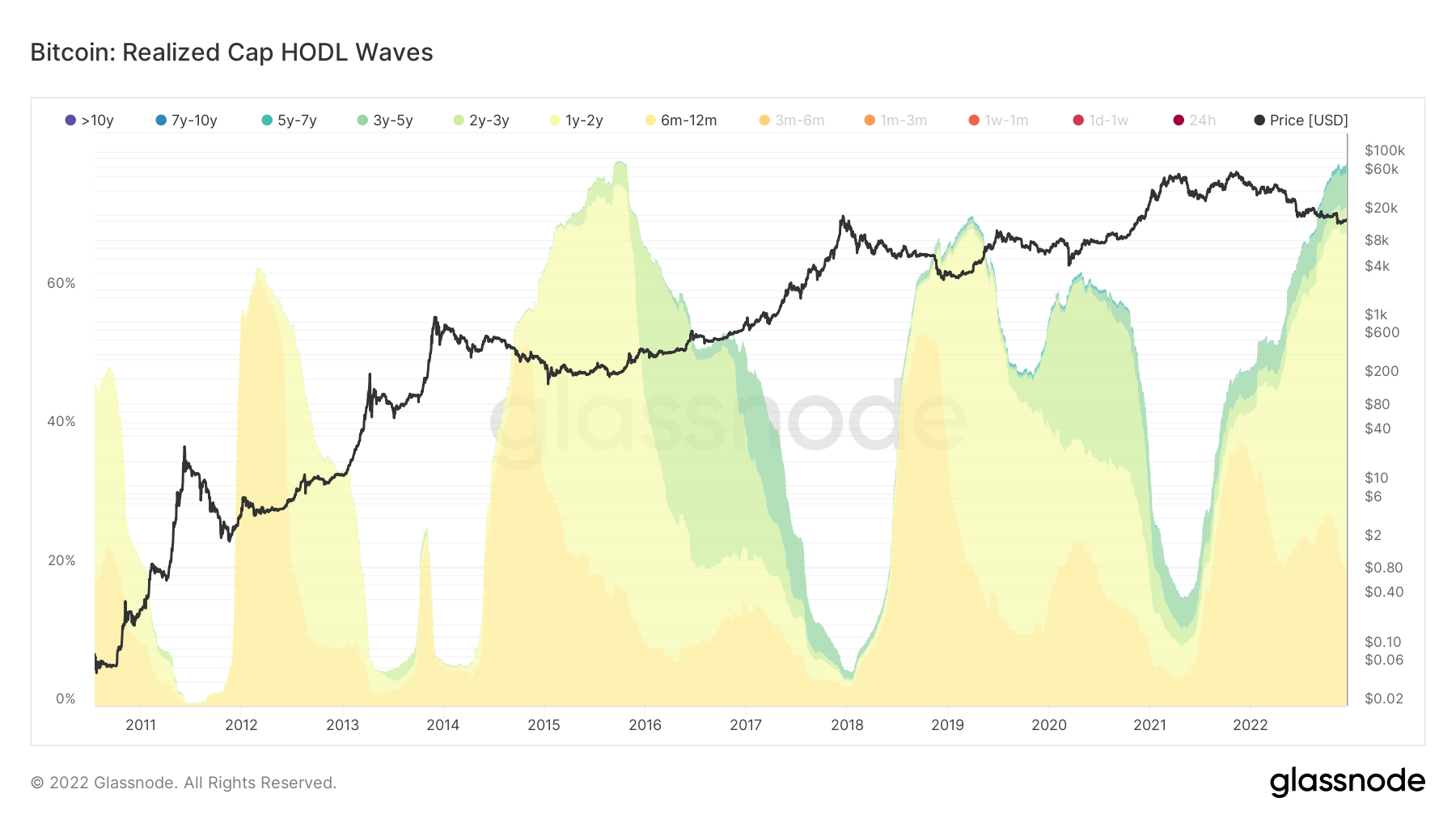

Regardless of these huge losses, 78% of BTC’s entire supply is still held by long-term holders, similar to the 2015 bear market levels.

»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Zcash

Zcash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur