Revealed: The top 10 metaverse projects by return of investment

The rapid expansion of the cryptocurrency industry has given rise to the metaverse space, which has recorded an increasing interest from crypto investors and traders who want to participate in it but do not know which of them would bring them the highest return on investment (ROI).

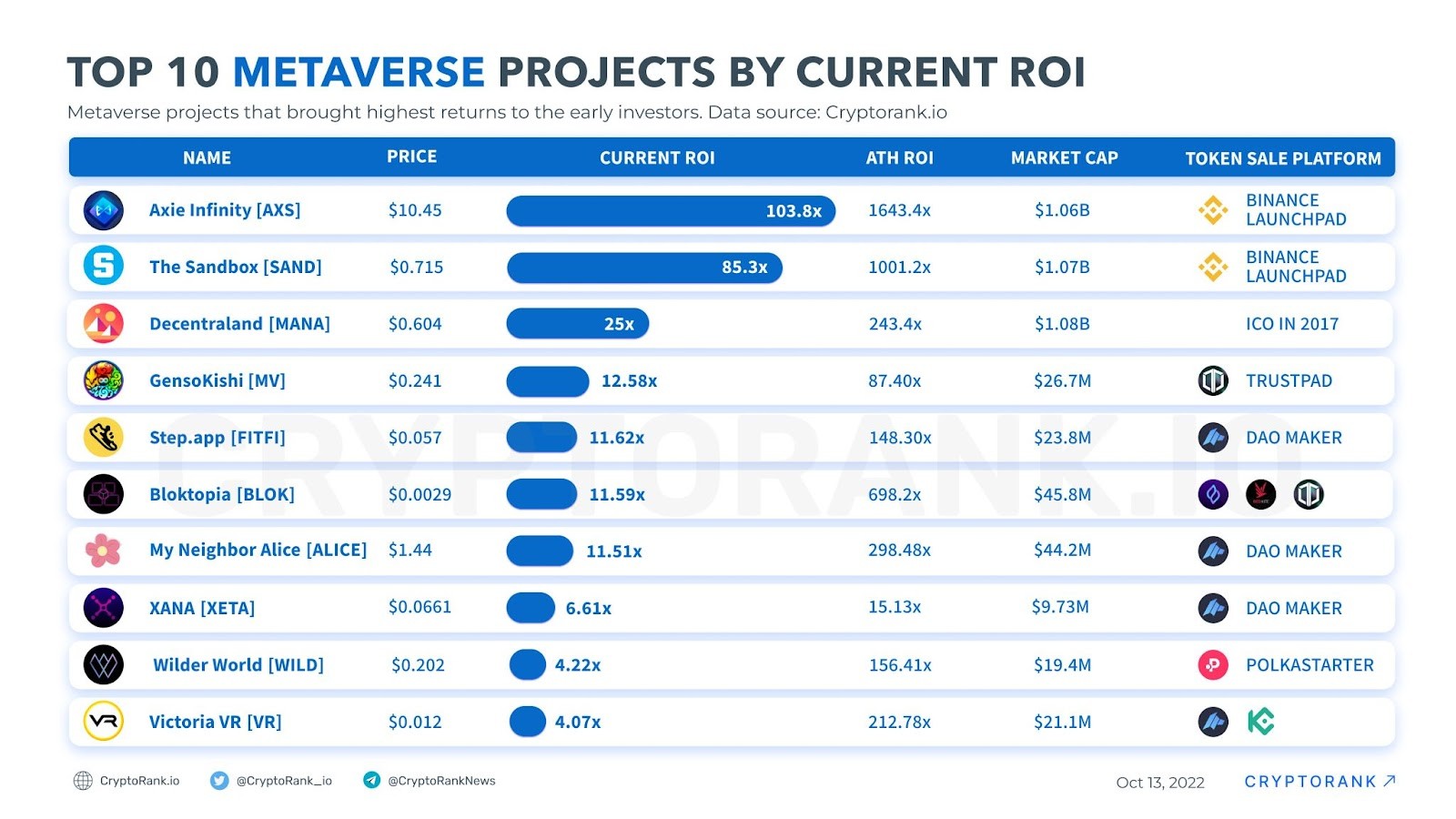

As it happens, the metaverse project that has brought the highest returns to the early investors is a Pokémon-inspired blockchain-based Play to Earn (P2E) metaverse game Axie Infinity (AXS), according to data by the crypto market analytics platform CryptoRank published on October 13.

RIO chart champions

With a current ROI of 103.8x, Axie Infinity precedes The Sandbox (SAND), a virtual environment that allows users to as well as “create, control, and monetize their game experiences,” according to the developers, which is in second place with 85.3x ROI.

With 25x ROI, putting it in third place, is Decentraland (MANA), a virtual living platform powered by cryptocurrency and built on the Ethereum (ETH) blockchain where users can purchase metaverse land plots as non-fungible tokens (NFTs), similarly as in The Sandbox.

Notably, Axie Infinity also has the highest all-time high ROI of a remarkable 1643.4x, with its current ROI representing a 93.7% decrease. Interestingly, all three top metaverse projects by ROI at the moment have a market capitalization higher than $1 billion.

Other metaverse projects that excel in their ROI, albeit considerably lower than the three top players, include GensoKishi (MV), Step.app (FITFI), Bloktopia (BLOK), My Neighbor Alice (ALICE), XANA (XETA), Wilder World (WILD), and Victoria VR (VR).

Diminishing trading and profitability of metaverse land

That said, it needs to be noted that the trading volume for 18 metaverse virtual land projects has recorded a drop of a whopping 98%, plunging from its peak in November 2021, when it stood slightly above $8 million, as Finbold reported.

On top of that, the profitability of metaverse land flipping has diminished along with plummeting profits in Q2, keeping up with the downward pattern that started in January 2020 and continued throughout 2021 and early 2022.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  HUSD

HUSD  Energi

Energi