Bitcoin Price To Hit $30,000? Willy Woo, Binance CEO «CZ», PlanB, Balaji Bullish On It

Bitcoin price rallied massively to hit a 9-month high of $27,787 as it strongly breaks above the key 200-WMA at $25.3K. Bitcoin and Ethereum prices soared after the U.S. Federal Reserve started money printing with an initial $300 billion in funding for rescuing cash-strapped banks since the collapse of Silicon Valley Bank and Signature Bank.

Crypto leaders and influencers including Binance CEO “CZ”, Bitcoin analyst Willy Woo, stock-to-flow model creator PlanB, former Coinbase CTO Balaji Srinivasan, and others are confident about Bitcoin price hitting $30,000.

Binance CEO “CZ” took to Twitter to share the good news that Bitcoin rallied past $27K, mocking U.S. banks and appreciating crypto holders who held amid FUD due to recent events. He is bullish on Bitcoin as banks crumble.

“Bitcoin is volatile, but it never needed a bailout. Holding crypto is tough. It wasn’t easy for the people who held on in the past few months.”

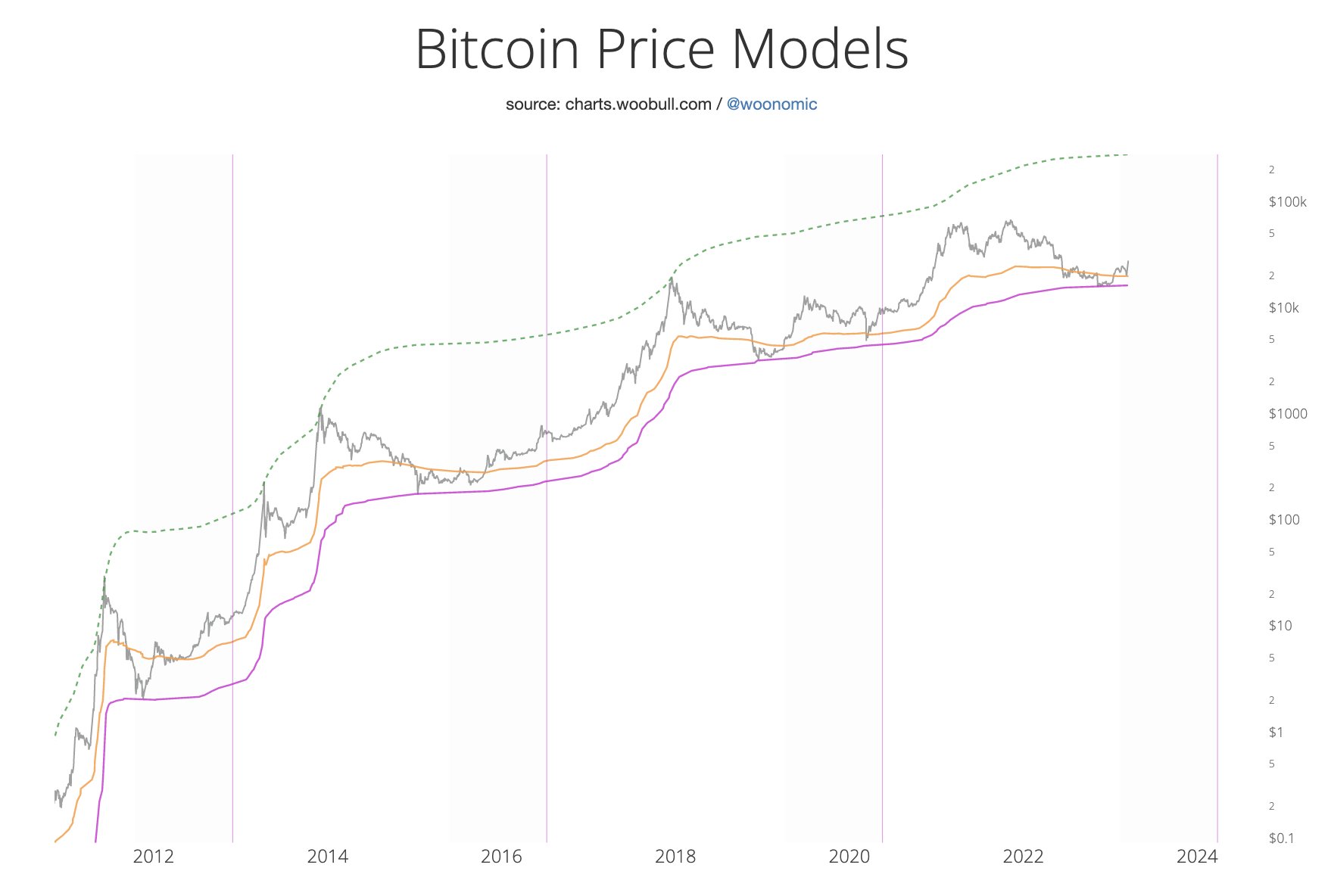

Popular Bitcoin analyst Willy Woo also took to Twitter to share his favorite on-chain indicators for Bitcoin. He recommends buying when the BTC price is between the realized price and the Cumulative Value Days Destroyed (CVDD) floor. Investors should also buy more when the price move past the purple line.

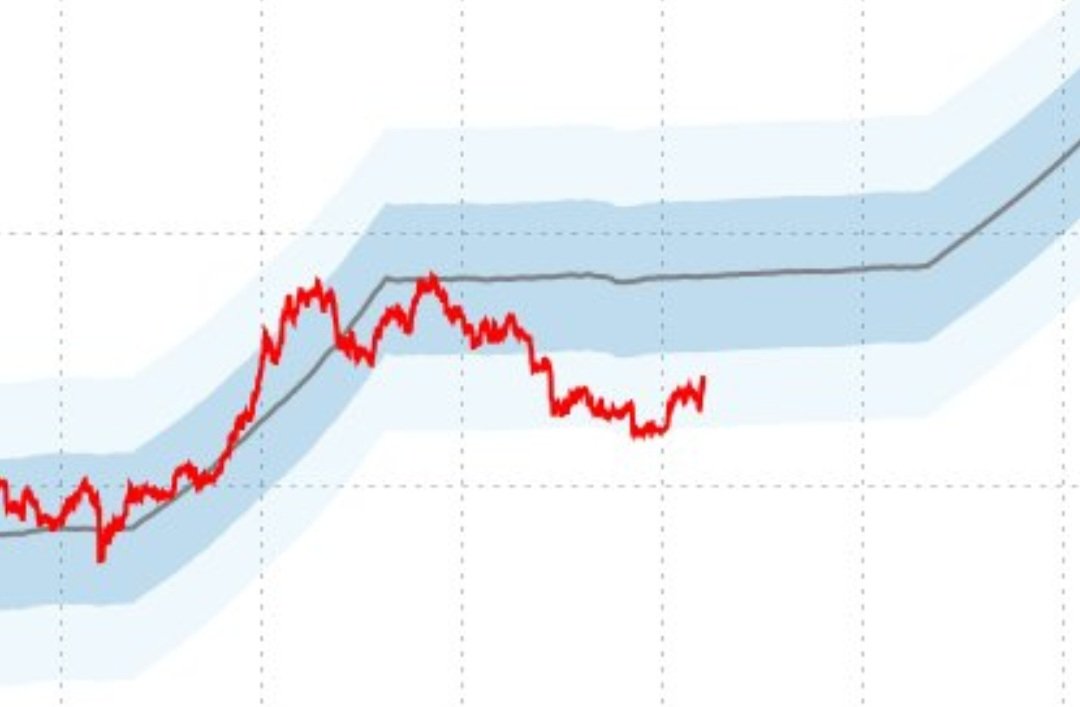

Bitcoin stock-to-flow model creator PlanB revealed that rebounding towards dark blue area of the stock-to-flow valuation model. He believes that Tripple top for a new ATH in the current cycle is possible as the Bitcoin halving is coming.

Bitcoin: Stock-To-Flow Model

Bitcoin Price To Hold Above 200-WMA

Meanwhile, former Coinbase CTO Balaji Srinivasan predicts bank failures and money printing will cause Bitcoin price to hit $1 million within 90 days. On Friday, he made a bet with James Medlock, a self-proclaimed social democrat, over U.S. entering hyperinflation. Balaji Srinivasan is ready to transfer $1 million in USDC for the bet to either a smart contract or an escrow person.

Bitcoin price currently holds above the 200-WMA, as reported earlier by Coingape. BTC price currently trades at $27,587. The 24-hour low and high are $26,209 and $27,787. Bitcoin will face resistance in the $28.5K-29K range, it will cross the mark if the U.S. Fed FOMC rate hike decision comes in dovish.

Also Read: Solana Mobile Hints At Saga Smartphone Launch Date

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur