SEC Cracks Down On Binance and Coinbase, DeFi Trading Skyrockets by 444%!

This has resulted in a significant increase in the median trading volume across the top three decentralized exchanges (DEX) in the past 48 hours, as investors try to find a safe haven.

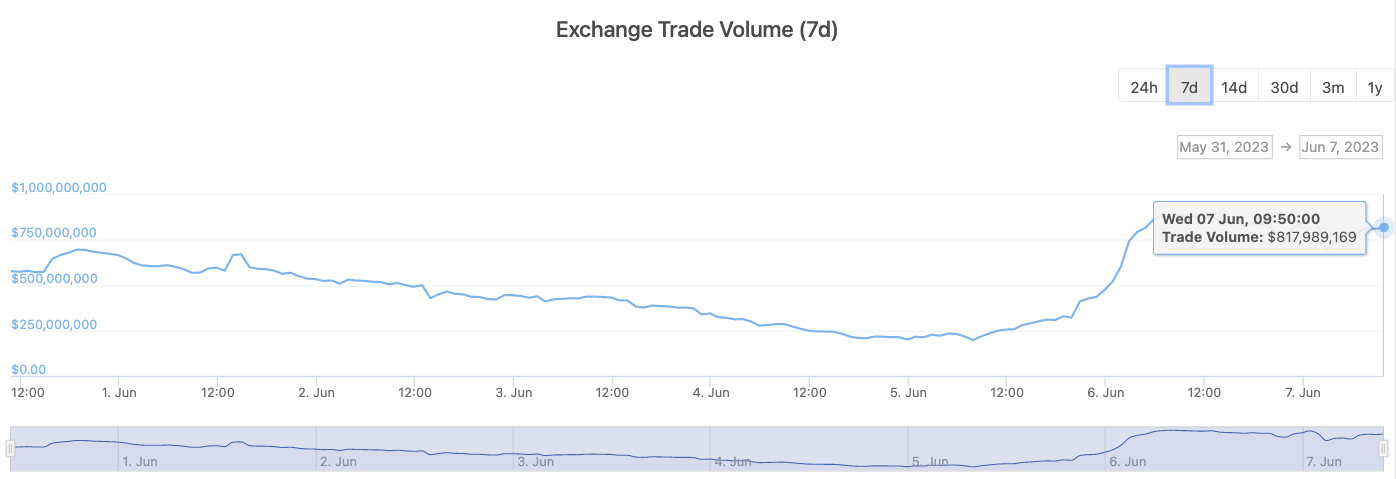

According to aggregated data from CoinGecko, Uniswap V3 (Ethereum), Uniswap V3 (Arbitrum) and Pancakeswap V3 (BSC) — which account for 53% of the total DEX trading volume in the last 24 hours — saw an increase of more than $792 million between June 5 and June 7. This represents an increase of 444% in median trading volume across the top three DEXs.

Trading volume on Uniswap V3 (Ethereum) in the last 7 days. Source: CoinGecko.

In addition to this, the trading volume on Curve, a DEX that allows for the trading of stablecoins, spiked by 328%. Trading activity on Curve is currently focused on trading the U.S. Dollar-pegged stablecoins USD Coin and Tether.

It is important to note that trading volumes on DEXs briefly surpassed those of Coinbase during May’s memecoin frenzy. The sudden surge in trading activity was largely driven by investors rushing to purchase tokens such as Pepe (PEPE) and Turbo (TURBO) through Uniswap and other decentralized protocols, as the memecoins were not listed on major centralized exchanges.

As DEX volumes surged, net outflows on Binance reached a staggering $778M. It is worth noting that current net outflows are still much lower than the exchange’s total reserve. Binance maintained a stablecoin balance of more than $8 billion.

Netflow to Binance over the past 24 hours is $778.6M negative on Ethereum – $871.7M in and $1.65B out

Over the past hour, netflow on Ethereum continues to be negative at $35.7M on Ethereum – $14.8M in and $50.5M out

Track it here https://t.co/nwTgpXWhZY and filter for «Binance» pic.twitter.com/jnNAN0QKVy

— Nansen ? (@nansen_ai) June 6, 2023

This market frenzy is taking place against the backdrop of a swathe of legal action against crypto exchanges by the Securities and Exchange Commission (SEC). On June 6, the SEC sued Coinbase alleging that it offered unregistered securities and acted as an unregistered securities broker among other charges. A day earlier, the SEC sued Binance, Binance.US and Binance CEO Changpeng Zhao (CZ) under similar allegations. The SEC alleged that Binance failed to register as a securities exchange and was therefore illegally operating in the U.S.. According to the charges, Zhao was sued as a “controlling person.”

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond