SEC’s Gensler Holds Firm That Existing Laws Make Sense for Crypto

Securities and Exchange Commission (SEC) Chair Gary Gensler told the Practising Law Institute last week that existing securities laws fit the crypto markets in a speech that’s garnered attention from all parts of the digital currency ecosystem. Prior to the speech, I had the opportunity to speak with the longtime regulator about his agency’s approach to crypto.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Gensler’s words

The narrative

SEC Chair Gary Gensler was one of CoinDesk’s 2021 Most Influential honorees for his role running the federal regulator. He spoke to CoinDesk ahead of last week’s speech on cryptocurrencies and how they fit into federal regulations, echoing comments he made in an op-ed published in the Wall Street Journal last month.

Why it matters

The following interview has been edited for clarity. You can also watch the video above.

Breaking it down

Nikhilesh De, CoinDesk: Thank you so much for joining me and agreeing to speak about all things crypto. I know it must be one of your favorite subjects. I wonder if we could get things started with previewing your speech to the SEC Speaks [program] tomorrow. You’re talking about crypto, you’re addressing a lot of I want to say frequently heard complaints from the crypto industry that the SEC is not doing enough to provide clarity. You do seem to address that head on. So I’m wondering if you could just speak to how you are looking at this issue. What are the top-of-mind issues for you when you’re talking about crypto regulation?

SEC Chair Gensler: So, Nik, good to be with you, good to be with an audience of CoinDesk subscribers or viewers. I think about investing in the context of markets. We had the Securities and Exchange Commission set up nearly 90 years ago, and it was to protect the investing public. And the speech that you reference, I start with those foundational things around President [Franklin] Roosevelt [and] Congress [and] what they tried to put together, and the first chair of the Securities and Exchange Commission, Joe Kennedy [father of later President John Kennedy and senators Robert and Ted Kennedy].

And so I think of it in that context. And 90 years later those basic bargains are really what it’s about when somebody is raising money from the public – the public gets to decide which risks they take. We at the Securities and Exchange Commission are not a merit regulator. If you want to take a risk, take a risk. But we are, and what our regime is about, is about disclosure, making sure there’s full and fair and truthful disclosure. Even President Roosevelt called it the “truth in securities act,” the first of our four key acts. And so I think of it all in that context.

Satoshi Nakamoto writes the white paper Halloween night in 2008 – a number of years later, people start to invest in it, they’re buying and selling it. Some years later, we start to see other coins, other tokens. And, you know, if you just look at coinmarketcap.com, there’s like 10,000 or so tokens listed there. Some have more liquidity than others, of course, and some have more value than others. But what is the investing public doing? They’re investing for a better future, based upon the efforts of others. There [are] websites you go to, Medium posts that you read, there’s Crypto Twitter, there’s Reddit forums and places you can look for information. And it’s about that common enterprise and that entrepreneurial effort which is the hallmark of investment contracts, which are securities. So I think that’s where we are, that most of the tokens meet the traditional standards that our Supreme Court has laid out, and that we, the SEC, have a role to help protect investors and instill and enhance trust in these markets. But back to you, Nik.

Well, you know, so to your point about instilling trust to these markets, you’ve said on numerous occasions that you believe a lot of crypto trading platforms, which we commonly referred to as crypto exchanges, should be registered as national Securities Exchanges because in your view, and in the view of your predecessor Jay Clayton, and in the view I think of many other SEC staffers and even lawyers, a lot of cryptocurrencies do resemble securities. What’s the next step?

They don’t just resemble securities, they are securities. Thurgood Marshall, a great Supreme Court Justice, wrote in an opinion – and I think it was in the 1970s – that the Congress painted with a broad brush to protect the public when somebody is raising money from the public and the public anticipates a profit. That’s kind of the core. And yes, the service providers, if you wish, the crypto exchanges, the crypto lending platforms, whether they call them such centralized or decentralized (so-called DeFi), they’re transacting and providing services to the public. And they’re providing those services around some very small handful of non-security tokens, crypto non-security tokens. But the vast number of these thousands of tokens – without prejudging any one of them – meet the standard of being a security, and thus the platforms have an obligation to come in and register, work with us and find a path forward.

Ultimately, it’s about protecting the investing public and, if the investing public is investing in crypto, to have some basic protection. So we just went through a time, earlier this year, where a number of platforms went bankrupt, or they just froze out their customers. I wonder about how many of your readers got frozen out or held [cryptos], and they just get in line in bankruptcy court. Even if the platform started to honor their obligations, sometimes they were frozen for three hours or three days or a week. And there are basic protections in our securities laws that guard against that. What’s more, right now, if you’re investing on any one of these service providers [or] platforms, you’re not getting those basic protections insuring against fraud, manipulation, what’s called front-running. The platforms are an amalgam of different services. Not only are they doing what you might be familiar with at the New York Stock Exchange, but they are also … acting as a broker against you. They’re like an amalgam of dealers trading against their public, they could be trading ahead of you. And our securities laws say no, that’s not allowed. So there are a lot of protections that you right now are not getting the benefit from but should be because it’s the law.

Right. My question is what’s the next step in having these platforms registered as securities exchanges or come in?

The next step is if they successfully register, the investing crypto public can get to decide. These are, by their very nature, speculative assets. There’s give or take 10,000, and pretty much any venture capitalist would probably tell you that most startups fail. That’s just the nature of the economics of startups. And so the investing public will get a fuller disclosure about those individual token projects. You’d also have protections in your trading against fraud, manipulation and the transparency of those platforms, how orders are matched and the like. And that if they are also dealers, that this amalgam of different features that they’re doing gets separated out.

If you have a desire to take your crypto and lend it, that you actually have some disclosures [from] the service provider providing you that interest. And remember, if somebody says reward or yield or interest or return, the label doesn’t matter. It’s similar to when you put your money with the money market fund and you say, well, they’re going to give me a return. Then they actually have to disclose what they’re doing with your money, and it’s your money ultimately. What are they doing with it? Are they trading like a hedge fund or are they lending it to somebody else? Are they putting it in safe assets or more speculative assets?

I guess I should clarify. If these platforms don’t come in voluntarily, which it doesn’t look like any of them will, is the SEC prepared to bring enforcement actions? Is there a rulemaking process?

Nik, [the SEC has] been doing that by my predecessors. I think you can go to our website and read about it. And sometimes the entrepreneurs and service providers in this field will say, ‘what has the SEC said on this?’ The SEC has said a lot. We’ve, as a commission, as a five-member commission – I’ve spoken to this numerous times, dozens and dozens of times, every enforcement action – it’s voted on by a five member commission, by my predecessor commissions and then I’m what I’m honored to chair, we’ve spoken about it directly.

In 2017, five years ago, in two really important circumstances, something called the DAO Report, and the Munchee order, both in 2017, [we] laid out – consistent with Supreme Court cases – when tokens are securities, and so it’s actually pretty straightforward there. And we are a cop on the beat. That’s what Congress set up in the 1930s. But we work with market participants and, and I said this, quoting Joe Kennedy, the first chair of the SEC, who spoke clearly on this – he said, “no honest business need fear the SEC.” Come in, we will look to see how we can facilitate compliance using those tools in our regulatory toolkit. We have various tools that the community understands about how to try to fit this in.

Look, I’m technology neutral. Before I was in this job, I was not so technology neutral, maybe. I was honored to be at Massachusetts Institute of Technology and studying and researching and teaching on the intersection of finance and new technology, around artificial intelligence and finance, but also around this topic, crypto markets and finance. And the job I’m in now, I’m technology neutral. I mentioned that to give you a sense of where I come from, but I’m not public policy neutral.

I think that the investing public not only deserves to be respected and to get its basic disclosure and anti-manipulation [and] anti-fraud protections, but also other issuers, other companies and entrepreneurs that raise money, need to have somewhat of a level playing field here. I think, without that, this field can’t reach any of the goals that many of the readers of CoinDesk might believe. If you believe in crypto, and I know there are both people that believe in it and don’t believe in it, but if you believe in it and you want to invest in it, I would say this. Few things ever persist without coming into basic public policy perimeters protecting investors, not undermining our capital markets or our financial stability at large. Being inside of the remit of fostering just legal activity and not illicit activity. Those are our basic bargains in our economy.

There’s a lot to unpack in all of that. We’re seeing enforcement actions being brought against companies that conducted initial coin offerings as far back as 2017, 2018. Is the SEC able to keep up with the sheer numbers, the 10,000 cryptocurrencies out there, or does the agency need more resources to address that?

I thank you for raising that. I joined an agency about a year and a quarter ago that had actually shrunk about 5% in the prior four or five years. And the capital markets, as we all know, had grown quite significantly, not just in value but in complexity and numbers of public companies, number of investors, and then this crypto field came up.

Though it’s give or take upon this recording a trillion dollars of worldwide asset value, the U.S. capital markets are a little over $100 trillion in total. So we’ve got a lot going on. I’m really proud of this agency, but we had shrunk about 5%. So absolutely, I think that we should be at least where we were in 2016, and should be above that. We should have grown in this period of time.

I would say this to any of the lawyers and accountants and entrepreneurs out there that are advising folks in this field: If you’re in, if you’re thinking about doing a project, come in, talk to us, let’s get it right. If you’ve been doing a project for three, six years and so forth, don’t wait for us to knock on your door. But I would say this also, Nik, this is a very concentrated ecosystem, some would say otherwise. But there’s really a handful – five, eight, crypto exchange platforms – that have the dominant market share. Similarly in so called lending platforms, even though a handful of them just went bankrupt. Also in the so-called decentralized finance, or DeFi, space, these are highly concentrated actors and players, they often have hundreds of tokens and so on.

So given what we’ve discussed, it’s highly likely they have securities on them. Come in, work with us, work on getting the right facilitation around your exchange function, your broker-dealer function, your custodial or clearing house function, your lending. We’ve spoken in a clear voice. I mean, over a year ago, in a speech, I said, “Make no mistake, if you have a platform, and you’re lending or borrowing crypto securities, you’ve got to come in and work with us and get registered.” And we did that with a company named BlockFi earlier this year. And we’re still sorting through in the crypto lending space. So there’s a path forward here.

Do you think that, not necessarily the SEC specifically but some of these lenders that are currently bankrupt – we’ve heard that numerous state regulators and the SEC have been looking into quite a few of them. Celsius Network, for example, just today, the Vermont Department of Financial Regulation said that over 40 states are looking into Celsius’ operations. But that hasn’t stopped these companies from taking investors’ money. And then, as you pointed out, [Celsius is] currently going through bankruptcy proceedings. Is there something more that regulators could be doing to be proactive on this issue, to have prevented getting to a point where these companies are built up, and they have this huge customer base and then they go to the courts and say, ‘we need some bankruptcy protections while we try to restructure our operations’?

So, for your listening public, let me just explain, I can’t speak to any one company. I can speak about things in the past as I did the settlement with one company as I did about BlockFi or the DAO Report from 2017. So let me just go to a more generic general question that I think you have. I think the investing public, whether you want to go and buy crypto or even, you think that it’s all too highly priced in so you want to short it. And remember, those risks are your choices. Whether you’re pro or you want to go short, that, entirely your choices. There’s a role for the official sector. The bulk of the tokens, though maybe not the bulk of the market value in crypto, but the bulk of the tokens have entrepreneurs at the middle, have a website, you’re reading the Reddit post, you’re reading the Medium and Crypto Twitter, you’re following those, and there’s somebody in that middle generally touting that.

We’re trying to help and look out for you. On these concentrated actors, the centralized actors, the exchanges, the lending the custody, the so-called DeFi, right now you’re not getting the compliance. The investing public is not only taking a risk on crypto, but you’re also taking a risk that the platforms are even doing what they’re saying they’re doing. I think that we’re actually aligned with the crypto investing public more than sometimes the news would report. I do think that in terms of the lending platforms, it’s unambiguous. Because it doesn’t matter what you hand over to a platform, if you hand over gold, if you hand over bitcoin, or you hand over any one of 1,000 plus alternative coins. Frankly, if you hand over chinchillas, that the platform is taking those funds of value and doing something with it, they might be operating a hedge fund, they might be lending it out, they might be operating other investment schemes.

That platform is under the securities laws book because of how they’ve taken that money from you. You deserve the benefits of disclosure and certain investor protections. And we’re going to continue to be leaning into that. But at the same time, trying to work with the platforms, the service providers, there’s probably only 20 or 30 that you really cover at CoinDesk actively. I apologize, maybe you’re going to tell me that you cover a lot more lending and exchanges and platforms. It’s a pretty concentrated market share.

Yeah, I mean, I can’t speak with any certainty as to how much we cover. We’ve grown quite a bit in the last couple years. I do know, we have written about some of the potential dangers posed by these same companies that we’re now talking about. But, you know, it brings you back to my first question, which is what role does or should the SEC have in being more active with these lenders, with these trading platforms, and all these other service providers that refuse to [register]. They believe that they don’t need to come in to talk to the SEC or register. At what point does it go from an invitation to something more forceful?

So, let me let me close on this, because I know our time is about up. I think that the platforms would be prudent to take the opportunity and work with us. We are a cop on the beat. And that’s what Congress wants, that laws and roles are meaningful. As everybody knows, if there wasn’t a cop, things would get a little messy on the highway. If I could just do an analogy to football. I mean, what would the game of football look like if we didn’t have rules of the play and everything and there were no refs on the field?

Congress writes the ultimate laws, but we are the ones that have to oversee the markets, like the refs on the field, and write some of the on-field roles. That game of football would look really messy after a while, and after a while it wouldn’t even look like rugby. It would be really messy. And the fans wouldn’t want to come after a while. I just think that you’re right. There is a role to work with these companies and service providers, both in the intermediary space and the token space. But also we’re going to be a vigorous cop on the beat. We’re going to work very closely with our colleagues at the Commodity Futures Trading Commission, because part of this market, what I’ll call crypto non-security tokens, I think it’s very few tokens, but, again, they have a lot of market value.

We’re gonna work with our colleagues at the U.S. Department of Treasury and the Federal Reserve around stablecoins and ensuring that there’s the appropriate safety and soundness in those markets as well.

And our international colleagues, I mean, there’s a lot to be done here. If we’re successful, there’ll be more trust in these markets and investors will get to decide and entrepreneurs will decide and projects will win or lose or fail, based on their inherent risks. But right now we’ve got another set of risks. And it’s the risk of non-compliance with investor protection or non-compliance with broader safety and soundness public policies, and working with our fellow regulators. We’re going to continue to use the authorities Congress gave us but also the mandates to help best protect the public.

Thank you for your time. I really appreciate it.

All right. Thank you, you be well.

Biden’s rule

Changing of the guard

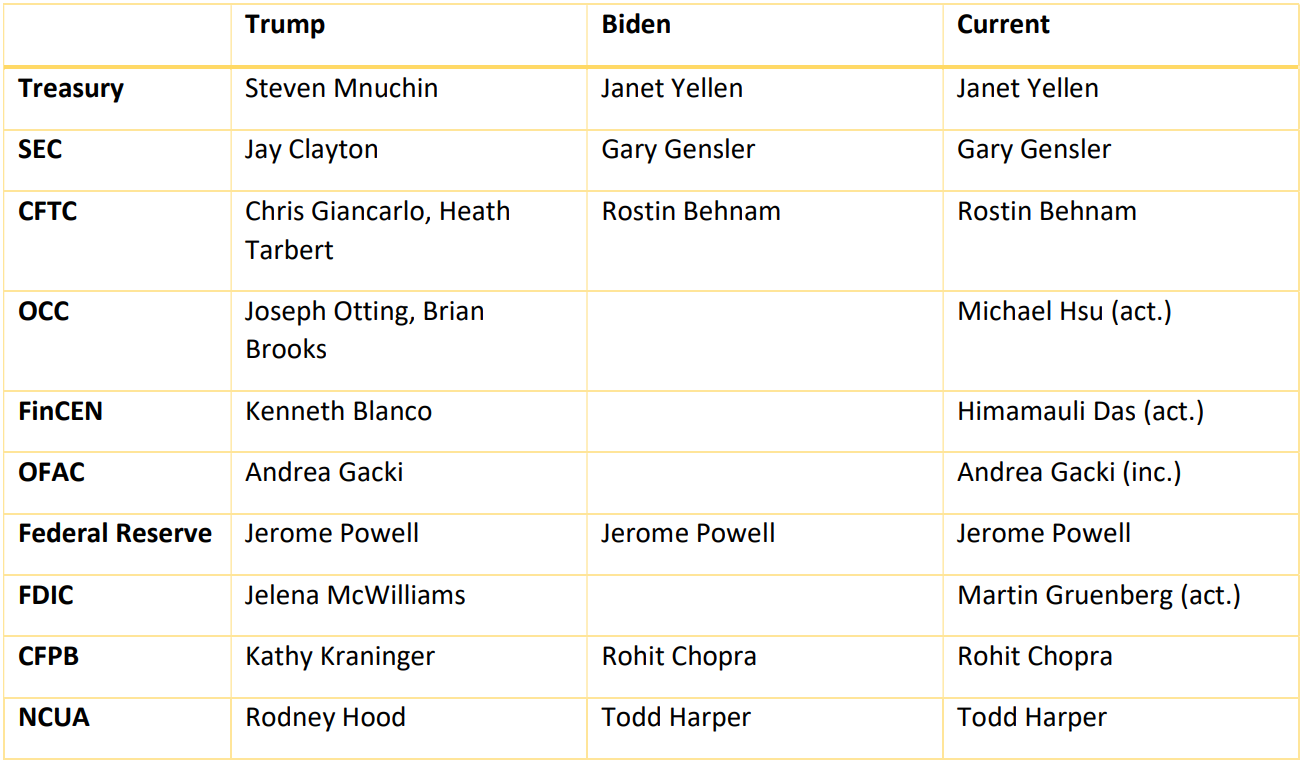

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

I think I’m going to replace this chart in the coming weeks as it seems pretty static now. Anyone have thoughts or suggestions on what I should have up here instead?

Outside CoinDesk:

- (The Washington Post) Former U.S. President Donald Trump has nominated federal Judge Raymond Dearie to be a special master who can review the materials seized by the Department of Justice to verify whether they were classified or not, a nomination the DOJ says it will agree with. I’m flagging this largely because Judge Dearie ruled in 2018 that the federal government could prosecute (alleged) initial coin offering frauds under securities laws.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Hive

Hive  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD