Silvergate hurtles back above $20 with crypto stocks in the green across the board

Crypto-related stocks soared in trading on Wall Street today. Silvergate, Coinbase, and MicroStrategy led the way with double-digit gains.

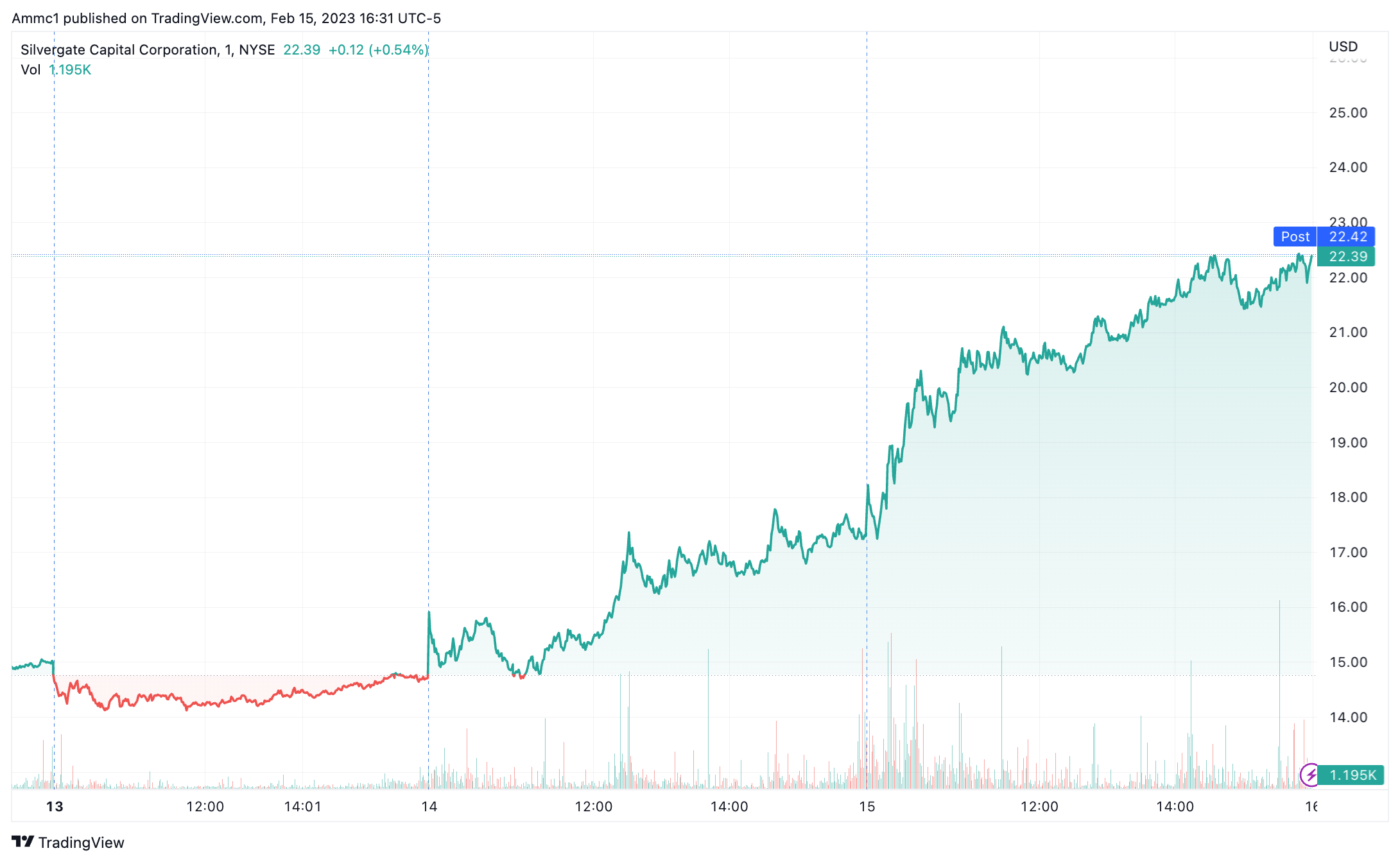

Silvergate rose 28.5% to $22.40 at the close, according to Nasdaq data. The crypto-friendly bank has attracted notable investors in recent weeks. BlackRock increased its stake to 7.2% on Jan. 31, while Citadel Securities and Susquehanna Advisors Group reported 5.5% and 7.5% stakes in the firm, respectively, yesterday.

SI chart by TradingView

Despite the interest from Ken Griffin’s firm, it doesn’t change what is fundamentally at play for the bank, said Andrew Defrance, an analyst at KBW. «It could lead to a squeeze short term given how high the short interest is, but there would need to be some sort of clarity to be a thesis-changing event for shorts/longs here,» he added.

Short interest in Silvergate remains high, with around 72% of outstanding shares currently sold short, according to NYSE data via Fintel.

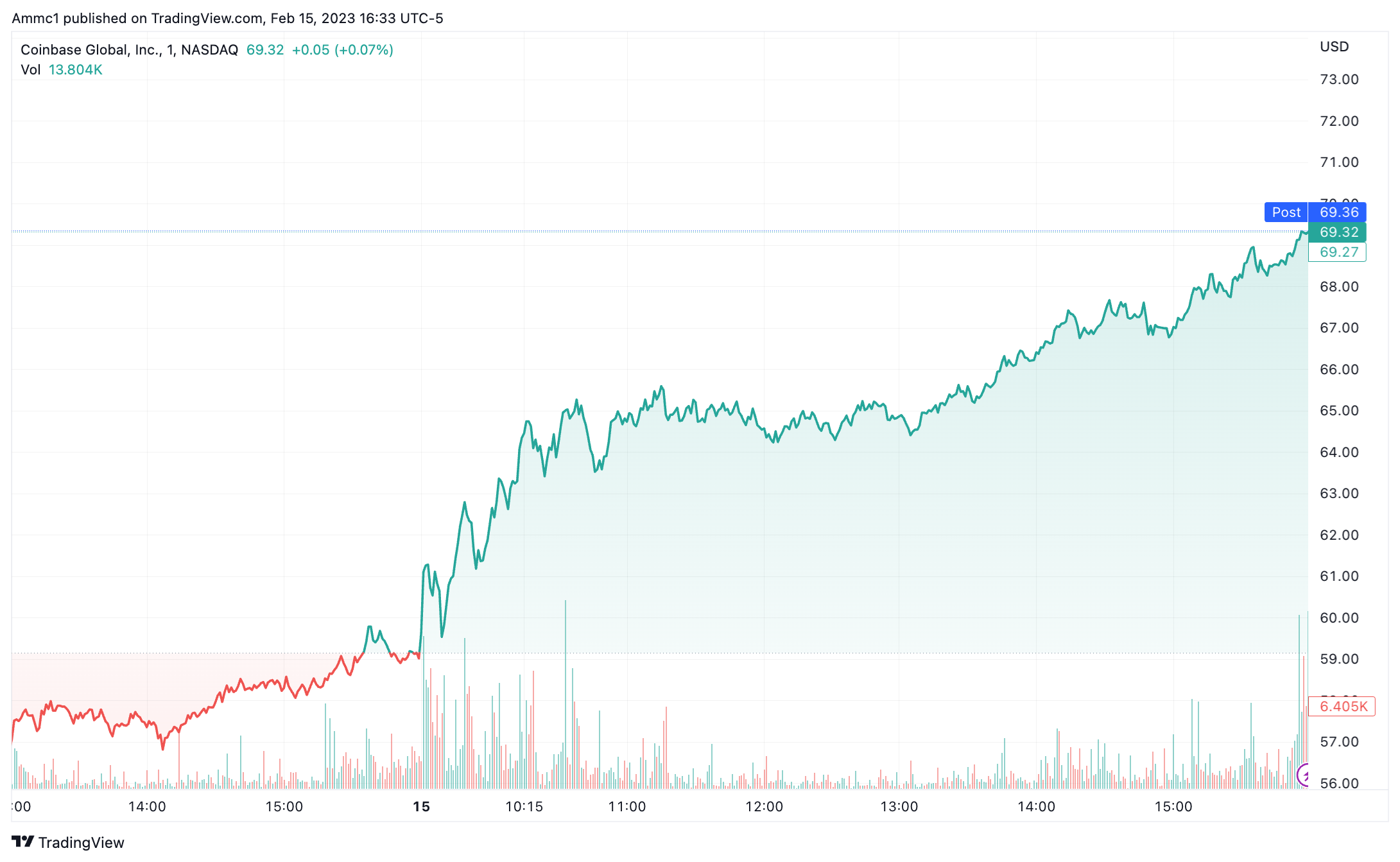

Coinbase gained around 17.5%, trading just below $70 at the close. The crypto exchange appears to have shrugged off last week’s regulatory woes for now.

COIN chart by TradingView

MicroStrategy jumped 10% to trade above $298 by the close. The software firm, better known in recent years for its bet on bitcoin, is up over 100% year-to-date. MicroStrategy owns over 132,500 BTC, according to The Block data, with the stock considered a proxy for investing in bitcoin by some.

Shares in Robinhood were also higher today, gaining 5.7% to trade above $10. The retail investing platform reported a 95% increase in crypto trading volumes in January to $3.7 billion.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur