OKX Exchange To Open New Office In Australia, Targeting Key Growth Market

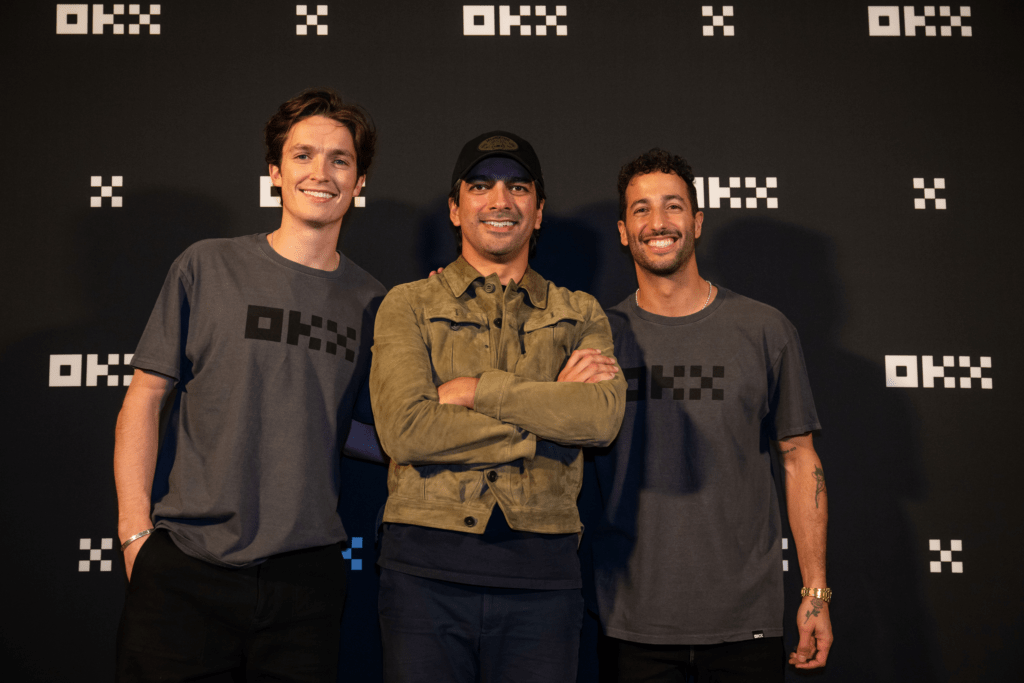

OKX, the second-largest cryptocurrency exchange by trading volume, announced that it will be opening a new office in Australia in the coming months. The announcement was made during an exclusive event for Australia’s crypto community at the Melbourne Arts Centre. OKX ambassadors Scotty James and Daniel Ricciardo were in attendance.

According to Haider Rafique, Chief Marketing Officer at OKX, the company’s ambition is to become the leading crypto platform in the world. To achieve this, OKX sees Australia as a key growth market and an indispensable part of its strategy. With such a strong uptake of crypto in Australia already, OKX is committed to the local market and aims to build a strong local office.

“I’m very excited to see OKX plan an office in my home country. I had a great time celebrating with the OKX team and the crypto community today. The future looks bright for OKX in Australia.”

Daniel Ricciardo, Australian F1 driver and OKX Ambassador, expressed his excitement about the announcement.

“Crypto never sleeps, and OKX continues to build its community. Australia is a special place for crypto, and it is exciting to see OKX announce it will be opening an office in Australia.”

Scotty James, Australian Olympic snowboarder, and OKX Ambassador, also expressed his excitement.

In addition to the new office, OKX is sponsoring the McLaren F1 Team car driven by Australian Oscar Piastri and Lando Norris at the upcoming Australian Grand Prix on March 30.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Tether Gold

Tether Gold  IOTA

IOTA  Theta Network

Theta Network  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Zilliqa

Zilliqa  Synthetix Network

Synthetix Network  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Decred

Decred  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  NEM

NEM  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Lisk

Lisk  Status

Status  Steem

Steem  Pax Dollar

Pax Dollar  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD