Bitcoin ETFs and Open Interest From BTC Futures, Options Follow Crypto Economy’s Spot Market Decline

Roughly 247 days ago, the total bitcoin futures open interest across 12 different cryptocurrency derivatives trading platforms was $26.73 billion and over the last eight months, bitcoin futures open interest has dropped 60% down to $10.69 billion. Further, the bitcoin exchange-traded funds BITO and BTF have followed bitcoin’s spot market losses, as the bitcoin ETFs have shed between 70% and more than 73% in value since last year’s price highs.

Bitcoin Exchange Traded Funds Slide Over 70% in Value Against the US Dollar

On November 10, 2021, the crypto economy’s 24-hour spot market trade volume worldwide was approximately $181.54 billion and more than 10,000 crypto assets had a valuation of around $3.13 trillion. Today, crypto spot market trade volume is 37% lower, as the global 24-hour trade volume on July 15 saw $114 billion in trades, and the crypto economy’s 13,400 crypto assets had a recorded overall value of around $980 billion.

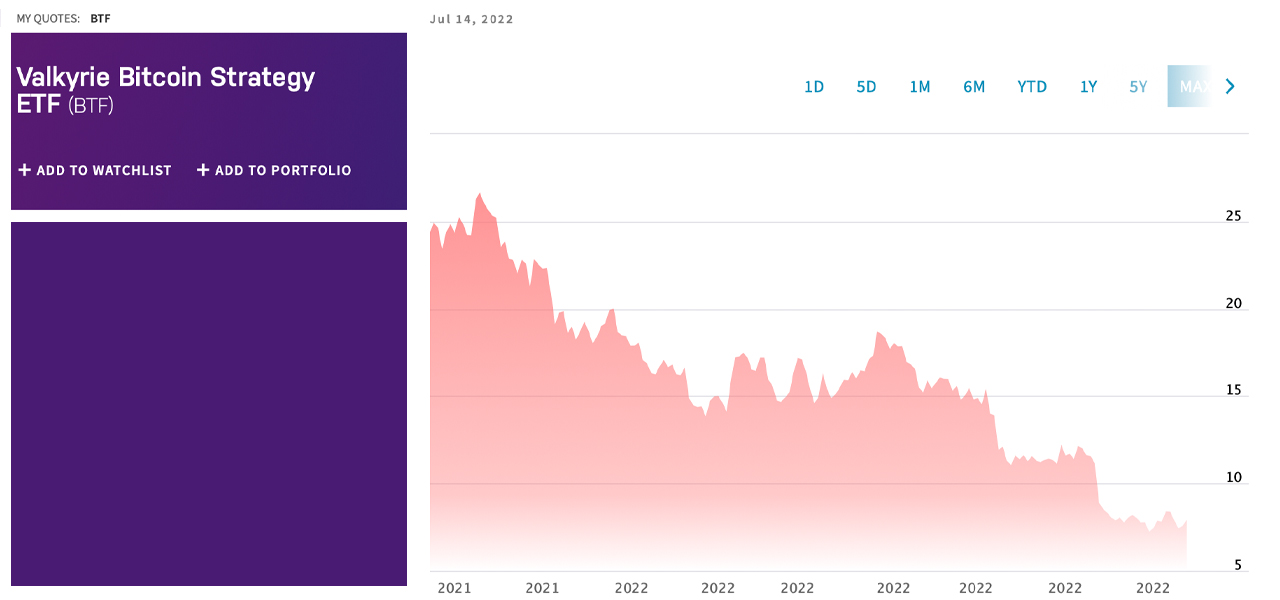

The Nasdaq-listed Valkyrie bitcoin futures ETF “BTF” chart on July 15, 2022.

During the past eight months, data shows bitcoin futures markets and BTC-centric exchange-traded funds (ETFs) have taken deep losses during this year’s crypto bear market. Last year, when U.S.-based bitcoin ETFs were approved, the funds traded for much higher prices and have followed BTC’s spot market downturn.

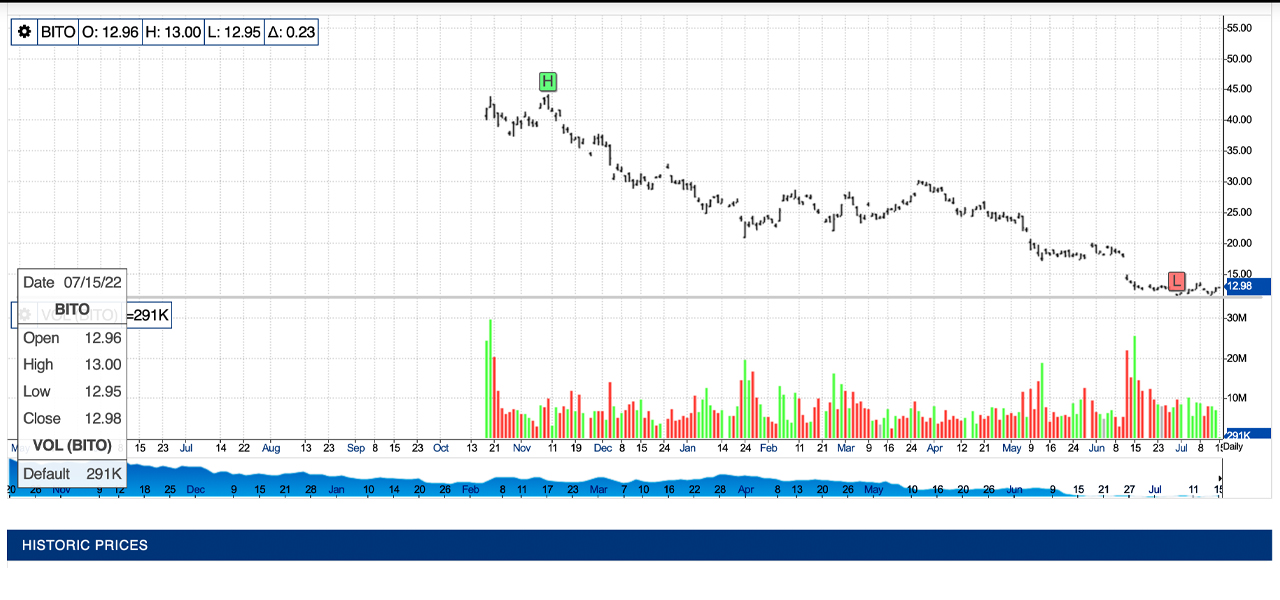

The NYSE-listed Proshares bitcoin futures ETF “BITO” chart on July 15, 2022.

Valkyrie’s bitcoin futures ETF, a fund that uses the ticker BTF on Nasdaq, traded for $26.67 on November 9, 2021, and on July 14, BTF’s price closed 70.19% lower at $7.95. The Proshares bitcoin ETF BITO has seen comparable losses, as the NYSE-listed BITO dropped 73.87% from $48.80 to $12.75 during the last eight months.

Bitcoin Futures Open Interest Slides, Options and Futures Volumes Spike

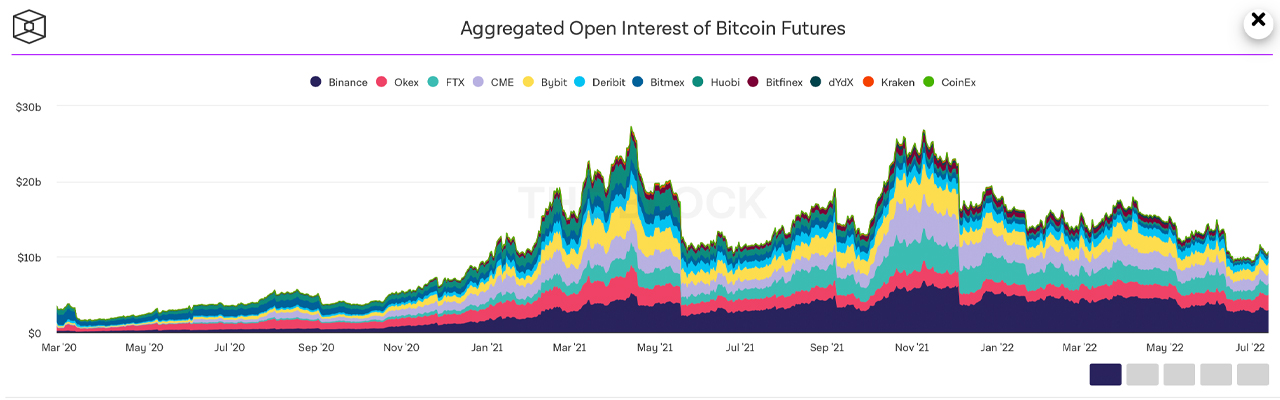

Much like the Valkyrie and Proshares bitcoin ETFs, the total bitcoin futures open interest has been on a downward spiral as well. According to recorded data, bitcoin futures open interest last November was awfully close to the all-time high of around $27.29 billion printed on April 14, 2021.

Bitcoin futures open interest on July 14, 2022.

On November 10, 2021, the aggregate bitcoin futures open interest was $26.73 billion and bitcoin (BTC) was trading for $68,766 per coin that day. Since then, bitcoin futures open interest is 60% lower as statistics recorded on Thursday, July 14, 2022, show open interest was $10.69 billion.

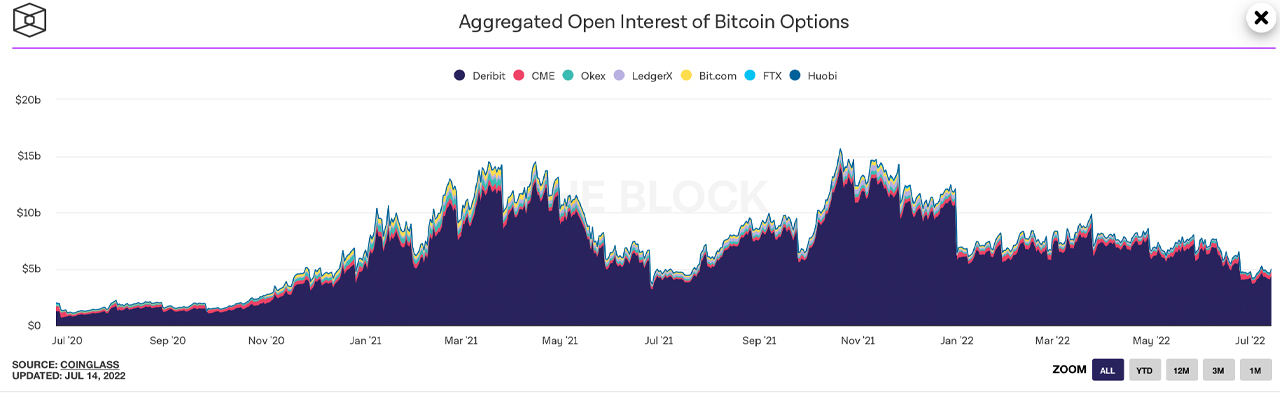

Bitcoin options open interest on July 14, 2022.

While bitcoin futures volume was down this past April, metrics indicate BTC futures volume spiked in May and even higher in June hitting $1.32 trillion. Bitcoin futures market leaders, in terms of monthly trade volume, include crypto exchanges like Binance, Bybit, Okex, FTX, and CME Group.

While bitcoin options open interest followed the same pattern as BTC futures open interest, bitcoin options volumes also saw an increase in May and June. Just like bitcoin derivatives and exchange-traded funds, stocks with exposure to crypto assets like BTC such as Coinbase Global, Microstrategy, Marathon, Silvergate, Riot, and more have also followed bitcoin’s spot market action over the last eight months.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur