Steemit (STEEM) news: +20% for the crypto

In this article we are going to learn about the STEEM crypto, a token native to the Steem ecosystem, and we are going to analyze the Steemit social platform, a fairly popular application within the cryptocurrency landscape.

Steem represents a “social blockchain” that powers several platforms where content creators can monetize their activity by receiving STEEM tokens as rewards.

In addition to Steemit social media, Steem’s blockchain does in fact power other dApps with real-world use cases such as eSteem, DTube, Utopian, and Steem Monsters.

Yesterday, the STEEM crypto had a significant price increase, yet the price has already started to deflate. What has happened?

Does Steemit have anything to do with the pump of the STEEM crypto?

Summary

- Steemit (STEEM) crypto news: the 20% growth in one day

- Why has this rapid rise and fall in price occurred?

- What is the STEEM crypto and how does the Steemit social media work

- The Steemit social media

Steemit (STEEM) crypto news: the 20% growth in one day

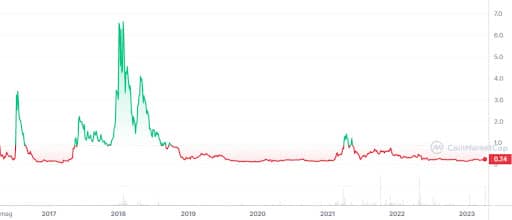

On Thursday 6 April, the cryptocurrency STEEM had a positive price increase of 15.26%, but if we also consider the spikes, the positive change was more than 60%, with volumes in the last 24 hours touching the $340 million mark.

This is crazy when we consider that STEEM’s market capitalization is $95 million.

STEEM’s current price is $0.24 per token, but yesterday it also touched $0.35.

The circulating supply is 431 million tokens, while the total supply is theoretically infinite.

The rise recorded yesterday has already been partially burned, with the formation of a local top well away from the current price.

The main markets on which STEEM can be traded are Binance, Bithumb, Bitvavo, and Upbit.

Why has this rapid rise and fall in price occurred?

Is there any Steemit-related news that has caused the price of the STEEM crypto to increase?

At the moment, there does not seem to be any news correlation that could justify this sudden price movement.

What stands out most is the frightening growth in volumes.

On Binance for example, on the STEEM-USDT trading pair it is possible to see that on 6 April at 1:00 AM (CET) average volumes (1h time frame) recorded $26,000 in trades while in the next candle, i.e. at 2:00 AM (CET), volumes grew to the figure of $9 million.

The highest volumes, however, did not occur on Binance, but on Upbit on the STEEM- KRW trading pair, which currently boasts 78% of the total volumes traded in the last 24 hours on all markets.

The reason for the rise of the STEEM crypto does not seem to be related to any news regarding Steemit, but rather appears to be an attempt at market manipulation by the South Korean whales in order to attract liquidity and offload their tokens at a higher price.

This can be well guessed from the parabolic increase in volumes, which normally happens only in the presence of strong news, as happened for example a few days ago with Dogecoin, when the logo of the famous dog replaced that of the blue bird within Twitter.

In the case of STEEM, no relevant news and a crazy growth in trading activity.

Beware because the token has been around for several years and is nowhere near its all-time high, touched in January 2018, during the ICO bubble.

Plus, the fact that the total supply is infinite and the token is generated from day to day creates constant selling pressure that could push the price lower and lower over time.

What is the STEEM crypto and how does the Steemit social media work

The Steem project represents a social blockchain solution that acts as a hub for all the decentralized applications that are built on top of it.

The STEEM crypto is the main token in the ecosystem and is central to how Steemit works

The basic mechanism is quite simple: there are applications that rely on the Steem blockchain where users are rewarded for their participation and content posted within the community.

All actions such as creating posts, comments, and reactions are recorded immutably in the distributed database that acts as the backbone of the infrastructure.

To simplify, the more active a user is in the community and produces engagement, the higher his earnings will be.

Monetization of content is through rewards delivered primarily in the STEEM crypto, but also from SBD, SF, and TRX tokens.

However, all tokens can be exchanged for other cryptocurrencies such as BTC, ETH and LTC.

SF (Steem power) is actually not a real token: rather, it represents a measure of the influence a user has on the Steem network.

The Steemit social media

The SBD token, on the other hand, represents a product similar to a stablecoin, but not backed by fiat money or liquid assets, as is the case with, for example, USDT and USDC.

TRX, on the other hand, belongs to the Tron ecosystem, led by the well-known Justin Sun.

In this regard, in February 2020 the project decided to abandon the Eos blockchain and migrate to the Tron blockchain.

It seems strange that Steem represents a blockchain in its own right but is simultaneously controlled by Justin Sun and under the tutelage of the Tron network.

This detail is not very reassuring considering the fact that the platform does not have an actual cryptocurrency wallet, but rather a centralized platform where users have credits that they can use ( somewhat like what happens in traditional banks).

The most widely used application in the ecosystem, as well as the one in which crypto STEEM is most present, is Steemit, a social media platform in which users can communicate and interact through them in a similar way as in traditional social network such as Facebook.

The difference is that on this platform users are paid for their activities and for contributing to the growth of the community.

However, Steemit is still a long way from achieving the same user base as Facebook.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD