Theories abound as Bitcoin hash rate records unprecedented rise

Hodlonaut — aka Magnus Granath — asked the Bitcoin community where the flood of additional hash rate was coming from expressing concern at the recent spike.

Granath said he found the pace at which the hash rate is climbing “A little frightening.”

Bitcoin hash rate records a new all-time high

The hash rate refers to a measure of the network’s processing power. A rising hash rate indicates that the number of miners is increasing and/or mining equipment hashing output/efficiency is up.

There is an ongoing debate on how hash rate and price are correlated. Some say the hash rate moves first — leading to price changes. Others argue that price changes drive movement in the hash rate.

However, an increasing hash rate is generally considered a positive development from a security perspective. This is because carrying out a 51% attack on the Bitcoin network becomes more expensive. Furthermore, it also signals miners’ confidence.

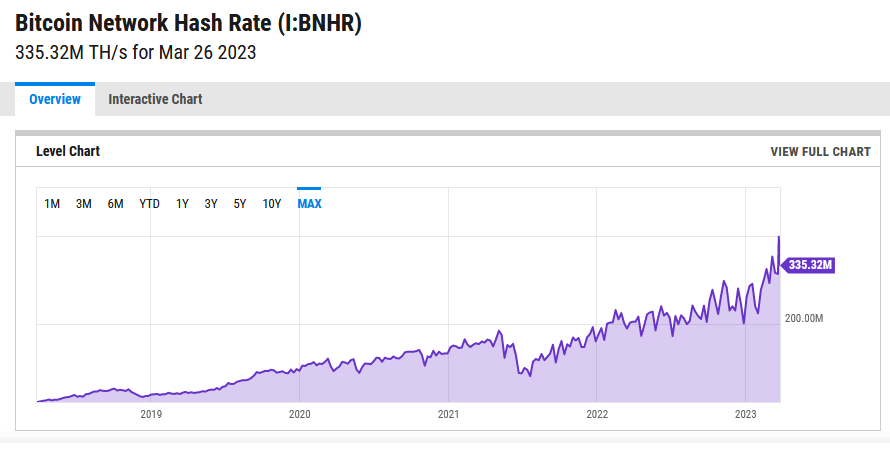

Data from ycharts.com shows the Bitcoin hash rate reached 335 TH/s on March 26. Zooming in shows an all-time high of 398 TH/s was reached on March 23.

At its peak, year-to-date gains amounted to 43%. Additionally, since the Terra ecosystem implosion, in May 2022, the Bitcoin hash rate has risen by 110%.

Community floats various theories

Seb Gouspillou — the CEO of mining firm BigBlock DC Bitcoin — explained the phenomenon as miners upgrading outdated machines to newer, more efficient equipment. He also said, “there are new farms, too, everywhere!”

“There’s nothing special. Old farms who are replacing their old asics with new ones. The energy improvement (from S9 to S19) is a factor of 3.3.“

Magnus commented that this seems like a valid explanation. But questioned whether this alone is sufficient to account for the “unprecedented” “rip.”

In response, Gouspillou said his firm upgraded from 2.5 EH/s machine to 17 EH/s rated ones in 2018. And while the “rip” is impressive, he thinks it aligns with expectations around firms upgrading their equipment.

Another user attributed the issue to the impact of Ordinals and additional miners joining the network to earn fees on the mania.

Research Analyst at River Financial Sam Wouters said recent Bitcoin price increases had encouraged miners to turn previously sidelined machines back on.

Several others theorized that unknown nation-states are getting into Bitcoin mining.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD