UK retail investors estimated to have spent over £30 billion on crypto

Although crypto prices continue to record significant volatility, new data shows that British citizens are increasingly pumping funds into the sector.

In particular, Brits have so far spent about £31.795 billion($34.7 billion) investing in cryptocurrencies. In particular, the report titled ‘Cryptocurrency on the High Street‘ indicated that each Brit had spent an estimated £473 on cryptocurrencies, according to data by VoucherCodes shared with Finbold on September 23.

The amount spent on digital assets was calculated by multiplying the amount the average Brit has spent on cryptocurrencies by the region’s latest population figures according to the World Bank.

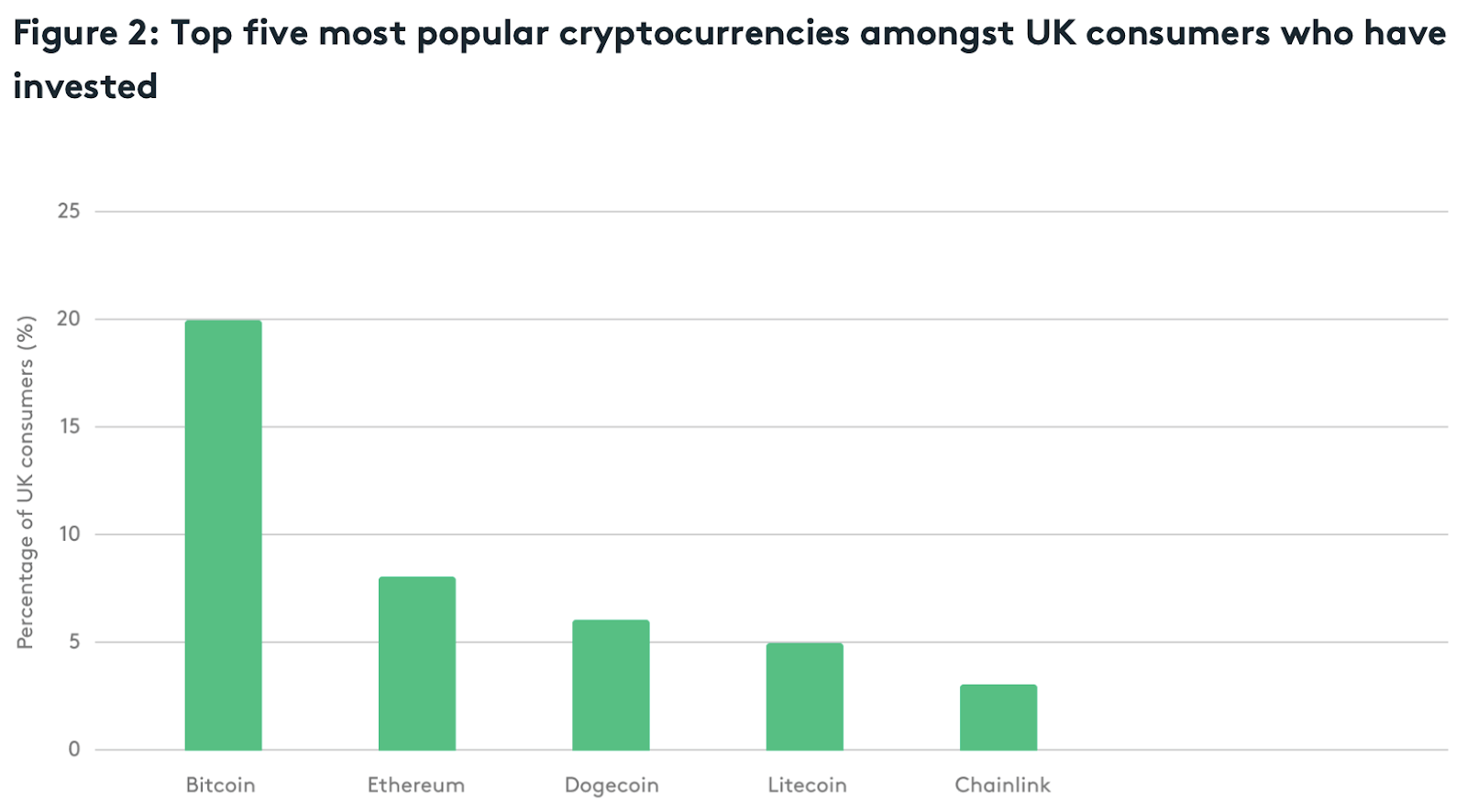

According to the findings, about 34% of the British population owns different forms of cryptocurrency. A breakdown of popular cryptocurrencies shows that Bitcoin (BTC) ranks top with a share of 20%, followed by Ethereum (ETH) at 8%, while Dogecoin (DOGE) is third at 6%.

However, the country continues to record a gender imbalance in crypto ownership, with 41% of men owning digital assets, recording an average spend of £767. Similarly, the imbalance is recorded in spending using digital assets, with only 27% of women investing in their crypto wallet, with £214 on average.

Use of crypto in payments

Furthermore, there is increased utilization of cryptocurrencies in purchasing essential commodities using cryptocurrencies with increased retail incorporation of digital assets in payments.

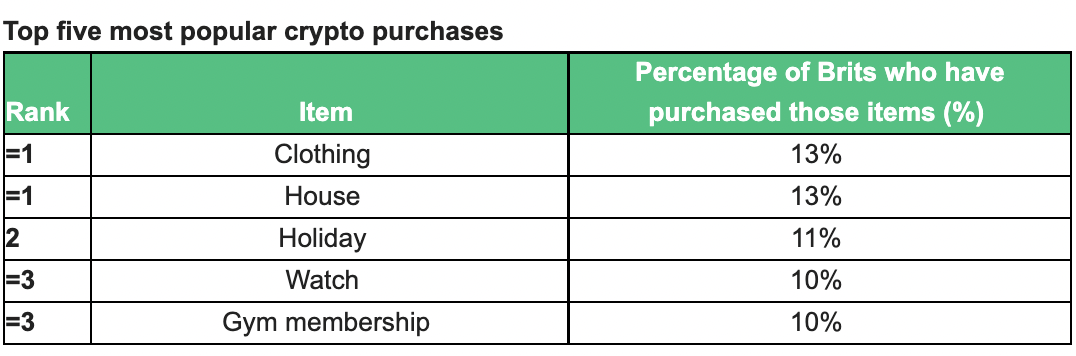

Interestingly, clothing ranks high at 13%, the same share as houses, while holiday accounts for 11%.

At the same time, the researchers pointed out that the scarcity of retailers to accept crypto payments is a crucial barrier.

“However, for Brits to be able to benefit further from technology, it’s clear there is still work to be done. Whilst it’s encouraging to see from the research that some are beginning to purchase commodities with their digital currency, the pool of retailers accepting crypto as a payment method is still small. For widespread adoption to take place we need to see more retailers welcoming crypto,” said Dr. Garrick Hileman, a crypto expert.

Crypto understanding

Elsewhere, the study highlighted discrepancies in understanding how cryptocurrencies work, with 11% of Brits revealing they are highly knowledgeable in the sector while 19% have a reasonable understanding.

The researchers further pointed out that future interest in spending cryptocurrencies is likely to grow, with an average person intending to invest about £593. Notably, the younger generation considers cryptocurrencies as the future.

Despite increasing cryptocurrency utilization in the UK, the region is facing uncertainty from a regulatory perspective. However, lawmakers in the country are pushing to make the region a global crypto hub through the right regulations.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Hive

Hive  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD