Why Ethereum Price Is Unlikely To Dump After “The Merge”

The Ethereum price is rallying above critical levels as “The Merge” is on the horizon, the bullish momentum might receive a fresh push and finally take ETH north of $2,000. In the meantime, market participants are speculating about the immediate future of the second cryptocurrency by market cap.

Related Reading: Cardano On White House Crosshair Can Push ADA Up This Route

At the time of writing, Ethereum’s price trades at $1,710 with a 4% loss in the last 24 hours and a 9% profit over the last week. After weeks of leading the market, ETH is underperforming Bitcoin. The number one cryptocurrency records an 11% increase in 7 days.

For a deeper dive into the Bitcoin price and its potential bullish signals, check out our video below where our Editorial Director Tony Spilotro makes the case for the formation of a bottom with massive potential for appreciation, similar to 2020.

Who Is Most Likely To Sell After “The Merge”?

The market is seemingly divided on “The Merge”, the event that will complete the ETH transition to a Proof-of-Stake (PoS) consensus. Some expect the Ethereum price will operate under a “buy the rumor, sell the news event”, other are betting on a bullish continuation.

In a recent report from on-chain analytics firm Nansen, looking into the top ETH stakers ahead of “The Merge”, the staking dynamics, and its impact to affect the Ethereum price, there is a forecast about a potential negative impact on the cryptocurrency from stakers.

Nansen rules out any short-term bearish influence from these investors as the ETH currently locked on the Beacon Chain, the PoS blockchain, will be illiquid for a portion of them until the implementation of the Shanghai upgrade in 2023. This update will allow stakers to withdraw their funds.

Illiquid stakers are those that send their ETH to the Beacon Chain in 2020, they can’t withdraw their funds for an undefined period of time, and liquid is those using Lido and similar solutions to stake their funds and receive the rewards.

Of this group, Nansen believes illiquid stakers are less likely to sell after the Shanghai upgrade in 2023 if the price remains above $600. There is around 1 million ETH locked at that price which could “dripped not the market”.

In that sense, the report claims around 71% of all ETH used to secure the PoS blockchain was staked at a loss. Nansen claims 18% of “all staked ETH at present belongs to illiquid stakers that are in profit, the category most likely to sell once they are able to unstake”.

However, Nansen is not expecting this selling negatively impacts the Ethereum price or to put massive selling stress on the crypto market. This factor could operate as another bullish fundamental for an Ethereum price post “Merge”.

Whales Accumulate Ethereum In 2022

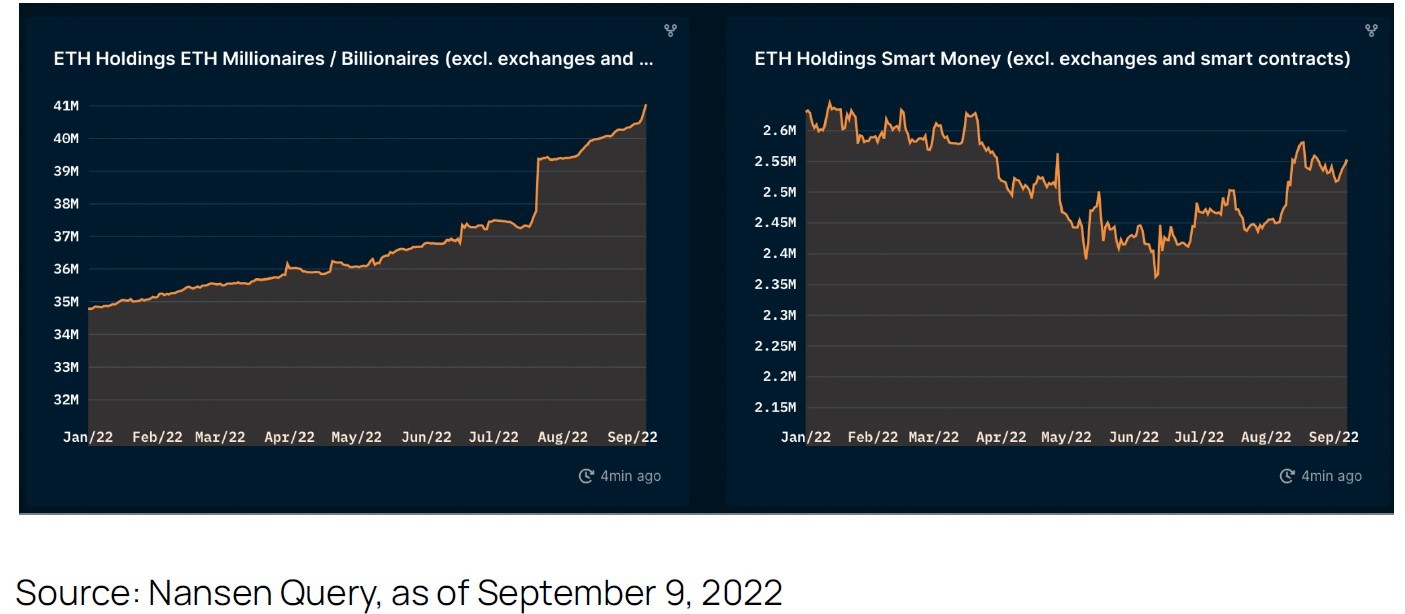

In addition to a possible low long-term negative impact on the Ethereum price, Nansen noted an increase in the amount of ETH millionaires and billionaires. These addresses have been labeled by the on-chain analytics firm as individuals and not smart contracts or exchange platforms.

The report claims that these large players have “consistently been stacking Ethereum since the beginning of this year”, despite the bearish price action. As seen in the image below, the trend has persisted and spiked in August and September this year.

Related Reading: Crypto Traders Bleed Heavily After Betting Against Market

Will tris accumulation positively impact the market or are these whales accumulating to dump ETH shortly after “The Merge”?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Tezos

Tezos  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren