Why Bitcoin Miners May Affect Ongoing BTC Rally?

The world’s largest cryptocurrency Bitcoin (BTC) has delivered a strong price pump moving closer to $25,000. As of press time, BTC is trading 3% up at a price of $24,678 with a market cap of $472 billion.

On the other hand, Bitcoin miners continue to book profits with every rise in order to cover their operational costs. As per the Glassnode data, the Bitcoin hash-ribbons remain inverted signaling the existing stress within the mining industry.

But Glassnode adds, “the faster 30DMA is starting to stabilize, suggesting some improvement to miner financial conditions”.

Courtesy: Glassnode

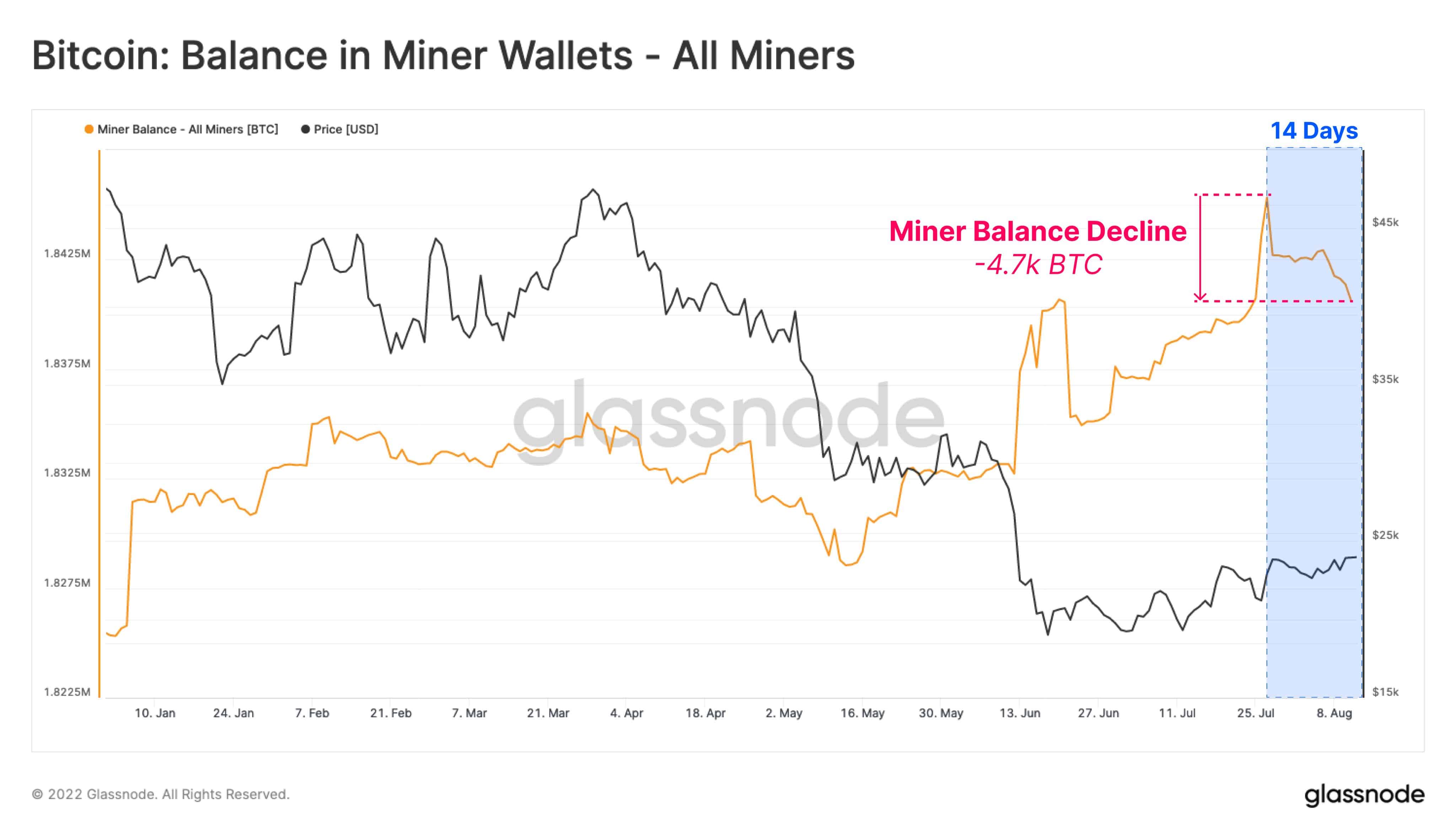

As the BTC price rallied over $22,000 over the last two weeks, we have seen a fall in the Bitcoin miner balance. This is because the miners want more liquidity. This ongoing selling could probably affect the BTC price rally going further. As Glassnode explains:

“Over the last 2-weeks, aggregate miner balance has declined by approximately 4.7k $BTC. This suggests aggregate miners are taking some exit liquidity during the recent price rally, likely to shore up balance sheets and hedge risk”.

Bitcoin Miner Distribution to Exchanges On A Decline

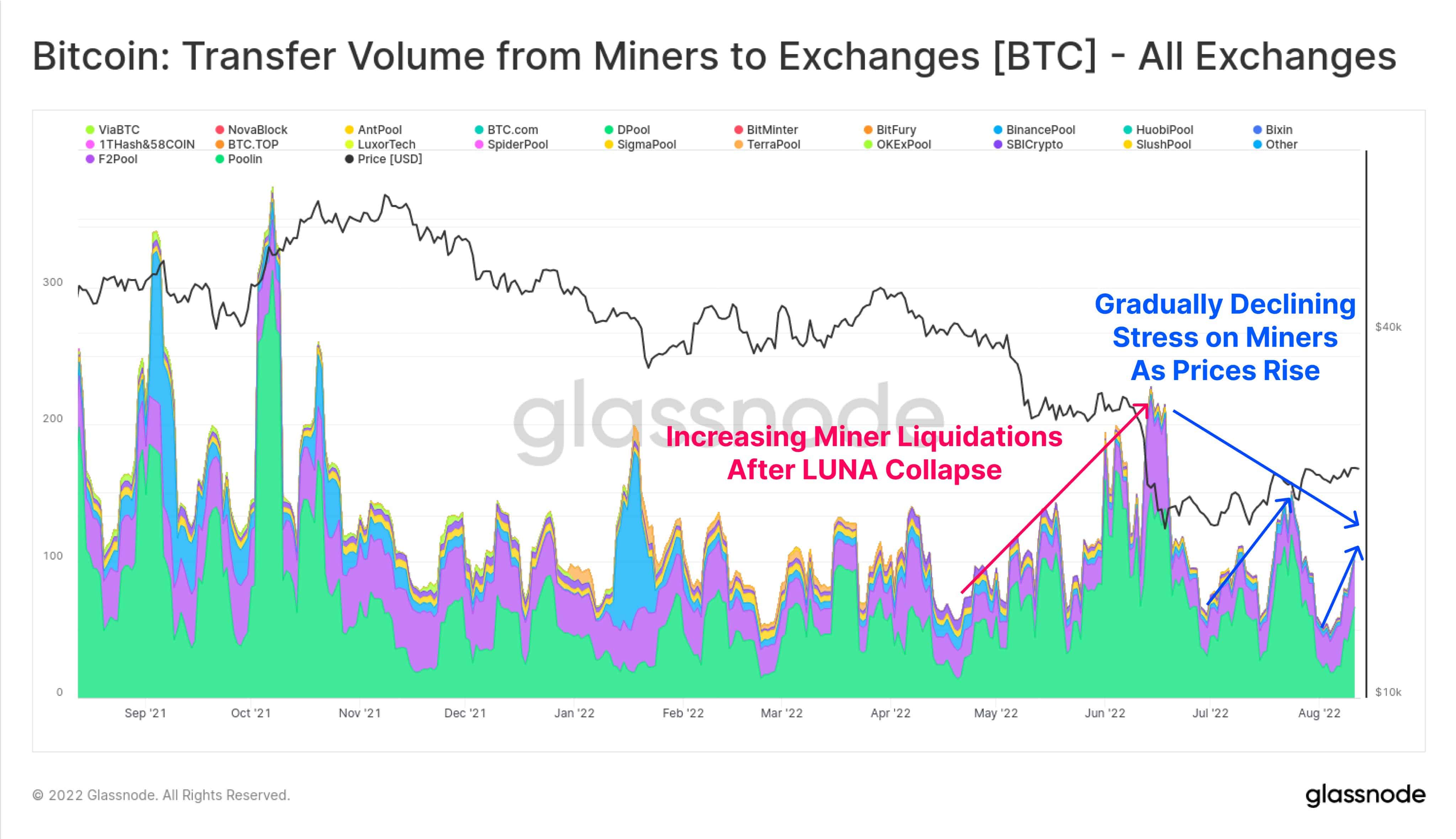

Furthermore, Glassnode adds that Bitcoin miner stress peaked in June 2022 when the BTC price tanked under $20,000. But the miner distribution to the exchanges has been on a decline in recent weeks. This goes on to suggest that while the stress remains in the industry, the worst of the times could be behind us.

Courtesy: Glassnode

As the Bitcoin price breaches $25,000, it will open the gates for the rally up to $30,000. However, Galaxy Digital CEO Mike Novogratz said that he doesn’t see this happening anytime soon. But here’s what popular trader Ali Martinez has to say. He notes:

The RSI on the daily is signaling a break out, but the 100MA at $24,900 is acting as resistance. Once this level is breached, $BTC could gain the strength to head toward $28,000 – $29,000. Invalidation at $23,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur