Why Ethereum will emerge victorious in the ongoing bull rally as Tether mints $2 billion USDT

Share:

- Stablecoin issuer Tether minted a total of $1 billion USDT on March 15.

- The company’s CTO, Paolo Ardoino, stated that this was inventory replenishment in case of a spike in demand.

- Meanwhile, Voyager has offloaded 130,000 ETH over the past two months, continuing its selling spree.

Tether’s recent mint of a billion USDT tokens might have momentarily caused FOMO among participants, but crypto markets quickly came to terms after clarifications from its CTO. Investors need to be cautious as matters could get dicey in the coming days due to the chaos caused by the collapse of traditional finance banks.

Also read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bullish momentum fades for BTC and ETH, XRP suffers SVB woes

Tether mints $2 billion USDT tokens

Tether minted a whopping $1 billion in USDT on Ethereum and TRON blockchains on March 15. The largest stablecoin’s market capitalization went from $72.1 billion to $74.6 billion between March 12 and March 14.

1,000,000,000 #USDT (1,004,070,000 USD) minted at Tether Treasuryhttps://t.co/6HjS8x47Yl

— Whale Alert (@whale_alert) March 14, 2023

Over the last few weeks, USDT seems to be taking the front and center stage but not because of a lawsuit or FUD, but because other US-based stablecoins are taking hits due to the collapse of three banks in the United States.

To put things into perspective, Tether’s market capitalization has skyrocketed from $66 billion at the start of 2023 to $73.6 billion as of March 15, denoting an addition of more than $7 billion.

Tether’s CTO Paolo Ardoino clarified that the $2 billion minted on Ethereum and TRON blockchains were not issued transactions. He added,

… this amount will be used as inventory for next period issuance requests and chain swaps.

Voyager’s Ether selling spree coming to an end

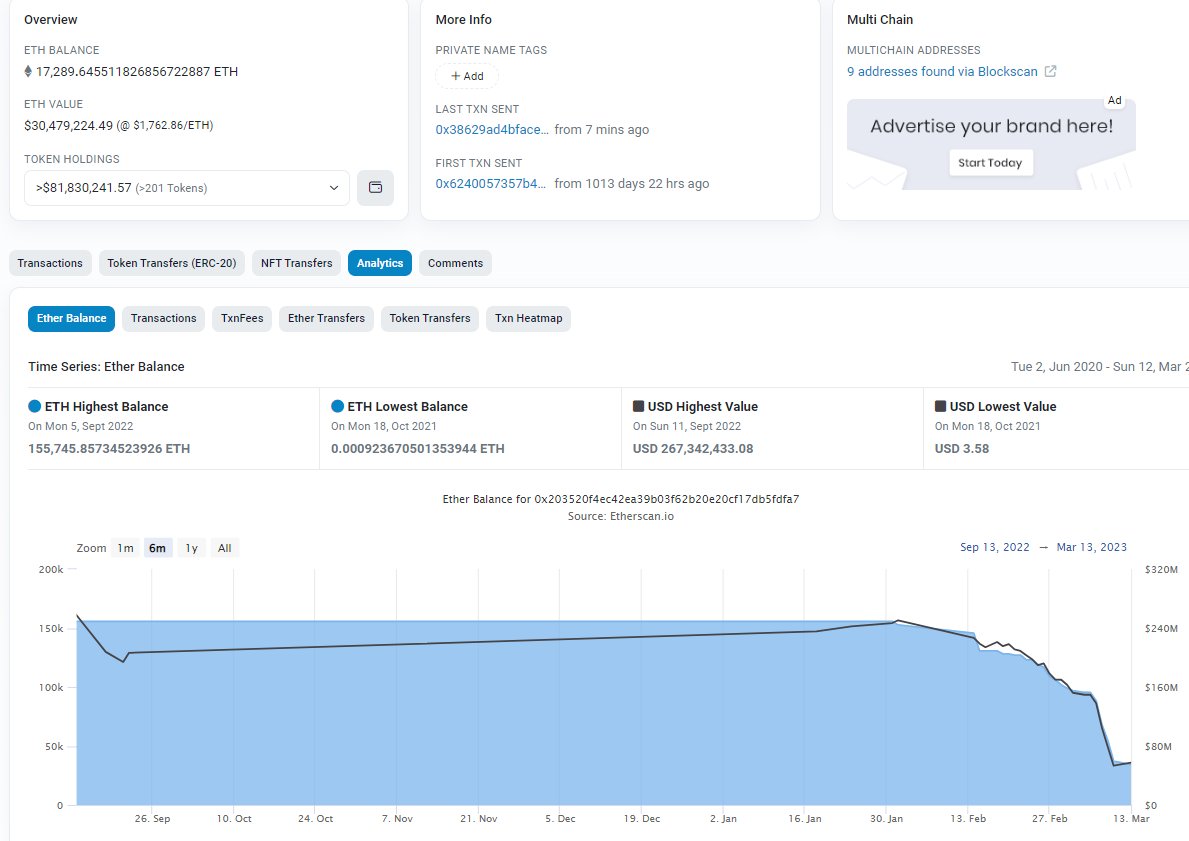

The bankrupt crypto lender Voyager continues to offload its Ethereum holdings over the last few weeks. The latest sell orders suggest that the defunct company has sold a total of 130,000 ETH, worth roughly $220 million, valued at $1,700 per token.

This leaves the crypto lender with 17,000 ETH, worth roughly $29 million at the current price levels.

Voyager’s ETH wallet balance

Also read: Ethereum holders could be in trouble if Voyager sells $151 million ETH in its holdings

Connecting the dots

With markets in turmoil, certain investors succumb to panic while others perceive the disorder and uncertainty as an opportunity. Binance CEO, Changpeng Zhao (CZ), seems to have taken the old adage, “never let a good crisis go to waste,” to heart as announced the conversion of $1 billion in Industry Recovery Fund into Bitcoin, Ethereum and Binance Coin.

To recap,

- Tether has minted USDT anticipating future demand.

- The selling pressure on the Ethereum price from Voyager nears an end.

- The last and final piece of the puzzle is a combination of CZ’s stance and ETH’s deflationary aspect post-Merge.

Considering these aspects, one can conclude that the buying pressure, although not here yet, is waiting to be triggered. Ethereum has a special reason to rally quicker and higher than most cryptocurrencies due to the aforementioned facts.

Macroeconomics and conclusion

If macroeconomics is to be poured into the mix, investors will only get more bullish. The US year-on-year Consumer Price Index (CPI) print on March 14 was 6.0% as forecasted. It came in lower than January’s 6.4%, suggesting disinflation.

A reduction in inflation would ease the pressure on the US Federal Reserve to raise interest rates at a faster pace. As a result, investors might have already priced in the 25 basis points (bps) hike for March. If true, then the worst is behind us and the bull rally is ready to resume.

However, not everything is certain, and things could change due to the chaotic nature of the markets and macroeconomic conditions. Therefore, investors should exercise caution even if they are bullish.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond