Will Bitcoin Golden Cross Lead to a 1835% Increase?

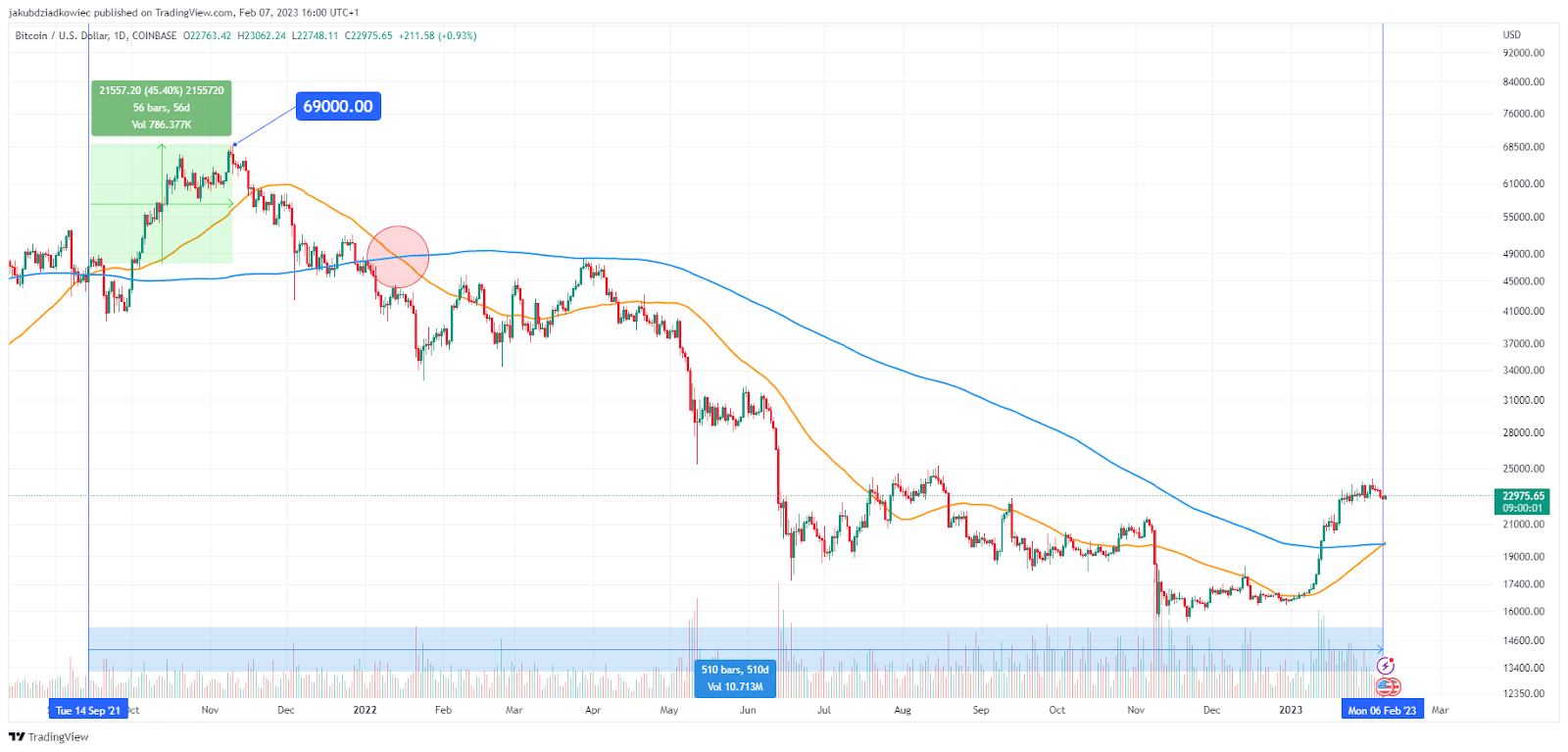

The long-awaited golden cross has appeared on the Bitcoin chart. This is the first such signal in 510 days or almost 1.5 years. If history repeats itself, this lagging indicator could confirm the start of a long-term bull market in the cryptocurrency market.

As BeInCrypto reported, just 5 days ago a golden cross appeared on the chart of the S&P 500, which is an indicator of the health of US traditional stock markets. Today, the same signal flashed on the Bitcoin chart, which determines the health of the broad cryptocurrency market. Should we expect a continuation of the increases initiated in January 2023?

Bitcoin First Golden Cross in 1.5 Years

The golden cross is a lagging indicator that has earned its popularity in long-term technical analysis of traditional markets. Although there are different versions of it, the most well-known one involves the crossing of the 50-day moving average (50D MA) above the 200-day moving average (200D MA).

On the one hand, this event occurs only if the price of the asset has already moved upward. Therefore, the golden cross only confirms a bullish trend reversal. On the other hand, this event is a confirmation of a long-term change in the market structure. Thus, its consequences may not become apparent until many months after the signal.

The last golden cross on the Bitcoin chart appeared 510 days ago – on September 14, 2021. The signal was generated after BTC hit a low of $29,000 in the summer of 2021 and rebounded. It then moved to the current all-time high (ATH). This one reached $69,000 on November 10, 2021. Measuring from the previous golden cross to the absolute peak, Bitcoin surged 45%.

BTC/USD chart by Tradingview

1835% Average Increase and One 61% Decrease

To get a better perspective on the efficiency of the golden cross in the Bitcoin market, it is necessary to look at the price action that followed the historical signals. Looking at the history of BTC trading going back to 2015, we see 5 golden crosses. Four of them led to a significant increase in Bitcoin price, while one led to a dramatic decline:

- October 28, 2015: Bitcoin surged 6566% to a historic ATH of $20,000

- April 23, 2019: Bitcoin surged 154% to a local peak at $14,000

- February 18, 2020: Bitcoin dropped 61% to a macro bottom at $3850

- May 20, 2020: Bitcoin surged 574% to its previous ATH at $64,900

- September 14, 2021: Bitcoin surged 45% to the current ATH at $69,000

BTC/USD chart by Tradingview

Thus, if one were to average four of the five historical increases that followed the golden cross, one would get an upward movement of 1835%. If Bitcoin, which is currently oscillating around $23,000, achieves such an increase in the next bull market, it will be worth $445,000.

On the other hand, if a stock market crash similar to the one in March 2020 happened, the price of BTC could fall to $9,000.

Both scenarios seem equally unlikely over the next several months. Historically, the golden cross signal has been accompanied by increased volatility, which has often led to a short-term correction in the BTC price.

However, in situations where this did not result in a loss of important support levels, a strong bounce followed. Only this initiated an actual bull market. Conversely, when Bitcoin after the golden cross collapsed below long-term support – as in the case of the COVID-19 crash – the entire cryptocurrency market reached new lows.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur