zkSync SyncDex Finance Rug Pull With Over 100 ETH And 98,444.8 USDC Stake

According to the information on the relevant page, users have committed a total of more than 100 ETH and 98,444.8 USDC to this project. According to community feedback, the commit pool is currently locked, and users cannot withdraw.

According to the platform’s introduction, SyncDEX is one of the first decentralized exchanges (DEX) with an automated market maker (AMM) on the zkSync Era Network. It offers the lowest crypto asset transaction costs compared to its rivals. In the entire zkSync ecosystem, the rewards from staking and yield farming are among the highest paying.

In addition, the DEX wants to involve consumers as much as possible in the decision-making process. Governance voting is used to make all critical decisions.

With advertising, the automated market-making (AMM) algorithm ensures that token swaps are executed quickly and efficiently without the need for order books or centralized order matching. SyncDEX also attracts users with charges a fee of 0.3% on each trade, which is used to incentivize liquidity providers and maintain the platform’s liquidity.

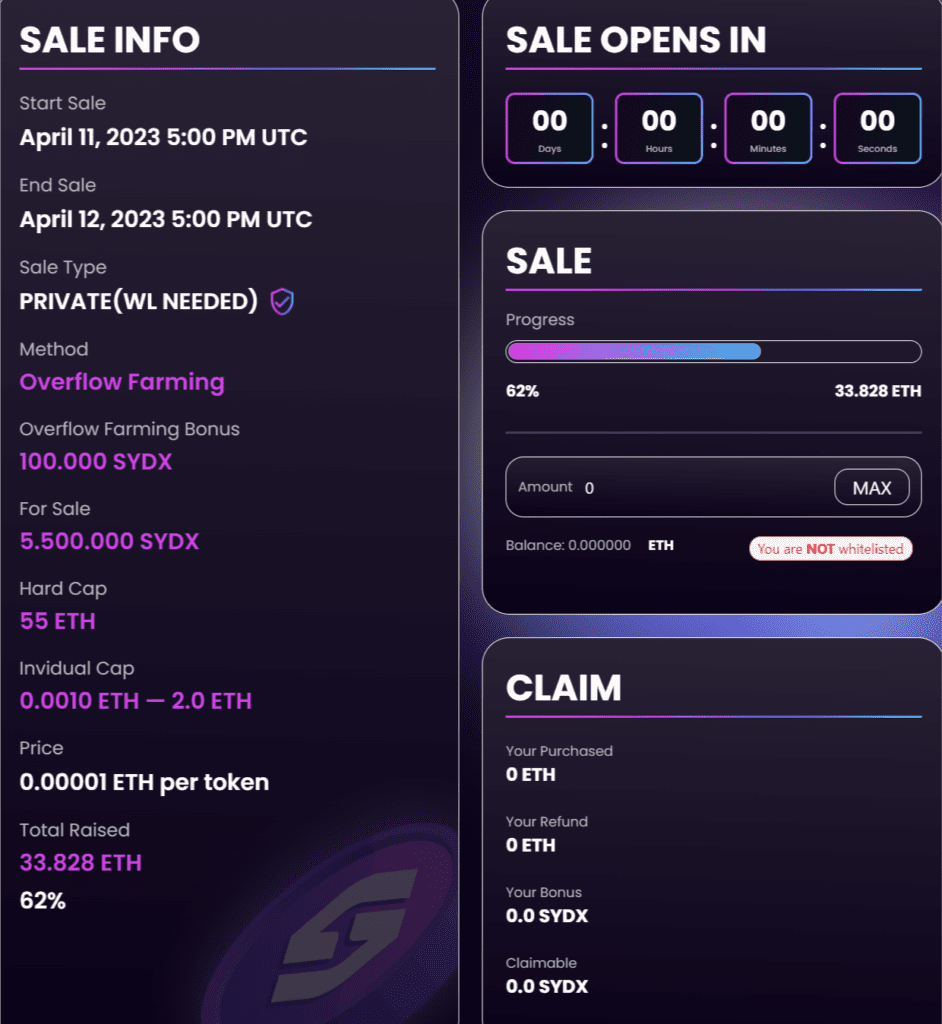

Prior to the crash, A launchpad took place at 5:00 pm UTC on April 11, 2023 for its SYDX token at 0.00001 ETH per token. It put up for sale 5,500,000 SYDX and raised 33,828 ETH.

This is still a work in progress so follow us for the latest updates.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD