6 Possible Reasons Why Bitcoin Crashed Below $20K in a Day

It’s safe to say that Bitcoin’s price has seen better days. The cryptocurrency fell below $20,000, reaching an intraday low at around $19,791 (on Binance) and charting a decline of around 8% in the past 24 hours alone.

That said, the move didn’t come without its catalysts, so let’s have a look at five potential reasons why it happened.

Silvergate Bank

On March 2nd, Silvergate Bank – a financial institution that used to serve a myriad of crypto heavyweights – said that it’s going through operational issues and that it won’t be able to file its financial reports in time. Some experts believed, at the time, that most of the damage in terms of market impact is done, but that obviously wasn’t the case.

Not long after that, however, the bank announced that it was entering a procedure of voluntary liquidation, saying they think that was the best course of action.

In light of recent industry and regulatory developments, Silvergate believes that an orderly wind-down of Bank operations and a voluntary liquidation of the Bank is the best path forward.

Silicon Valley Bank

While it may seem unrelated to crypto, it’s important to keep in mind that the industry is part of the broader fintech field, which undoubtedly took a beating throughout the past day, at least on a macro level.

One of the largest financial institutions and also a massive tech VC – Silicon Valley Bank – is going through serious turmoil.

Reuters reported that the bank is struggling to reassure its clients of the safety of their funds following a 60% stock wipe-out.

The latter was caused by the fact that SVB is attempting to raise $1.75 billion through a share sale because it needs to plug a $1.8 billion hole. Investors are apparently unsure of whether the raise will suffice.

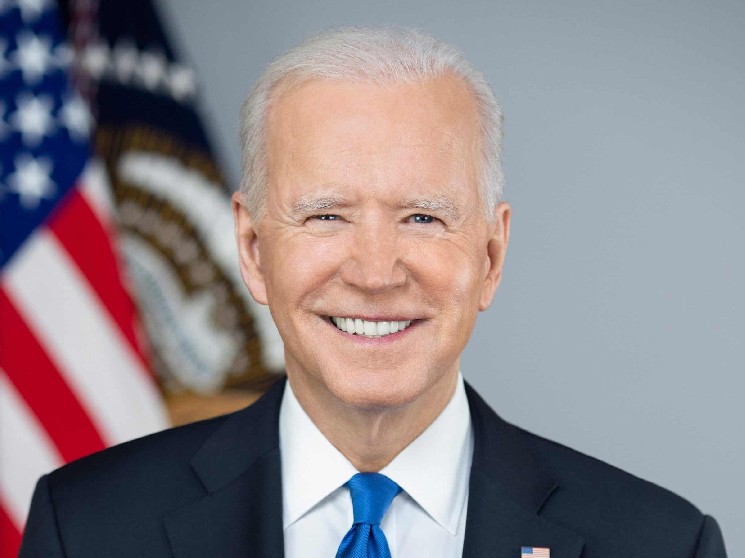

Biden Proposed Tax Changes

The US President’s budget proposals also came with a few upsets for cryptocurrency traders and investors in the US.

First of all, the budget plan seeks to increase the capital gains tax while also targeting a provision that is commonly referred to as “tax-loss harvesting.”

This is a strategy that some traders take advantage of to offset their tax liabilities by selling assets at a loss. They would then repurchase them immediately after.

This, coupled with the fact that the budget also seeks to almost double the capital gains tax for investors with an income of over $400K to 39.6%, had the market scared. While many believe that the budget will face massive opposition and is unlikely to pass, tensions are rising.

Gary Gensler Continues to Pressure

Gary Gensler, the Chairman of the United States Securities and Exchange Commission, also continues to pressure the industry.

Just yesterday, he came out with another opinion piece and argued:

Crypto entrepreneurs might claim, in their own marketing materials, that they’re transparent and regulated.

But make no mistake: Very few, if any, are actually registered with the SEC and fully compliant with the federal securities laws.

The SEC has been on a tear lately, taking huge aims at the industry and filing lawsuits left and right. Gensler’s latest op-ed is a sign that they have no intention of slowing down.

To make matters worse, the NYAG also claimed that ETH is security in open court in a filing against KuCoin.

The Fed Will Likely Hike 50bps

Adding to the problems is the latest speech of the Chairman of the Federal Reserve – Jerome Powell. He reiterated that the inflation pressures are higher than what they had been previously expected, hinting at a higher interest rate hike, perhaps of 50bps.

A higher interest rate hike suggests a further tightening of the US monetary policy to curb inflation, which is nowhere near the Fed’s targeted 2% rate.

In any case, it’s interesting to see how the market will shape in the coming weeks and if the fiasco with Silvergate Bank and Silicon Valley Bank will escalate.

US Govt Sells BTC on Coinbase?

When it comes down to actions undertaken by the US that could have impacted the market, one cannot miss out on the thousands of BTC deposited to Coinbase shortly before the most recent plunge. On-chain data showed earlier this week that the US government transferred nearly 10,000 BTC to the largest local crypto exchange, all of which were seized from Silkroad.

CryptoQuant also weighed in on the matter, saying the Bitcoin Coinbase Premium (the metric showing the difference in BTC’s price on Coinbase and other exchanges) went into negative territory. According to one of the company’s analysts, “this suggests that there was strong selling pressure from Coinbase.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  NEM

NEM  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur