Will Bitcoin Price Rally Above Key 200-WMA Level? Or It’s A «Bull Trap»

Bitcoin price climbs nearly 5% in the last 24 hours to hit a 24-hour high of $24,924. While macro indicators and hawkish U.S. Fed comments dragged down BTC price from a high of $25,134 earlier, fresh data has lifted the price again.

Moreover, the market sentiment remains positive, with the Bitcoin Fear and Greed Index at 60. Traders are also wondering if the recent rally is a bull trap and taking caution due to “Greed” sentiment in the market. However, there’s a key level that expert investors are watching.

Level To Watch Out For Bitcoin Price

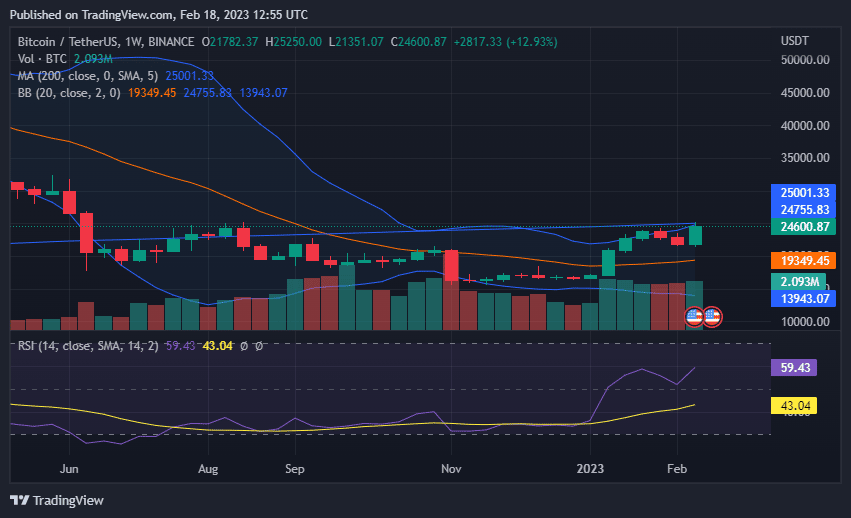

BTC price is currently trading at $24,585. Surpassing the $25,000 psychological level will be a key momentum gainer for the market. However, investors must keep an eye on a key level to confirm a bullish momentum — the 200 Weekly Moving Average (WMA).

The 200-WMA is one of the most effective indicators that a trader uses to help identify long-term changes in direction of Bitcoin. The recent decline in Bitcoin price came as a result of resistance at 200-WMA, which is right above $25,000.

Bitcoin Price at Weekly Timeframe

If Bitcoin rallies above $25,000 and hold above the level, a major bullish rally will likely follow. However, it’s a strong resistance too and breaking above that level will be challenging.

Meanwhile, the RSI at 60 shows strength in the Bitcoin price and Bollinger Bands are opening wider. Thus, the indicators are bullish on Bitcoin and signal an upcoming price rally above $25,000.

Also Read: Bitcoin Price Still Bullish To Hit $30K, Predicts On-Chain Data And Crypto Analyst

Macro Indicators Impacting BTC Price

The U.S. Dollar Index (DXY) dropped to 103.88 after hitting a high of 104.67 in the last 24 hours. A further drop in U.S. dollar strength will bring more upside move in Bitcoin price.

Meanwhile, oil prices and U.S. 10-Year Treasury bond yield are also declining. It will force the U.S. Federal Reserve to keep interest rate hikes away from the table and announce a pivot later.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Ravencoin

Ravencoin  Decred

Decred  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  Status

Status  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Energi

Energi