Bitcoin battles downtrend; Can it retest key channel and retake $28,000?

As Bitcoin (BTC) continues to follow a largely sideways trading pattern, specific indicators need to line up for the decentralized finance (DeFi) asset to repeat the earlier run toward $28,000 and continue up, including a successful retest of a critical channel and invalidation of a bearish pattern.

In fact, Bitcoin is still attempting to retest a channel that kickstarted the most recent move to $28,000, as it needs to retest the top of the chart pattern and remain inside a crucial area, as observed by pseudonymous cryptocurrency analyst Rekt Capital in a tweet on June 1.

Specifically, the crypto expert was referring to the down-trending channel and its upper edge for a retest, as well as the ‘red box’ area between $26,920 and $27,500, in which the asset needs to stay “to have a chance at invalidating the bearish head and shoulders.”

As it happens, this is another attempt by Bitcoin after failing at a red box top retest earlier on May 31, which Rekt Capital also noted on the same day, and the spotlight at the moment is again on retesting the upper border of this pattern.

Bitcoin price analysis

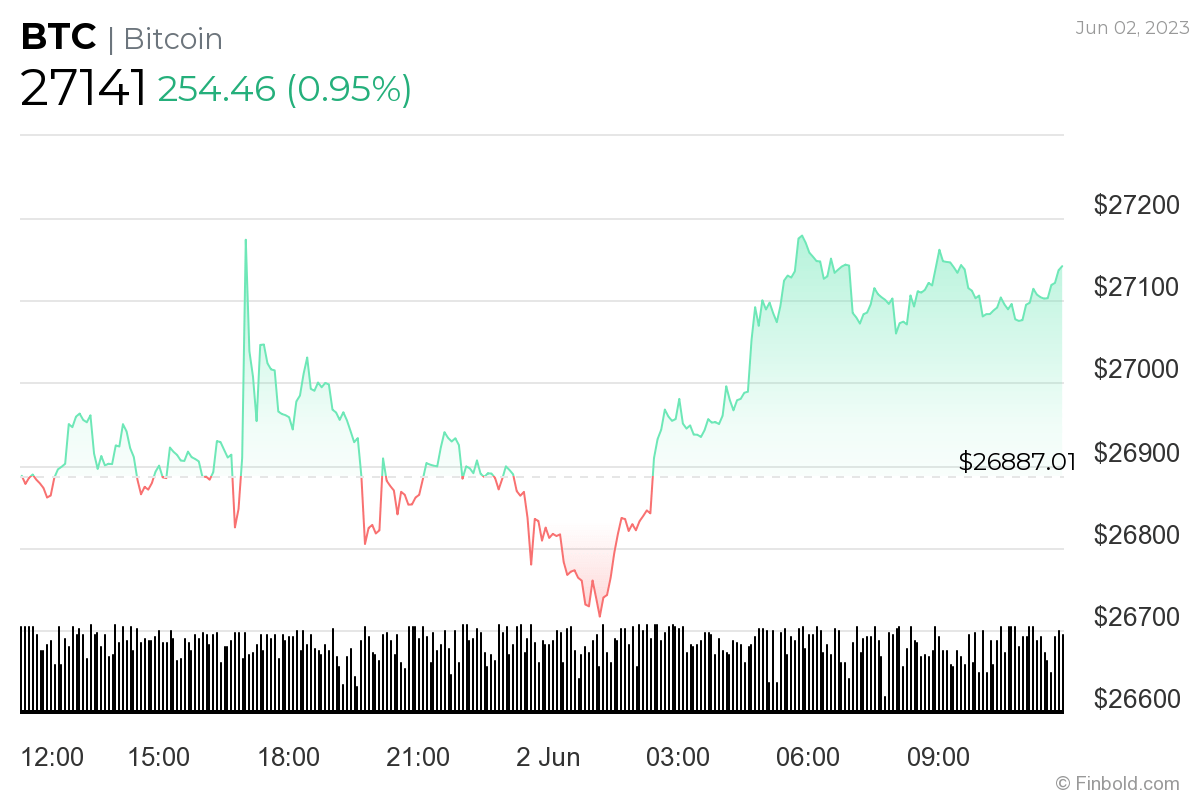

Meanwhile, Bitcoin was at press time changing hands at the price of $27,141, recording a 0.95% gain on the day and 2.57% across the week, as it still holds on to the losses of 5.31% on its monthly chart, according to the data retrieved by Finbold on June 2.

Earlier, Altcoin Sherpa noted that Bitcoin could still decline further, even dropping to as low as $23,000, as he cited data from several technical analysis (TA) indicators, including the 200-week exponential moving average (EMA), support and resistance levels, 200-day EMA, and the 0.382 ratio Fibonacci level.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Nano

Nano  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD