Bitcoin breakout imminent ahead of key macro events-filled week

Bitcoin (BTC) is still looking for a trigger to break past the $20,000 level, having consolidated around the zone for several weeks. The asset’s possible rally has partly been delayed by the prevailing macroeconomic factors, with the flagship cryptocurrency trading in tandem with the stock market.

Notably, both bulls and bears lack a clear advantage at the moment as they tussle for dominance when market participants are projecting that a possible rally is still in play.

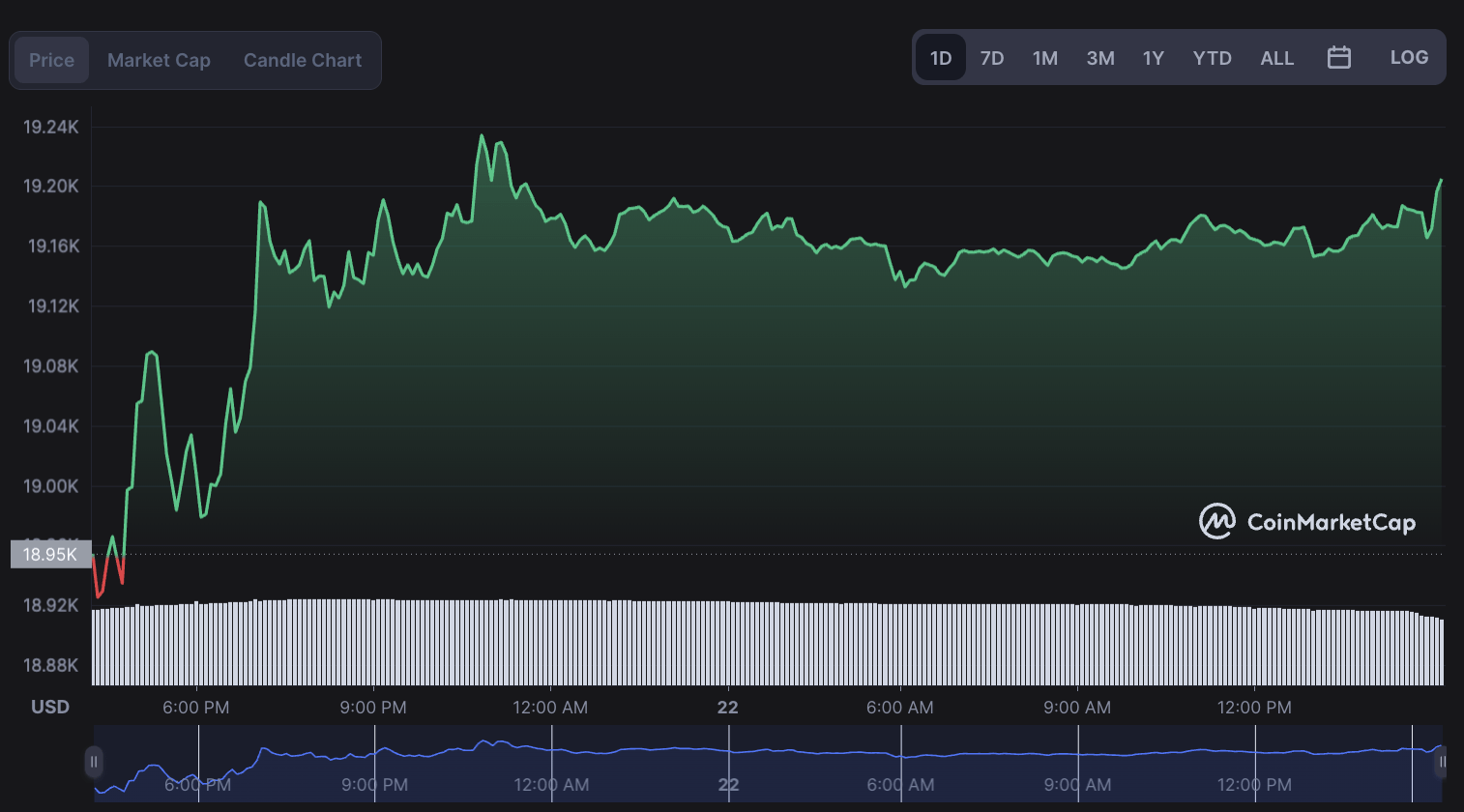

As things stand, Bitcoin was trading at $19,200 by press time, with slight gains of almost 2% in the last 24 hours. Notably, Bitcoin’s stabilization around the key psychological level of $20,000 has contributed to the asset’s dropping volatility.

The latest gains come about 24 hours after the cryptocurrency corrected to a low of about $18,700. However, the price has moved away from the key support zone of $18,900. At the same time, according to experts, Bitcoin’s price has been termed as discounted amid the extended bear market.

Expert’s take on Bitcoin

In this line, crypto trading expert Michaël van de Poppe has suggested that Bitcoin’s potential breakout is imminent in the coming week, mainly triggered by macroeconomic events likely to impact risk assets like BTC positively.

In a YouTube video posted on October 21, Poppe stated that factors like the upcoming speech by U.S. Treasury Secretary Janet Yellen would impact yields and likely dictate Bitcoin’s next price actions. This comes after the 10-year treasury yield rose to its highest level since 2008.

“When we turn around with the yields, it’s going to have an impact on risk and especially Bitcoin will do relatively well. Today, we are seeing that we are still making new highs, it’s decisive how the week is going to end. <…> Yields are going to fall, we most likely are going to climb to the upside,” Poppe said.

Furthermore, Poppe stressed that data from earnings by big tech firms like Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN) would potentially impact the market and provide a chance to build positions.

He also pointed out that the Flash Manufacturing PMI (Purchasing Managers’ Index) for some European countries and the U.S. will be key. From Asia, Poppe noted that investors should look out for China’s GDP data and the Bank of Japan’s outlook report.

Bitcoin price action

On the Bitcoin price action, Poppe highlighted that the next position to look out for is the $19,600 zone, and if flipped, it will be a trigger of longs with a focus on $20,700 and $22,100.

Elsewhere, Poppe noted that longs are clear, but if Bitcoin breaks beneath $19,000 and bounces from $18,500, it will be a short trigger and take lows of $17,600.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Hedera

Hedera  Stacks

Stacks  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur