Bitcoin (BTC) Continues Consolidating Near $24,000 in Unclear Trend

Bitcoin (BTC) is trading inside a short-term corrective pattern. The direction of the short-term trend is still unclear.

On July 18, Bitcoin broke out from a descending resistance line that had been in place since the end of March. The reaction after the breakout was relatively weak — Bitcoin failed to even reach the 0.382 Fib retracement resistance level at $29,370.

While BTC reached a local high of $25,211 on Aug. 15, it created a long upper wick (red icon) and has been mostly falling since.

More importantly, the bullish divergence trendline in the daily RSI (green line) that preceded the upward move has now been broken. This is a sign that often precedes price decreases.

If BTC continues to fall, the closest support area would likely be found at $21,550.

BTC/USDT Chart By TradingView

Short-term pattern

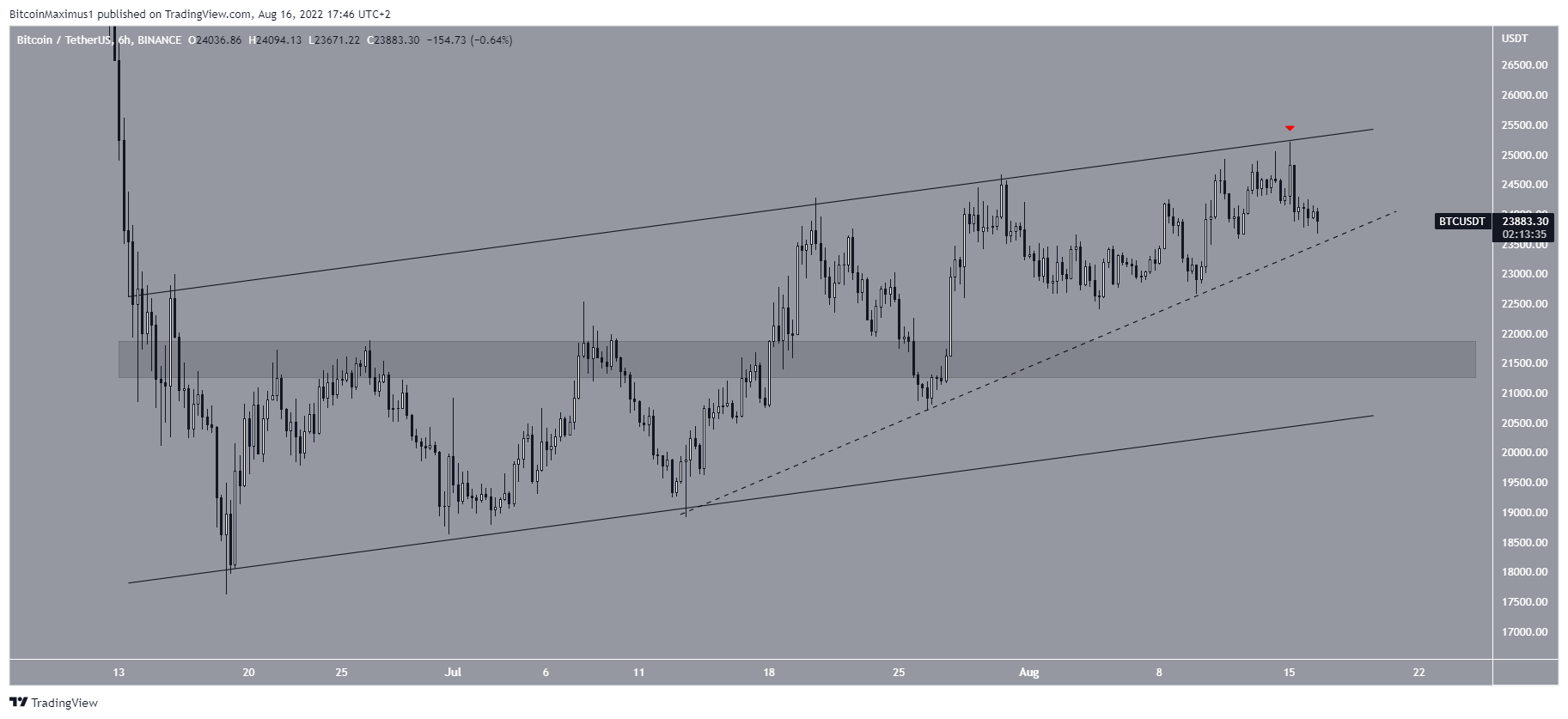

The six-hour chart shows that BTC is trading inside an ascending parallel channel since reaching a low on June 18. Such channels usually contain corrective movements, meaning that an eventual breakdown from it would be expected.

Bitcoin was rejected by the resistance line of the channel on Aug. 15 (red icon) and has been falling since.

If it breaks down from the short-term ascending support line (dashed), a decrease towards the aforementioned $21,500 support area would be expected. This area also coincides with the support line of the channel.

BTC/USDT Chart By TradingView

BTC wave count analysis

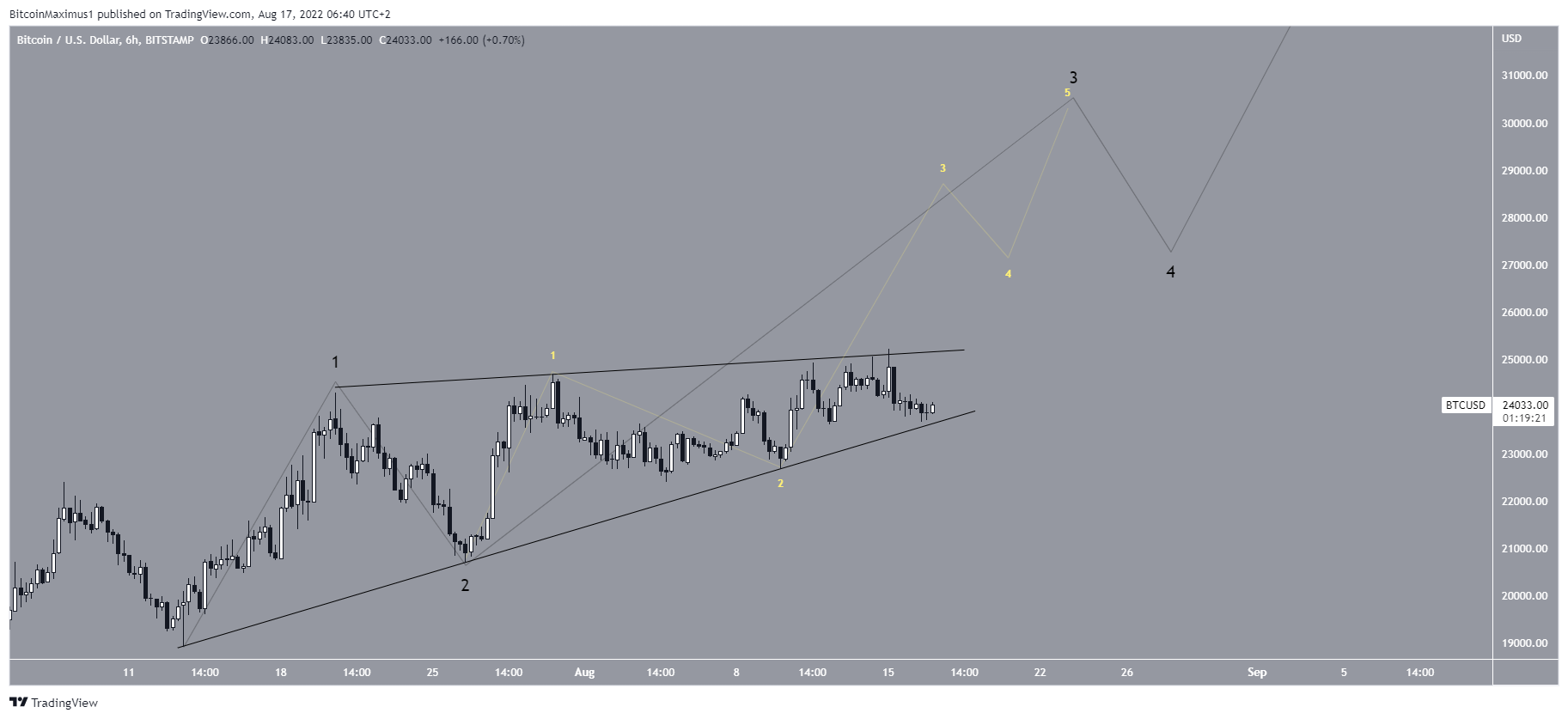

There are two potential short-term wave counts for the future trend.

The first suggests that BTC began a five-wave upward move (black) on July 13 and is currently in wave three. The sub-wave count is shown in yellow, where Bitcoin appears to be in sub-wave three. In order for this possibility to remain valid, the price has to hold on above the slope of the current ascending support line.

BTC/USD Chart By TradingView

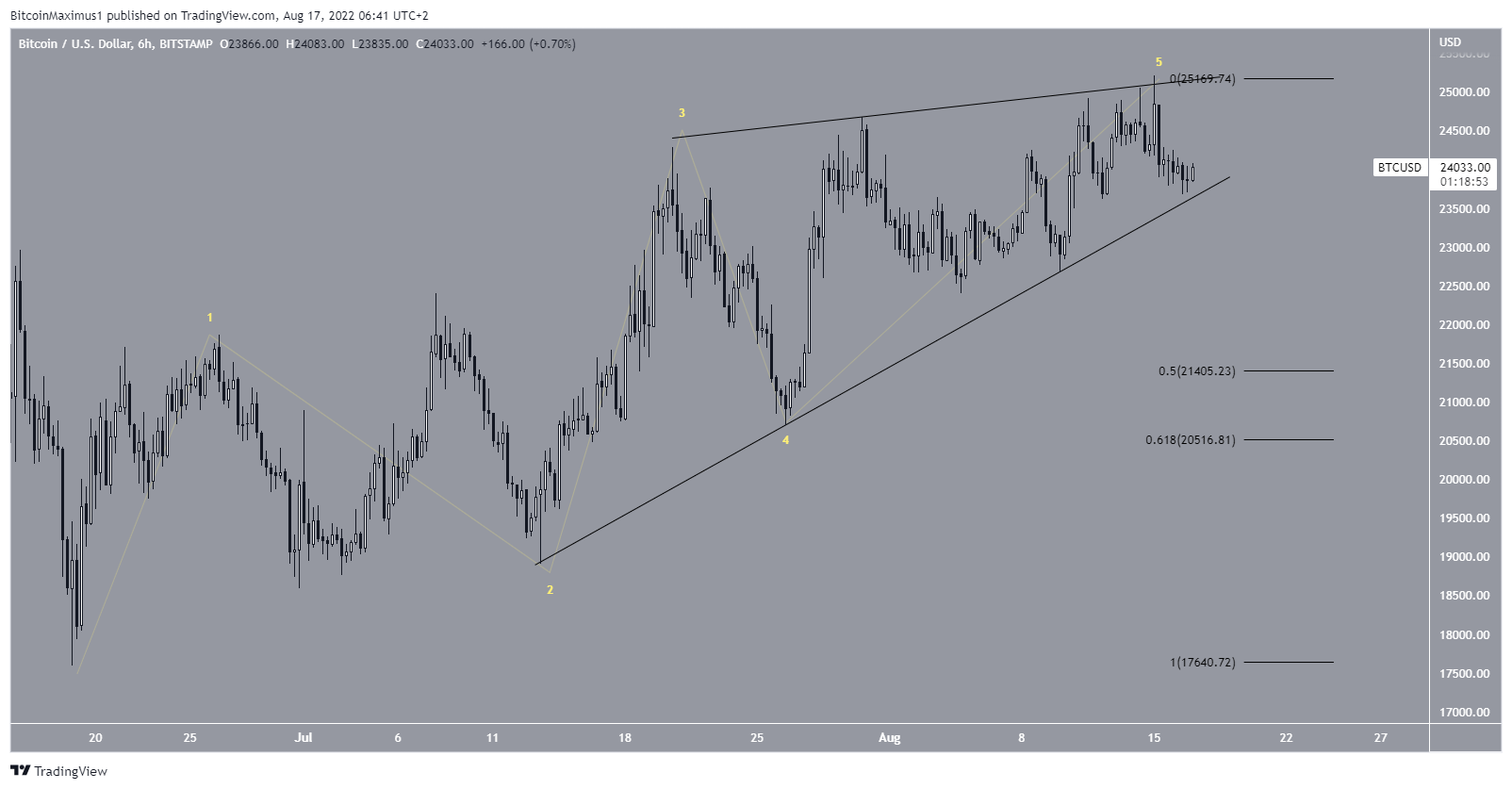

The second short-term count suggests that Bitcoin has completed wave five of a leading diagonal, thus shaping the ascending wedge. In this case, a breakdown from the wedge and subsequent decrease towards the 0.5-0.618 Fib retracement support levels between $20,500 and $21,400 would be expected prior to the continuation of the upward move.

To conclude, both the short-term counts and the most likely long-term wave count suggest that a bottom has already been reached.

BTC/USD Chart By TradingView

For Be[in]Crypto’s previous Bitcoin (BTC) analysis, click here

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur