Bitcoin (BTC) Hovering at ‘Decision Point’ As Critical On-Chain Metric Foreshadows Next Move: Glassnode

Bitcoin (BTC) is now sitting at a critical junction, with its next move potentially being foreshadowed by an on-chain metric, according to analytics firm Glassnode.

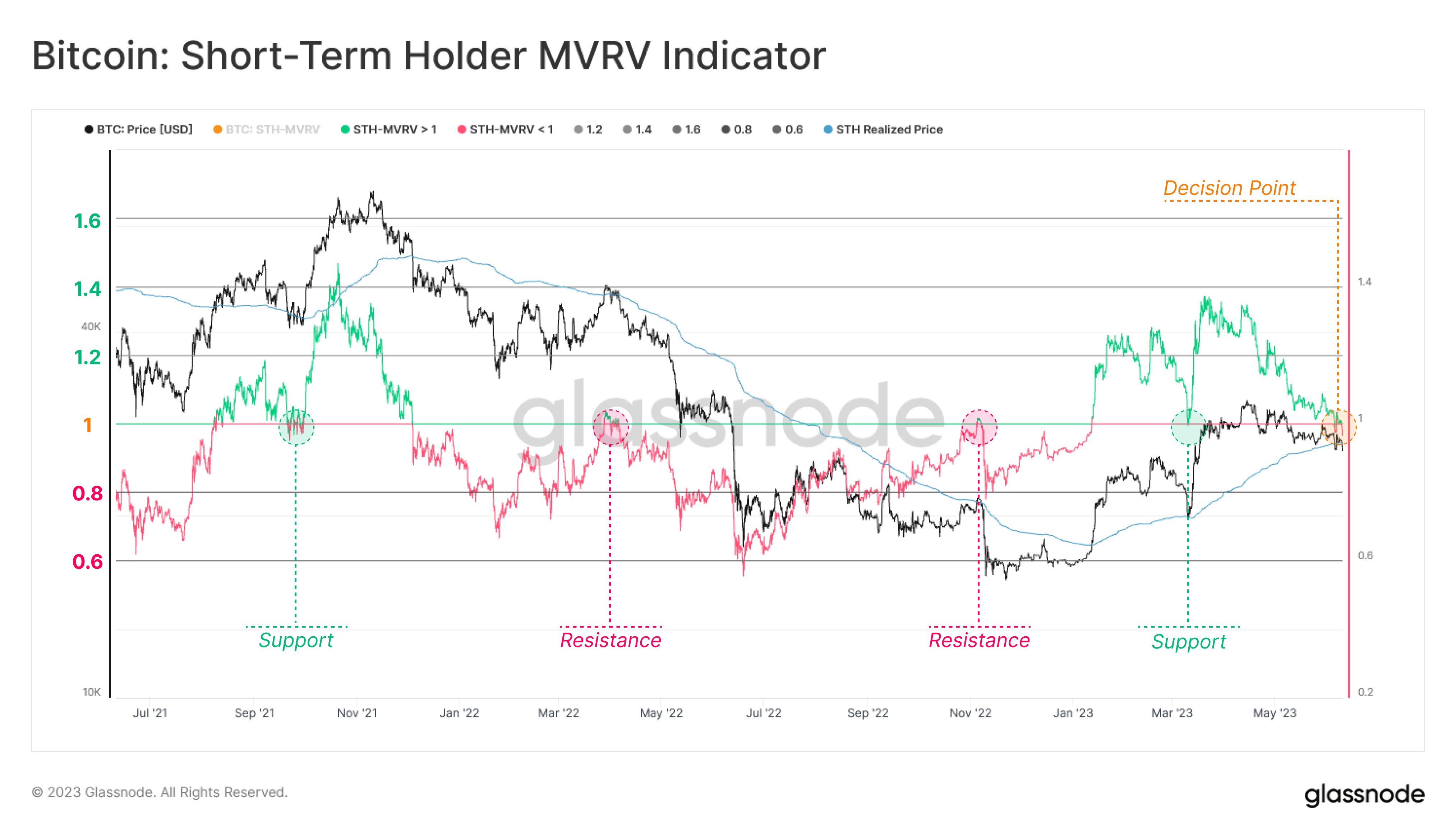

Glassnode says that it is watching BTC’s short-term holder market value to realized value (MVRV) indicator.

The metric is designed to measure the unrealized profit or loss of Bitcoin holders that have bought their BTC stacks within the last 155 days. According to Glassnode, Bitcoin is at a critical “decision point” as the metric hovers at a level that indicates short-term BTC holders are breaking even.

“The market remains at a decision point as the Bitcoin spot price continues to indecisively oscillate around the short-term holder cost basis.

A retest and strong bounce off of the cost-basis would suggest significant strength in the prevailing trend, whilst a decisive break below would infer weakness in the current market.”

Source: Glassnode/Twitter

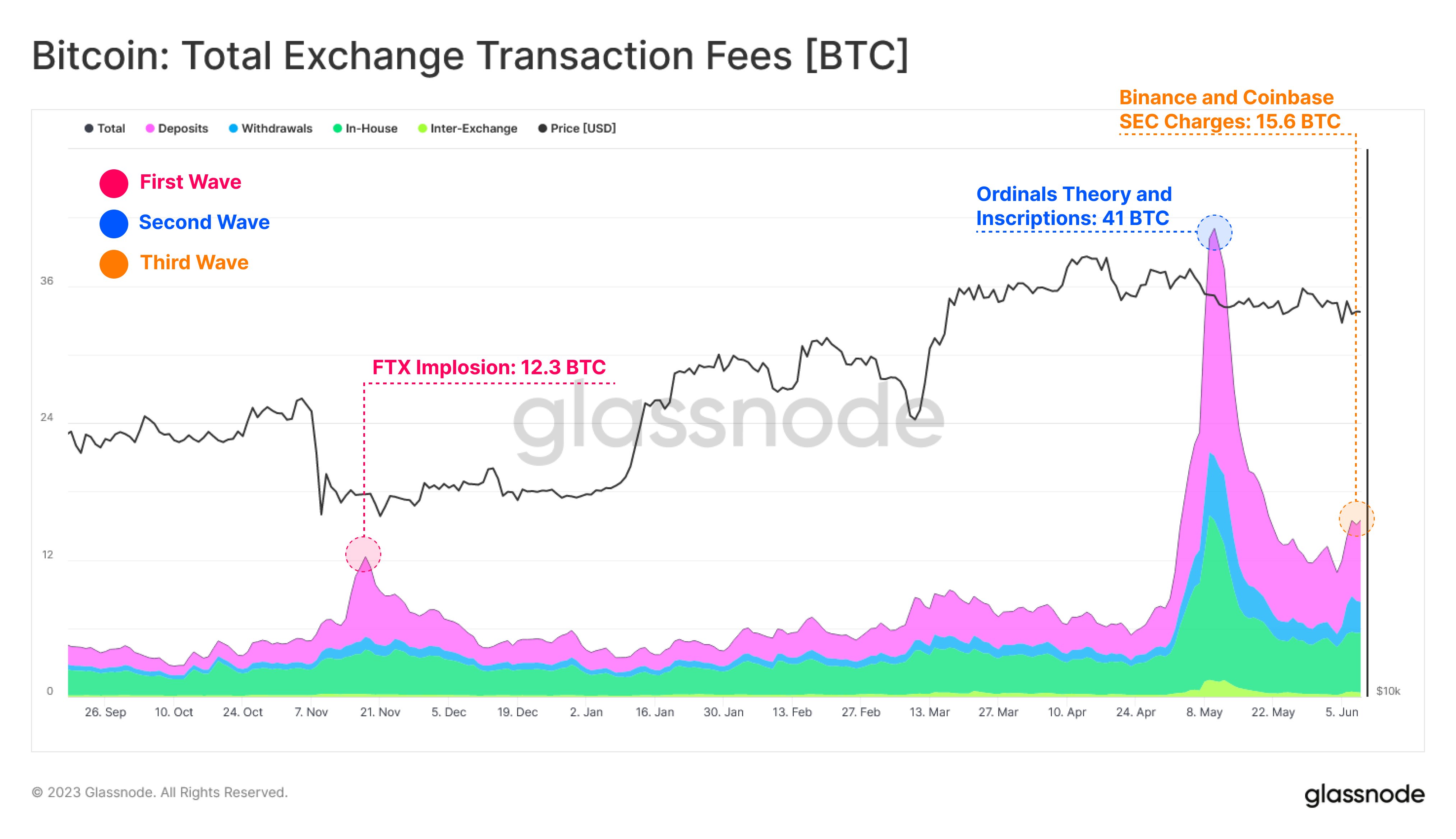

Looking deeper into the Bitcoin network, Glassnode says that the amount of BTC transaction fees related to on-chain exchange activity is experiencing a bump amid the charges brought against Binance and Coinbase by the U.S. Securities and Exchange Commission (SEC).

The surge in BTC’s total exchange transaction fees suggests that holders are moving Bitcoin in and out of exchanges at a higher-than-usual rate.

“Total Exchange Transaction Fees are experiencing a third wave of heightened fee pressure following the SEC charges against Binance and Coinbase, rising to a total of 15.6 BTC.

- FTX Implosion: 12.3 BTC

- Inscription Mania: 41 BTC

- Binance and SEC Regulations: 15.6 BTC”

Source: Glassnode/Twitter

At time of writing, Bitcoin is trading at $25,937, down 4.4% in the last seven days.

Generated Image: Midjourney

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Ontology

Ontology  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur