Bitcoin (BTC) Price Begins Road to Recovery After Avoiding Breakdown

Bitcoin (BTC) price increased significantly over the weekend, saving a potential breakdown in the process. However, the future trend’s direction has yet to be determined.

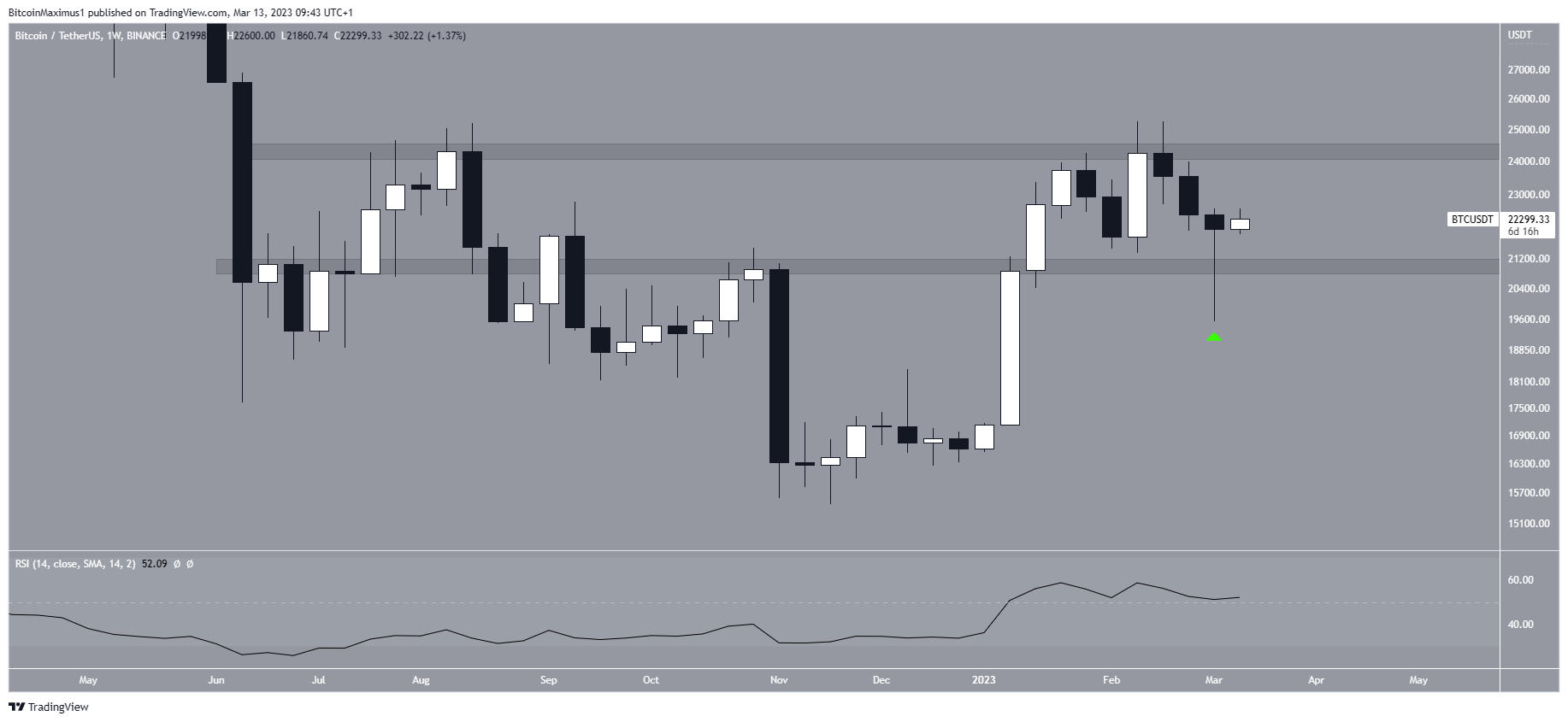

Last week, the Bitcoin price created a massive, long lower wick (green icon). Even though the close is slightly bearish, the movement can be considered bullish due to the length of the wick.

Moreover, the wick affected two other bullish structures.

Firstly, it saved a potential breakdown from the $21,000 horizontal area. Now, the area is expected to provide support once more. Secondly, it caused the RSI to remain above 50. This is considered a sign of a bullish trend.

Therefore, while the trend is still neutral due to the range, several bullish signs make a breakout more likely.

A breakout from the top of the range could lead to an increase toward $28,000. On the other hand, a breakdown could lead to a fall toward $17,000.

BTC/USDT Weekly Chart. Source: TradingView

Bitcoin (BTC) Price Gives Mixed Signs

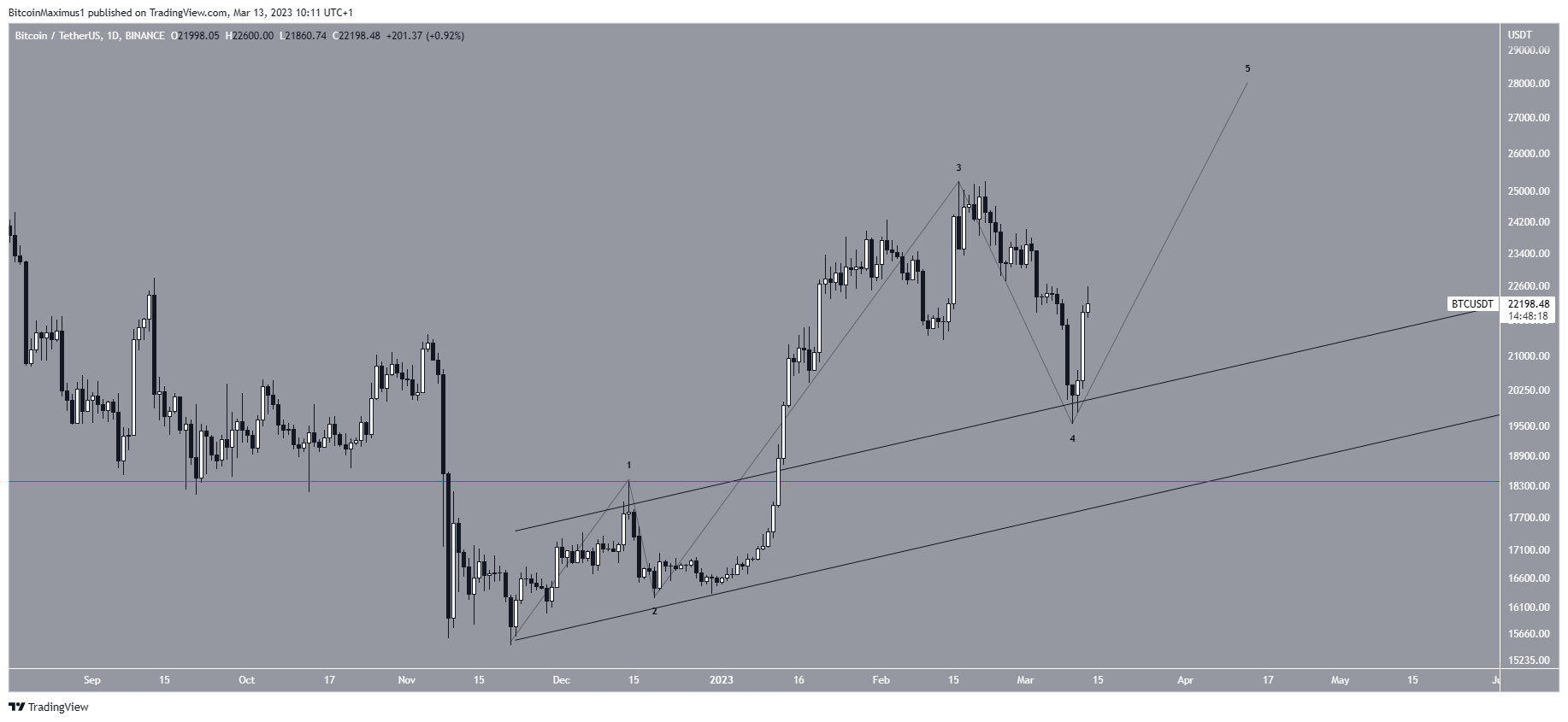

Similar to the weekly chart, the daily one provides some mixed signs. The BTC price bounced on March 10, validating the previous channel as support. It created a massive bullish candlestick on March 12.

However, the daily RSI has yet to break out from its bearish divergence trend line (green line). Moreover, it is still below 50.

Therefore, the trend cannot be considered bullish yet.

BTC/USDT Daily Chart. Source: TradingView

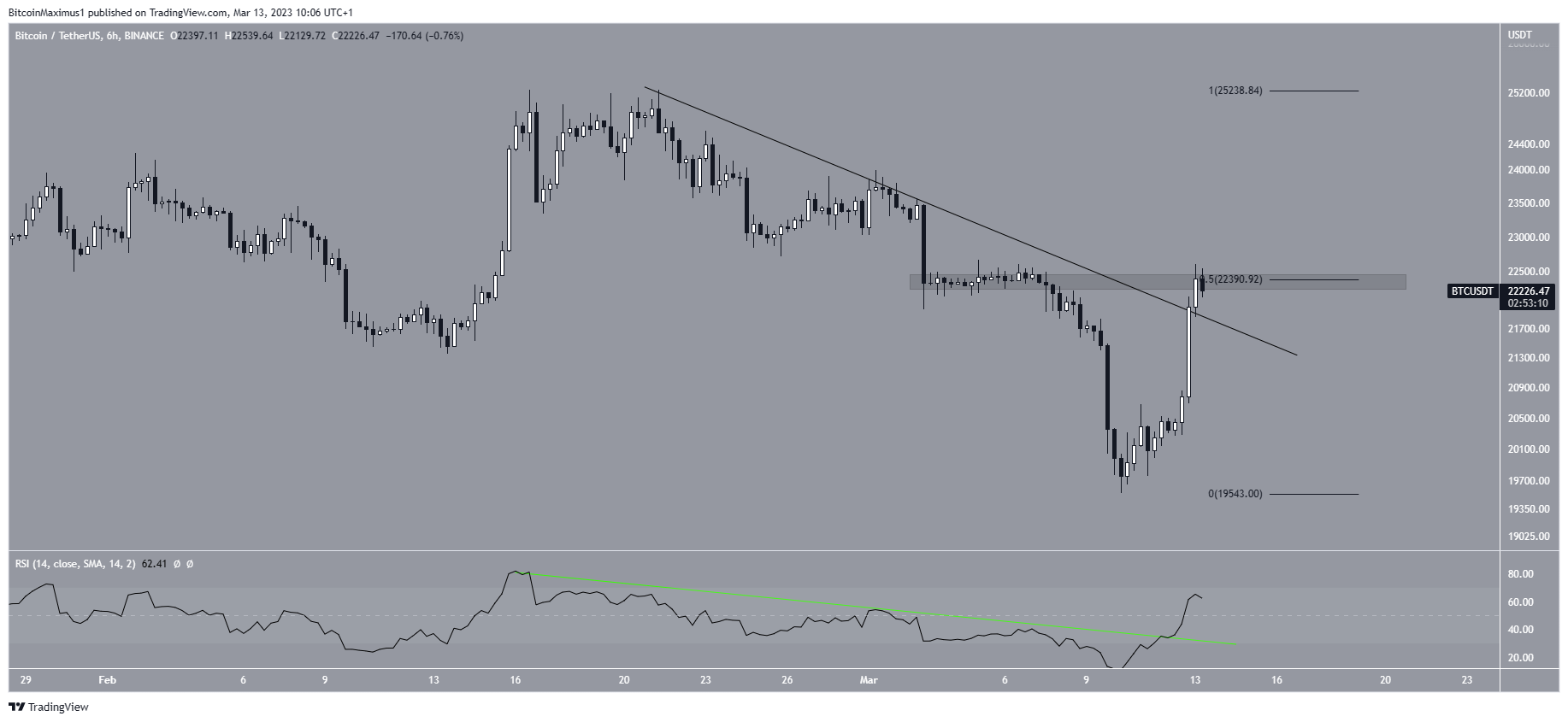

Next, the short-term six-hour chart shows that the Bitcoin price broke down from a descending resistance line. This followed an RSI breakout and movement above 50.

Now, the BTC price trades at the 0.5 Fib retracement resistance level at $22,400. Whether it breaks out or gets rejected could determine the future trend.

BTC/USDT Six-Hour Chart. Source: TradingView

Wave Count Analysis: Relief Rally or Bullish Reversal?

There are two potential counts in play. The bullish one suggests that BTC has just completed a fourth-wave pullback. If so, it has begun the fifth and final wave of an upward movement that will take it toward $28,000.

The count would be invalidated by a fall below the wave one high (red line) at $18,387.

BTC/USDT Daily Chart. Source: TradingView

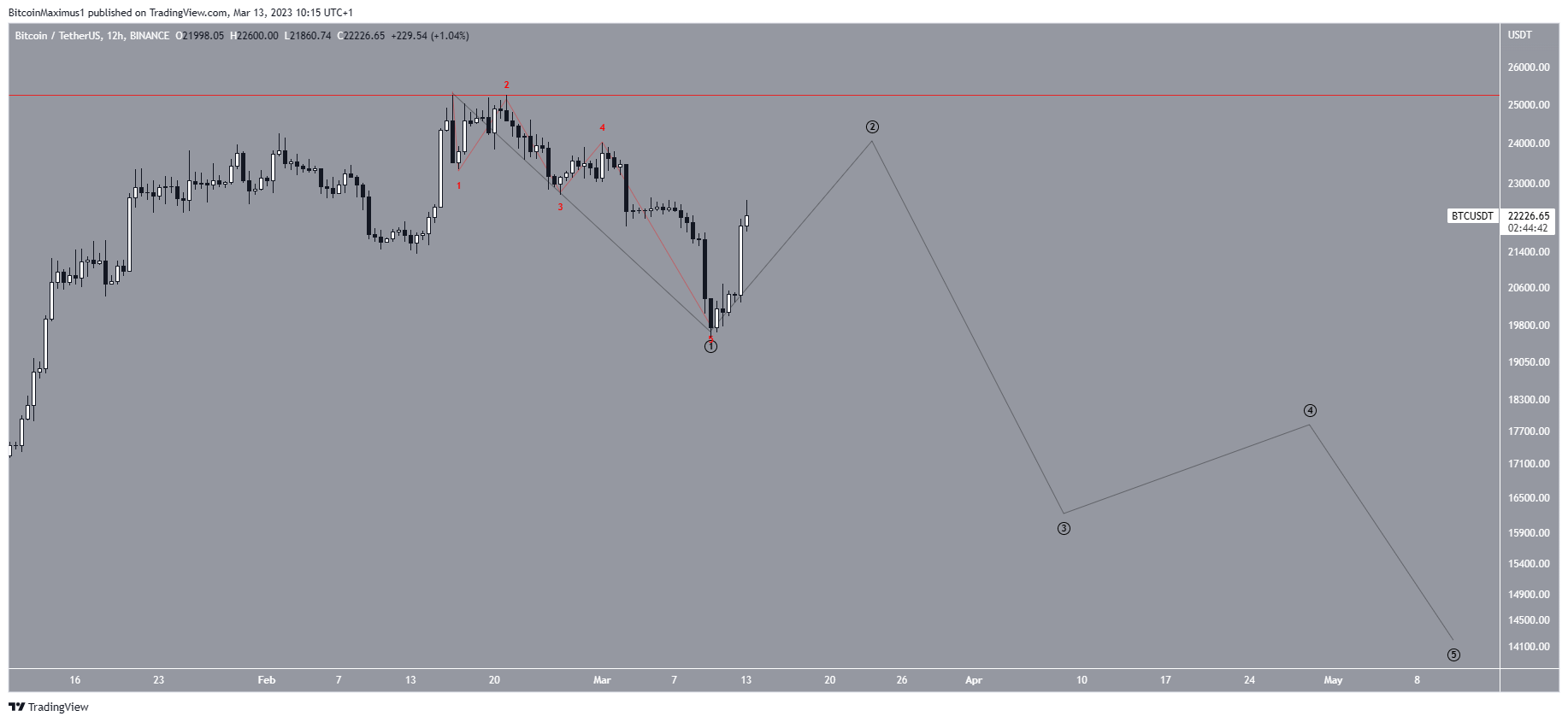

The bearish count suggests that BTC is in a corrective wave two and will decrease again. However, the sub-wave count (red) in wave one is extremely unusual. As a result, the first count is more likely. The bearish count would be invalidated by an increase above the previous highs at $25,250.

BTC/USDT 12-Hour Chart. Source: TradingView

To conclude, the future BTC trend is still undetermined. Whether the price falls below $18,387 or increases above $25,250 will help determine the future movement. The former would lead to lows below $15,000 while the latter could lead to an increase toward $28,000.

For BeInCrypto’s latest crypto market analysis, click here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  0x Protocol

0x Protocol  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD