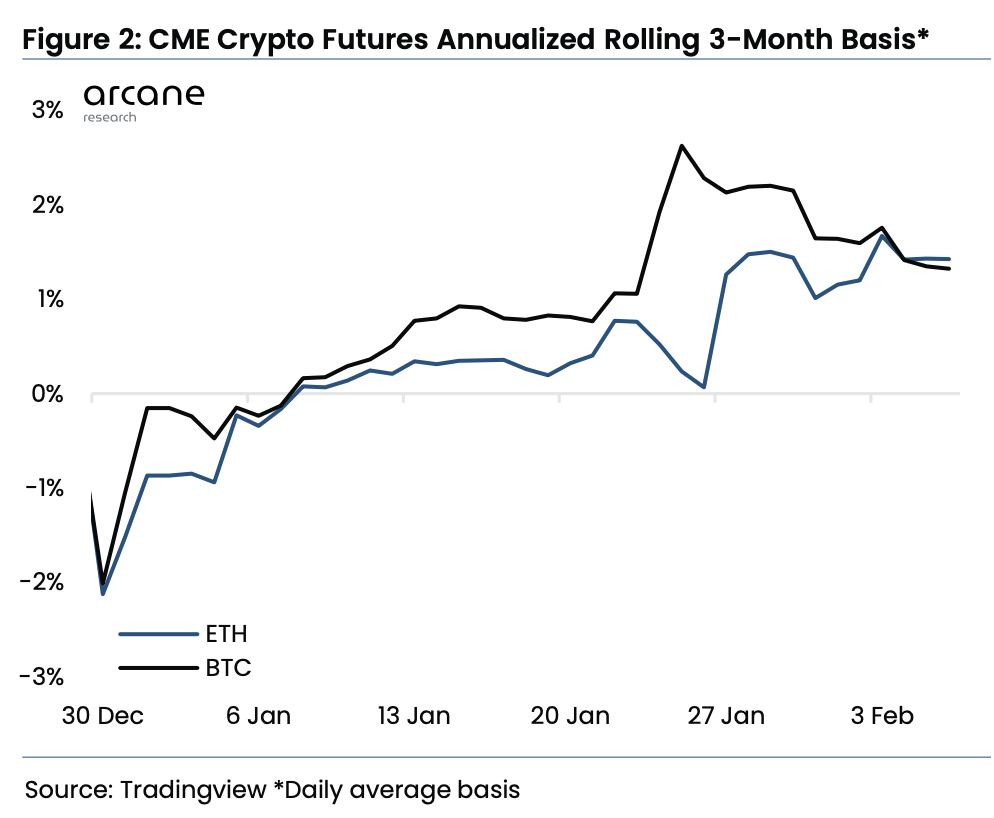

Bitcoin Favored Over Ether by CME Traders So Far This Year, Arcane Research Report Shows

Institutional traders are prioritizing bitcoin over ether exposure so far in 2023, according to a report from digital asset analysis firm Arcane Research.

Open interest in bitcoin (BTC) futures listed on the derivatives giant Chicago Mercantile Exchange (CME) has climbed 6% this year while CME’s ether (ETH) futures have declined by 29% in open interest, Arcane Research said.

Open interest is the total number of outstanding derivative contracts that have not been settled for an asset.

Joe DiPasquale, CEO of crypto fund manager BitBull Capital, told CoinDesk that institutional investors’ preference for BTC represented “the safest choice in a bear market.” He noted that Ethereum’s upcoming protocol updates might be raising concerns about an increased “risk of things going wrong,” and added that the Shanghai hard fork, which will allow validators who help operate the network to withdraw 16 million staked ETH, “is expected to add selling pressure.”

DiPasquale also said that BTC’s role could also serve as the base currency in all altcoin pairs, meaning when the market drops other cryptocurrencies would lose value in both U.S. dollar and BTC terms.

«By gaining exposure to BTC, investors can also hedge against such losses, and potentially even gain more during the initial phase of a bull run, since it is typically led by bitcoin rising in price,» he said.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur