Bitcoin is now more stable than Amazon and Meta shares amid uncommonly low volatility

Swings in the price of bitcoin are famous for being exceptionally chaotic when compared to old-school asset classes like precious metals, fiat currencies and blue-chip stocks. But the world’s largest cryptocurrency by market capitalization is currently less volatile than shares in tech giants Amazon and Meta.

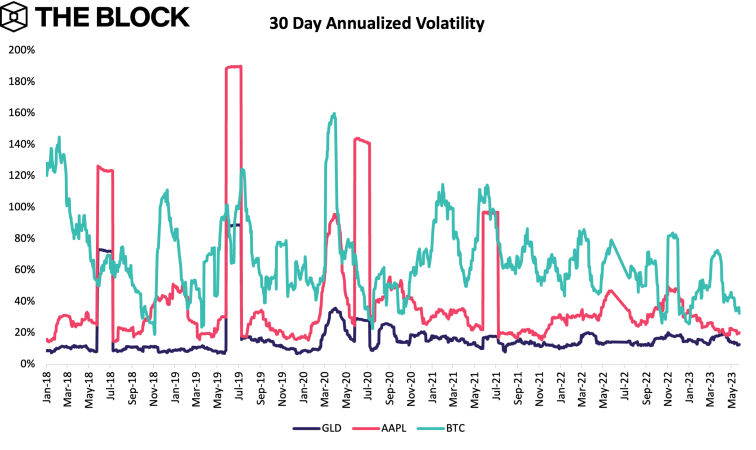

The so-called annualized volatility of bitcoin, which tracks the standard deviation of the last 30 days of daily percentage change in price, is currently resting around 32%, according to The Block Research. That’s notably low, given the asset’s all-time average price volatility of 71%.

The cryptocurrency has seen the uncommonly low levels of volatility amid what many traders call the «summer lull,» a period traditionally marked by lower trading volume. This summer, in fact, is on track to be the calmest one since 2020.

The Block Research analyst Rebecca Stevens said bitcoin experienced a summer of pronounced instability in 2021 after its value plummeted in May before recovering by year’s end. Last summer, bitcoin’s price and stability were both negatively impacted by a general downturn in crypto and the Terra-Luna fallout, she added.

While bitcoin volatility hasn’t dipped to levels low enough to rival rock-solid assets like gold and Apple stock, at its current level, the cryptocurrency is enjoying more stability than both Meta and Amazon shares, which sit at volatility rates of 44% and 34%, respectively.

The volatility rate of the Dow Jones Industrial Average is currently 13%, as a matter of comparison.

Bitcoin volatility versus Apple shares and gold

Bitcoin volatility versus Amazon and Meta shares

A calm before the storm?

Laura Vidiella, a vice president at crypto investment firm LedgerPrime, doesn’t think bitcoin’s recent respite from volatile price eruptions represents a major shift.

«Low volatility is a reflection of how the market sees price movement at this point in time given the information the market has,» she said. «But I don’t see it becoming into a new norm just yet and expect big price swings together with volatility to return this fall.»

If Vidella’s prediction proves true, it could coincide with Maelstrom co-founder and CEO Arthur Hayes’ own expectation of an upcoming bitcoin price surge.

«The fireworks and the real bitcoin bull market will begin in the late third and early fourth quarter of this year,» he wrote this week.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Decred

Decred  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur