Bitcoin Miner CleanSpark to Buy Mawson’s Georgia Mining Facility, Rigs for Up to $42.5M

CleanSpark (CLSK) continues its bear market buying spree with an agreement to purchase competitor Mawson Infrastructure Group’s (MIGI) mining facility in Sandersville, Georgia, and 6,468 latest-generation mining rigs for as much as $42.5 million.

The acquisition will mark the latest in a string of deals made by CleanSpark during this year’s crypto winter, which has been particularly tough for miners, dealing with higher energy costs and difficult capital markets in addition to the plunging bitcoin price.

Read more: Bear Market Could See Some Crypto Miners Turning to M&A for Survival

Earlier this week, CleanSpark purchased 10,000 new Bitmain Antminer S19j Pros for $28 million after credits and discounts – a significant markdown from the manufacturer’s listed price. In August, the company acquired another mining facility and bitcoin mining rigs in Georgia from Waha Technologies for about $25 million.

The terms of the Mawson deal have CleanSpark paying $26.5 million in cash and $11 million in common stock, $4.5 million of which is subject to hitting earn-out levels. There’s also $5 million of seller financing consisting of a $3 million promissory note and another $2 million earn-out. The maximum purchase price for the facility and miners is $42.5 million.

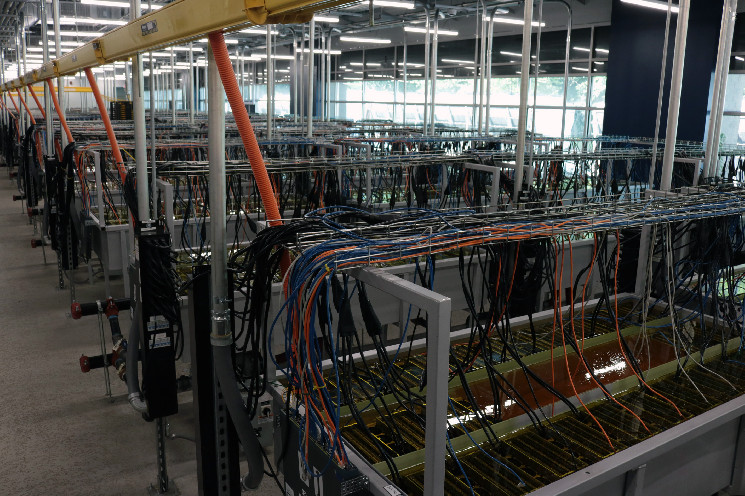

“The [Sandersville] site is nothing but impressive — well-run by over 20 dedicated professionals who have taken significant pride in the design, development, and maintenance of the site,” said CleanSpark CEO Zachary Bradford in the statement. “We are enthusiastic about Georgia and believe that our expansion there will continue to build value for our shareholders and the communities we operate in throughout Georgia,” he added.

The deal is expected to add 1.4 exahashes per second (EH/s) to CleanSpark’s computing power before year-end, bringing the company’s hashrate to 5.2 EH/s versus previous guidance of 5.0 EH/s. Another 2.4 EH/s are expected to be added in early 2023 and 7.0 EH/s by the end of next year, according to the release.

The sale has been approved by the boards of both companies and is expected to close in early October. H.C. Wainwright acted as the financial advisor to CleanSpark.

Georgia exit

The completion of the sale means Mawson’s total exit from Georgia, allowing the company to fully focus on development of its Pennsylvania and Texas facilities, where it sees “opportunity for compelling returns on capital,» said CEO James Manning. Prior to this deal, Mawson had five facilities – 4 in the U.S. and one in Australia – according to its latest presentation. Sandersville was its largest mining plant with a planned power capacity of 230 megawatts (MW).

Mawson is not the only miner exiting Georgia. Earlier this month, Compass Mining – a middleman that allows retail investors to participate in bitcoin production – said it was closing two facilities in the state due to rising power costs.

Mawson shares are down nearly 90% this year, underperforming those of CleanSpark which are down a bit more than 50%.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  HUSD

HUSD  Energi

Energi