Bitcoin mining stocks record whopping gains in the last 30 days despite dull markets

The recent recovery in the value of crypto assets has trickled down into the ‘traditional’ finance world, more specifically into stocks of crypto mining companies. Furthermore, the rise of crypto prices increased mining profitability, which has seen some mining businesses rallying up to 120%.

Some of the major crypto mining companies such as Marathon Digital Holdings (NASDAQ: MARA), Riot Blockchain (NASDAQ: RIOT), Hut 8 (NASDAQ: HUT), and Core Scientific (NASDAQ: CORZ), increased their share price over the past 30 days by 124.12%, 96.69%, 98.95%, and 110.39% respectively.

It seems that crypto mining stocks were deep in oversold territory, and the rally seen over the past month could be attributed both to a rebound from those levels coupled with a rally in crypto initiated mostly by Ethereum (ETH) as it nears its transition to proof-of-stake (PoS) network.

An increase in Bitcoin (BTC) mining seemed to have happened across the board with the above-mentioned companies.

Core chart and analysis

Namely, Core reported in their earnings release that the rate by which self-mined Bitcoin increased in Q2 was 1601%, reaching 6,567 BTC in their custody. Revenues increased by 118% year-on-year (YoY).

In the last month, COR-Z has been trading in the $17.75 to $20.57 range, with technical analysis indicating a support line at $18.76 and resistance at $20.18.

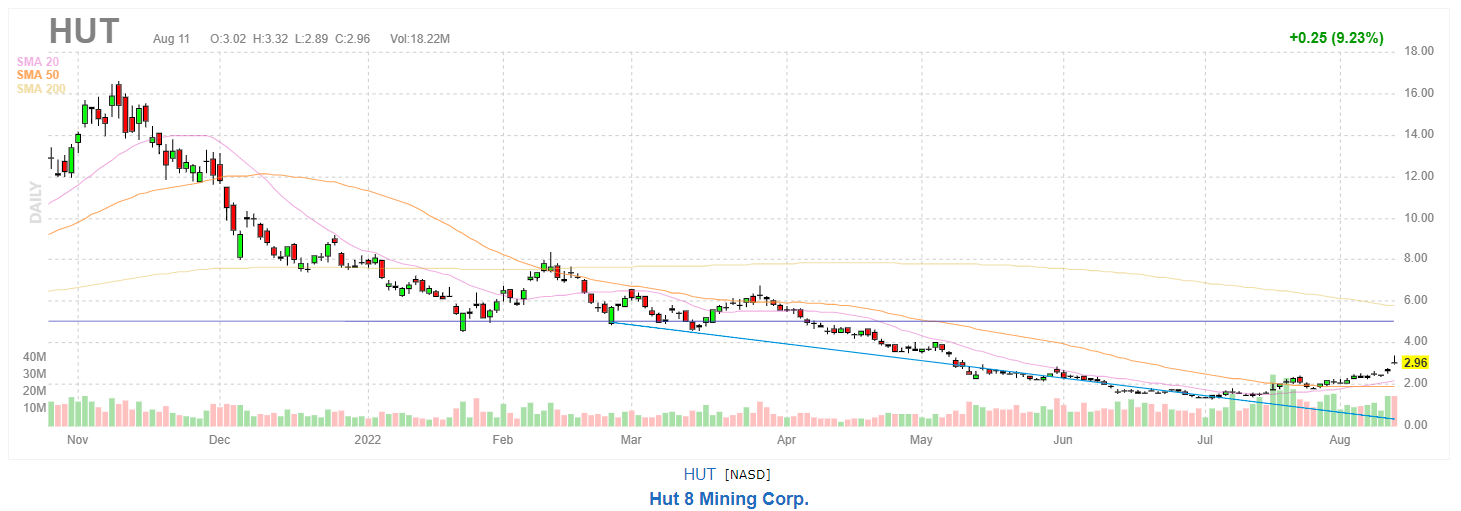

HUT chart and analysis

Meanwhile, Hut 8 increased its BTC mining by 71% as stated in their production update, employing, what they call, more efficient miners, and increasing their revenue by 30.7% YoY.

The short-term trend is positive, while the long-term trend is still negative, with the support line at $2.06 and a resistance line at $4.19.

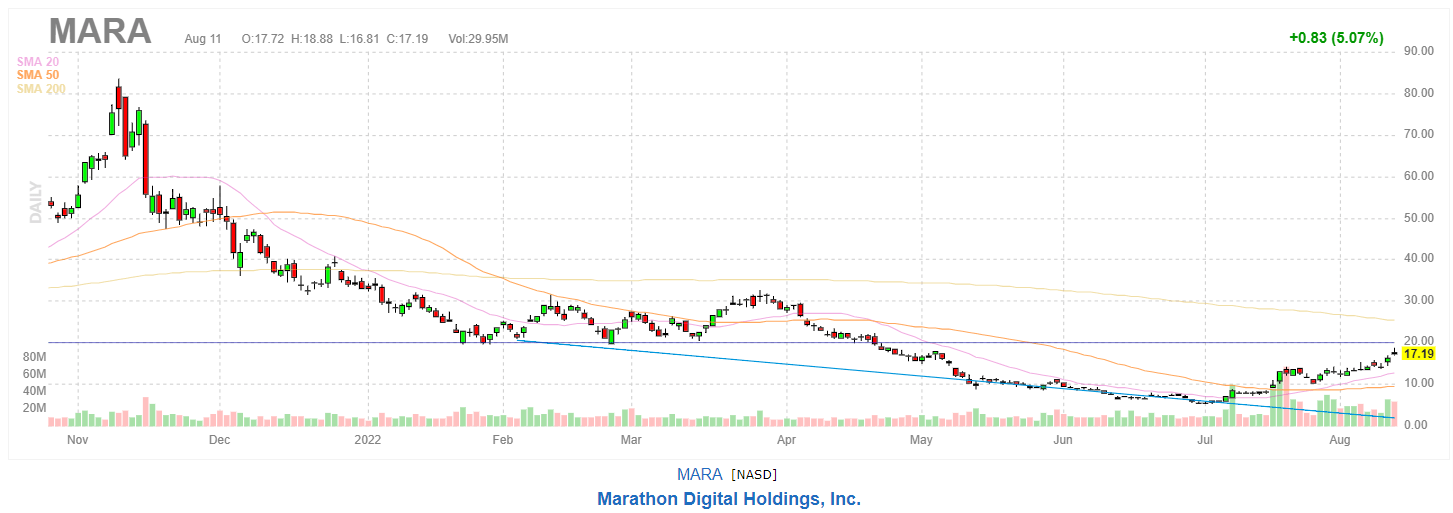

MARA chart and analysis

Marathon used its earnings to highlight that it also increased its BTC production, grabbing 707 Bitcoin in the quarter.

Looking at the yearly performance, MARA did better than 75% of all other stocks, with prices rising strongly lately. The resistance line is at $19.14, while the support line is at $13.48.

RIOT chart and analysis

Finally, Riot claimed that they have increased their revenue by 244% for the quarter while also increasing their mining production by 186% to a record 1,405 BTC compared to 491 BTC in the previous quarter.

In the last month, RIOT has been trading in a wide range between $5.35 and $10.52, with the support zone stretching from $7.52 to $7.64, while resistance is at $16.34.

Some clouds on the horizon

It’s not all sunshine and rainbows, as the major crypto miners posted widening losses to go along with increased revenue. Additionally, BTC miners often sell 30% of their holding; however, in June, that number climbed as high as 400%, due to impairment losses on their crypto holdings.

Market participants should keep in mind that BTC miners faced quite a few challenges this year, the tech stocks rout on the Nasdaq, rising inflation and rates, falling crypto prices, and rising energy costs. Adding all of these challenges together produces a difficult environment in which crypto mining stocks could extend and continue the current rally.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD