Bitcoin network: 90 minutes to produce a block

Yesterday, an anomaly occurred within the Bitcoin network: a block was produced 90 minutes after the previous block was validated.

In fact, the blockchain was idle for 90 minutes waiting for the resolution of block 793099, which was completed at 11:55 AM (CEST).

Furthermore, ever since that block, users’ tx fees have increased by quite a bit, making more money for the miners.

What does all this entail for Bitcoin?

Let’s take a look at it together in this article

Summary

- Bitcoin network: block validated 90 minutes late

- Tx fees on the rise on Bitcoin: miners say thank you

Bitcoin network: block validated 90 minutes late

Yesterday, there was an anomaly in the Bitcoin network regarding the validation process of a block by the miners.

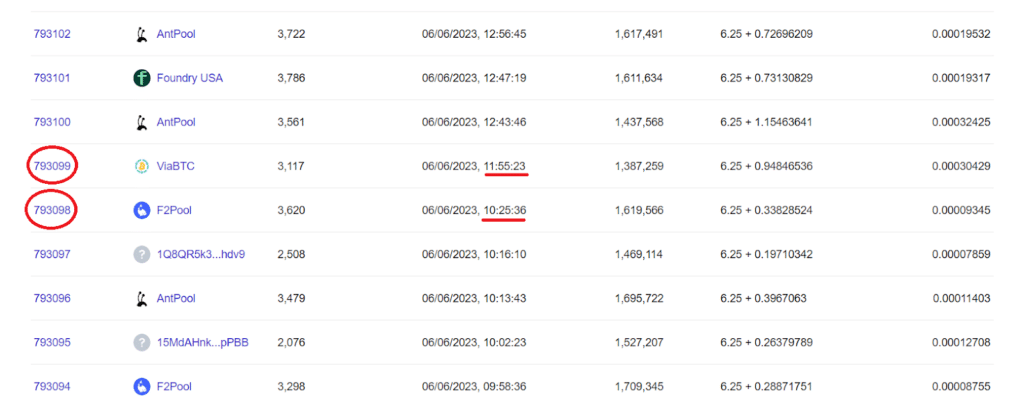

Specifically, there was a 90-minute time discrepancy between the production of two separate blocks: 793098 and 793099.

Block 793098 was successfully added to Bitcoin’s distributed ledger at 10:25 AM (CEST), by the F2Pool mining pool.

In contrast, block 793099 was successfully validated at 11:55 AM (CEST) by ViaBTC.

Between 10:25 AM and 11:55 AM., the Bitcoin network obviously continued to function properly as usual (it did not crash), but did not produce any blocks.

This means to us that those who made a transaction after 10:25 AM had to wait until at least 11:55 AM before it was actually confirmed.

It is not yet clear why this system glitch occurred.

We know that on average the time to produce a block on Bitcoin is 10 minutes.

But nowhere is it written that this value has to be fixed every time.

It is merely a statistical average: sometimes it might take 30 minutes while other times as little as 1 minute

However, it remains rare to see two confirmed blocks 90 minutes apart.

The “difficulty adjustment” mechanism regulates exactly this process, increasing or decreasing the complexity of mining a block by miners according to the needs of the network.

However, this changes only every 14 days, and yesterday its value remained unchanged.

The next Bitcoin adjustment is expected in 7 days.

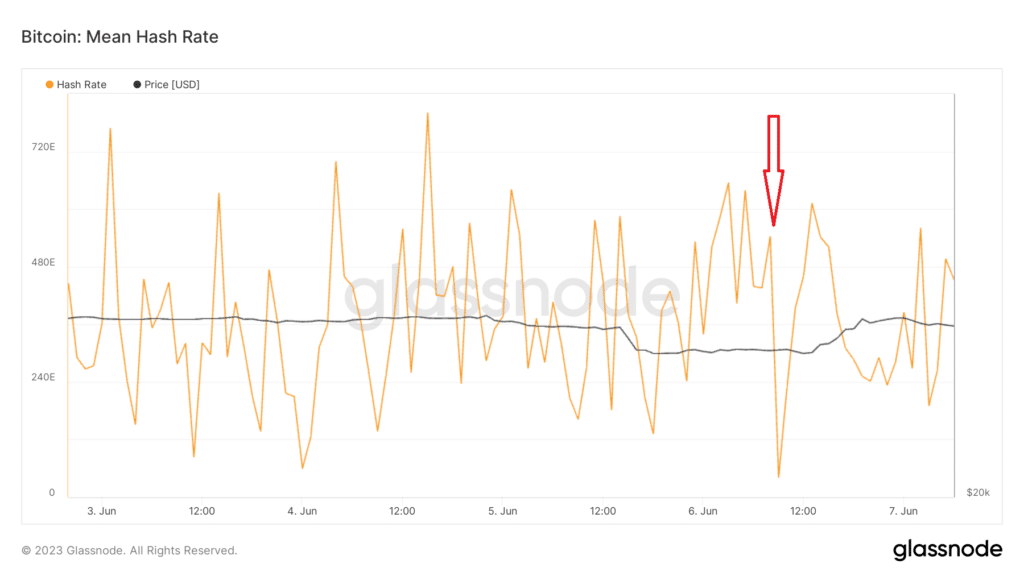

The most plausible hypothesis is that a brief drop in hashrate caused difficulties in achieving adequate computing power to validate block 793099.

Indeed, if we look at the hashrate values in the time span from 10:00 AM to 11:00 AM yesterday, we see a decline in this data.

Specifically, at 08.00 UTC (i.e., from 10.00 AM CEST) this value recorded 543.33 EH/s while at 09.00 UTC (11.00 AM CEST) the hashrate dropped to 40.84 EH/s.

Most likely the sudden drop from network power created problems in reaching the appropriate Exa hash per second threshold to be able to resolve the offending block.

The “problem” was resolved in the next hour when the hash rate returned to normal values.

There is currently no relevant news to account for this momentary drop in network computing power.

Graph of hashrate trend on the Bitcoin network

Tx fees on the rise on Bitcoin: miners say thank you

Another very interesting detail emerging from the anomaly that occurred yesterday on the Bitcoin network between the production of block 793098 and 793099 is an increase in the tx fees paid by users.

Each time a block is validated and added to the previous blockchain, the miner responsible for validation (or the mining pool behind it) earns a block reward of 6.25 BTC plus a variable transaction fee amount.

The block reward is halved every 4 years according to the halving logic, while the tx fees are highly variable block by block and depend on the competition among actors who want to execute transactions faster on the network.

In block 793098 (the one prior to the anomaly) F2Pool earned 6.25 + 0.33828524 BTC while in block 793099 ViaBTC received an impressive 6.25 + 0.94846536 BTC.

Considering the average fees paid per transaction in the two blocks, 0.00009345 in the first and 0.00030429 in the second, respectively, this is an increase of more than 300%.

This means that sending a transaction on the network before 10:25 AM cost on average about 2.34 euros while immediately afterwards it cost 7.63 euros.

If we then look at the subsequent blocks we even find that the AntPool mining pool mined a block receiving 1.15463641 BTC as a reward from transaction fees.

Rarely do we see such high fees.

The trend then continued in subsequent blocks up to the current ones, where tx fees decreased slightly, but remained higher than those recorded in block 793098.

In practice, it appears that the 90 delay in the production of the alleged block 793099 triggered a rise in fees, which obviously translates into a gain for network miners.

Underneath this event could likely be the hand of users who are particularly active these days in the Ordinals protocol that allows for the creation of NFTs or BRC-20 tokens in the Bitcoin blockchain.

Although the FOMO of inscriptions has decreased a lot compared to the first week of May, the network’s tx fees continue to register medium to high values, especially in the last two days.

Histogram of the number of Inscriptions divided by network fee (sat/vB)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Dash

Dash  Algorand

Algorand  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur