Bitcoin on-Chain Analysis: NUPL Returns to Hope Area

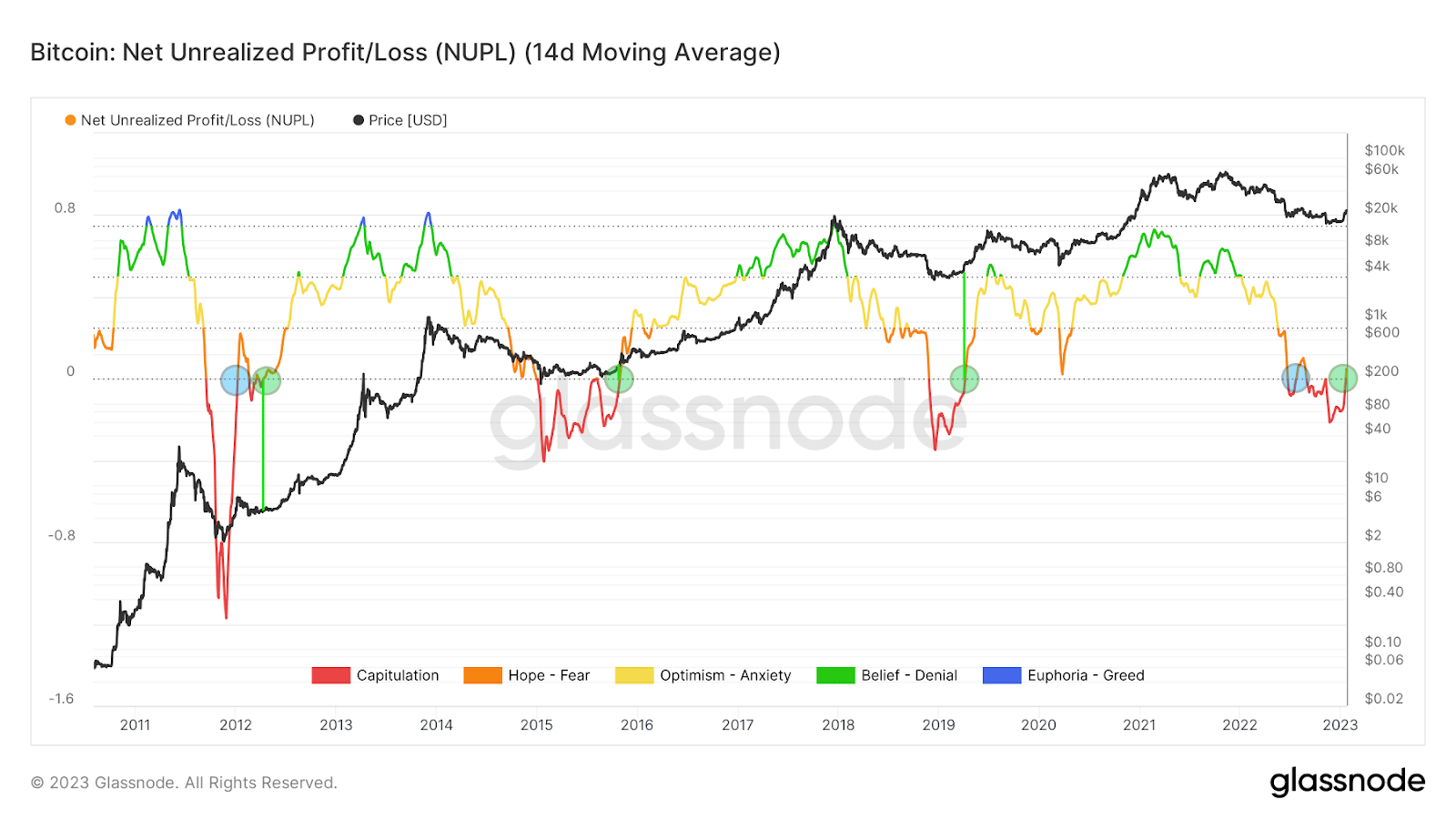

In today’s analysis, BeInCrypto takes a look at one of the better-known on-chain indicators for Bitcoin: Net Unrealized Profit/Loss (NUPL). Bitcoin (BTC) positive price action in the first weeks of 2023 caused the indicator to generate a signal to start a bullish cycle.

For the first time since August 2022, the NUPL 14-day moving average turned positive and entered orange territory. Historically, this event has been correlated with the end of the accumulation phase and the beginning of a new bull market. Moreover, based on the historical data of the BTC price and our indicator, an attempt can be made to estimate the timing and magnitude of the next bull market.

NUPL Enters the Area of Hope

Net Unrealized Profit/Loss expresses the difference between Relative Unrealized Profit and Relative Unrealized Loss. Another way to calculate this indicator is to subtract the realized market capitalization from the total market capitalization, and then divide the result by the latter value.

In the previous bull market, NUPL 14-day moving average peaked at 0.73 on February 2, 2021, when the price of BTC was $54,000. After that, Bitcoin still continued its upward rally, but NUPL did not increase any higher.

Even during the ATH at $69,000 in November 2021, the index was in the vicinity of 0.63. It is worth mentioning that during the entire previous bull market, it never once exceeded the value of 0.75, above which the blue area of euphoria/greed is located. The flat top of the previous bull market, which fits Wyckoff’s distribution pattern, only brought NUPL to the green belief/denial level.

Source: Glassnode

Subsequently, throughout the 2022 bear market, NUPL continued to fall along with the price of Bitcoin. It first entered red capitulation territory in June and a second time in August (gray circles).

After the second decline into negative territory, it remained negative for another five months. During this period it also recorded a capitulation low of -0.21, which came just a day after the BTC price bottomed at $15,476 on November 21, 2022. It only returned to orange hope/fear territory a few days ago, reaching 0.05 yesterday.

NUPL Signals the Beginning of a Bull Market

On the long-term chart of NUPL and the price of BTC, we see the significance of the return of the indicator to positive territory. This event usually signaled the end not only of a bear market, but also of the several-month accumulation phase that immediately followed (green circles).

In both 2015 and 2019, NUPL’s return to orange values was perfectly correlated with the end of accumulation. The situation was slightly different after the historic first bear market in 2012. At that time, the index increased to positive territory, only to later return to the capitulation area and increase again (blue and green circles).

We are seeing a similar situation in the current cycle. The cryptocurrency market crash caused by the collapse of the Terra (LUNA) ecosystem was the first catalyst for the indicator’s movement to the capitulation area. A return to the orange level failed to initiate a rebound, and NUPL fell back into red territory to reach the bottom after the FTX exchange collapse in November 2022.

However, a second return to the hope area could signal the end of the accumulation phase. This is confirmed by the price of BTC, which is currently oscillating around $23,000. Recently, the Bitcoin price broke through important resistance at $21,500. In doing so, it printed its first long-term higher high since the end of the previous bull market.

Source: Glassnode

How High Will the Bitcoin Price Go?

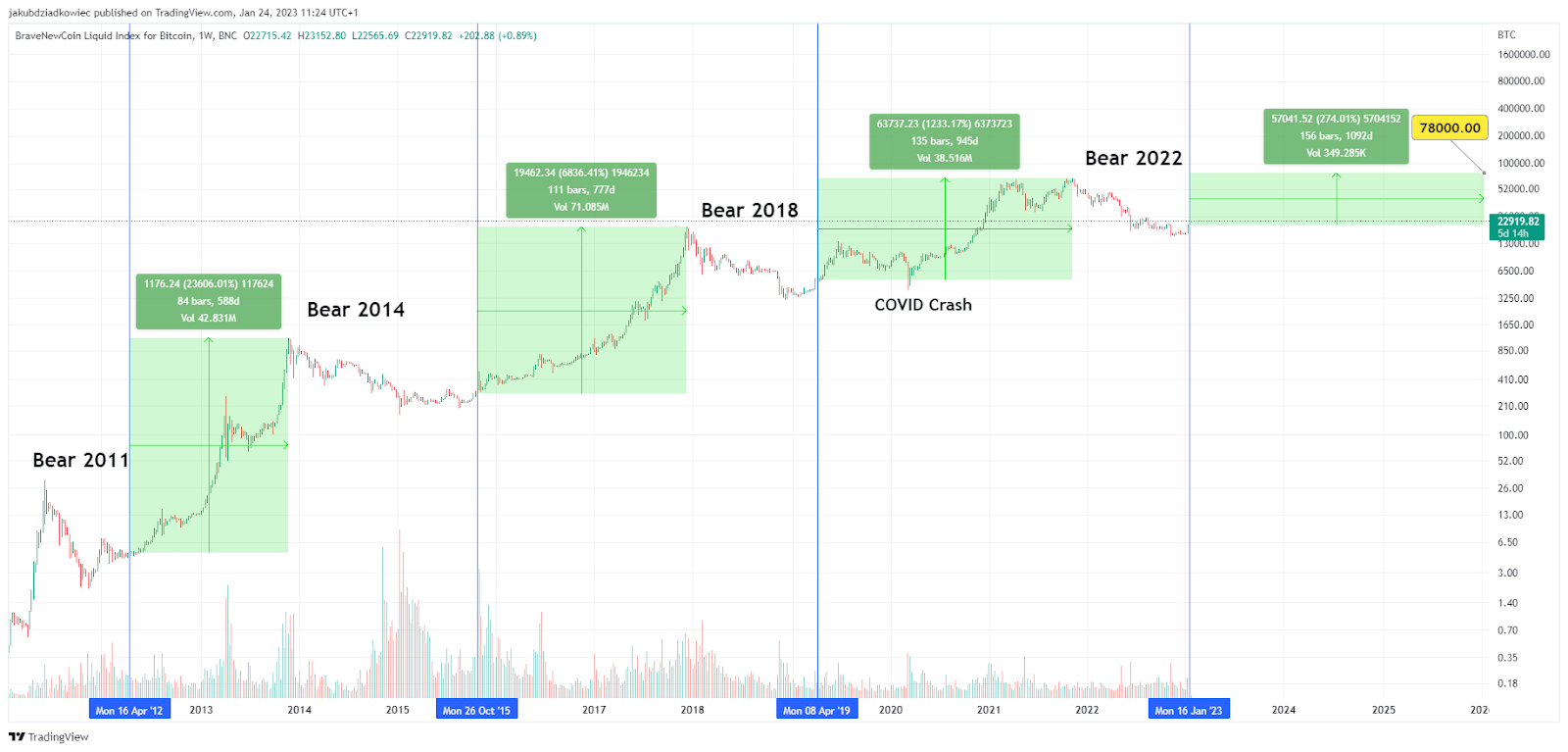

Based on the above premises, an attempt can be made to estimate the timing and magnitude of Bitcoin peak in the next bull market. Of course, two assumptions must prove true. First, the bottom of the BTC price has already been reached. Second, the return of NUPL to the orange area of hope signals the end of the accumulation phase.

In addition, the premises of Bitcoin’s lengthening cycles and diminishing returns must be accepted. These stem from historical data, which indicate that each successive peak in the BTC price was proportionally lower than the previous one. Moreover, it was reached after a longer period of time. Counting from the NUPL signal to the peak of historical bull markets, we get the following data:

- 2012-2013: NUPL signal on April 16, 2012, BTC up 23,606% after 588 days,

- 2015-2017: NUPL signal on October 28, 2015, BTC up 6,836% after 777 days,

- 2019-2021: NUPL signal on April 8, 2019, BTC up 1,233% after 945 days.

BLX/USD chart by Tradingview

Keeping the above ratios of cycle extension (1.26x on average) and diminishing returns (4.5x on average), we can estimate the peak of the next bull market. Based on simple calculations and maintaining the given proportions, we get a potential peak of Bitcoin price at $78,000 on January 5, 2026.

This hypothesis certainly does not do credit to the expectation of a Bitcoin price above $100,000. However, based on historical data of the BTC price and the NUPL indicator, it is what can realistically be expected.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Lisk

Lisk  Decred

Decred  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD