Bitcoin options contracts worth $2.26B near expiry: Potential upsurge expected

- Around 86,000 Bitcoin options contracts will expire on May 26. They have a notional value of $2.26 billion and a max pain point of $27,000.

- According to his research, a swift recapture would be required before Bitcoin can reach $38.8K if it fails to close this week above these levels.

- The imbalance between the crypto Bull market and the bear market continues.

$2.26 billion worth of contracts for bitcoin options are set to expire. Derivatives traders eagerly await the conclusion of the 86,000 bitcoin options contracts that are set to expire on May 26 as the positive attitude in the market intensifies and the bears retreat.

Contents

1 Derivatives traders remain bullish as Bitcoin options worth $2.26B approach expiry

2 Bullish Bitcoin Options Ratios

3 Bitcoin price outlook

4 Trader predicts bitcoin to surpass $38K soon

Derivatives traders remain bullish as Bitcoin options worth $2.26B approach expiry

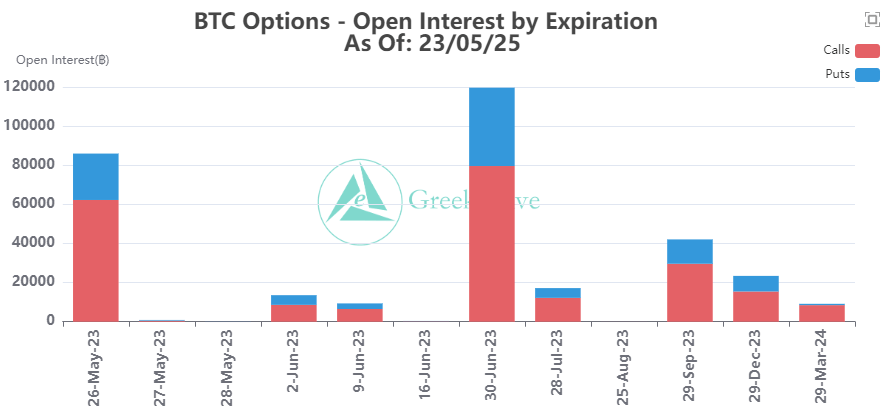

According to the reports, several bitcoin option contracts are about to expire. In addition, the prognosis for derivatives traders is becoming more bullish. Some 86,000 bitcoin options contracts will come to an end on May 26. They have a maximum pain point of $27,000 and a hypothetical worth of $2.26 billion.

The strike price represents the maximum point of agony with the most active bitcoin options contracts. At this price, most contract holders would experience losses upon contract expiration.

Bullish Bitcoin Options Ratios

The put/call ratio (PCR) is 0.38 for this group of bitcoin options. The number of traded put (short) contracts divided by the number of traded call (long) contracts yields this ratio.

Values under one are typically considered bullish since more speculators buy call options than put options. This shows that investors have predicted future bullish trends. Far more call contracts are about to expire than put contracts.

Deribit estimates that there are 325,311 open contracts with total open interest. However, the reports state that the put/call ratio is 0.44. This demonstrates that traders in derivatives are bullish.

Additionally, 695,000 contracts for Ethereum options are scheduled to expire. These have a maximum pain point of $1,800 and a hypothetical value of $1.25 billion. Additionally, Ethereum options have a PCR of 0.49, which strongly favors call (long) contracts.

Bitcoin price outlook

In late trade on May 25, bitcoin prices fell to a ten-week low of less than $26,000. Nevertheless, during the morning Asian trading session on May 26, they returned to $26,423.

According to Glassnode, the asset has dropped to a crucial long-term Fibonacci level of support at -61.8%, corresponding to $26,200. However, a breakdown from here might be ugly. Analysts have also projected that BTC may decline to lower support at $24,400 if the selling pressure persists.

Trader predicts bitcoin to surpass $38K soon

In a recent market analysis, Michael van de Poppe, a renowned crypto trader, and analyst, examined the potential effects of interest rate pauses and significant resistance levels on the future of Bitcoin (BTC). Van de Poppe stated in his video that BTC’s price might surpass $38K in the upcoming weeks.

The expert claimed that there was a potential for interest rate pauses in the most recent FOMC meeting minutes. He projected that the pauses would happen at the following meeting or one that follows, which might help the cryptocurrency market. A halt in interest rates is typically viewed as favorable for the market mood.

The weekly chart for BTC/USDT

Source: TradingView

BTC needs help getting over the $30K critical resistance level. Van de Poppe stressed the importance of keeping an eye on the 200-week Moving Average (MA) and 200-week Exponential Moving Average (EMA) levels that are below the price of BTC.

According to his research, a swift recapture would be required before Bitcoin can reach $38.8K if it fails to close this week above these levels. A significant component in influencing the possible price movement would be the speed of reclamation. The price of BTC might fall to $20K if it fails to rise again above the two lines.

The expert also covered how the rise of the dollar affected BTC. From a macroeconomic standpoint, BTC is not favored by a strong dollar. While noting that the Dollar Index is approaching a significant resistance level and is still in a medium-term slump, Van de Poppe suggested it might see a relief rally.

If the US index breaks through this resistance, BTC may trade downward and fall toward the mentioned $20K level. The conclusion would rely on forthcoming fundamental market data over the following several weeks, which the expert anticipated would be negative for the dollar and likely positive for BTC.

At the time of publication, CoinMarketCap showed that BTC had increased by 0.80% over the previous 24 hours to trade at $26,439.31. However, Ethereum (ETH) surpassed the market leader at this time, and the market leader was down 0.66% compared to the top altcoin.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur