Bitcoin Price Prediction 2023-2032: Will Bitcoin Bulls Rally?

Contents

1 How much is Bitcoin (BTC) worth?

2 What is Bitcoin?

3 What Influences Bitcoin’s Price?

4 Bitcoin Challenges

5 Bitcoin Price Overview

6 Bitcoin Price History

7 Bitcoin Technical Analysis

8 Bitcoin Price Prediction by Cryptopolitan

9 Bitcoin Price Prediction by Market Experts

10 Conclusion

BTC Price Predictions 2023-2032

- BTC Price Prediction 2023 – up to $45,367.75

- BTC Price Prediction 2026 – up to $141,944.40

- BTC Price Prediction 2029 – up to $415,415.70

- BTC Price Prediction 2032 – up to $1,196,601.36

Experts say that with no end to the cryptocurrency price seesaw, the war, inflation, and shifting monetary policy in the U.S. will likely continue to drive more volatility in the coming weeks and months. This Bitcoin Price Prediction intends to shed a light on the long tunnel of crypto winter.

The $2Million bet by ex-CTO of Coinbase has been the subject of much discussion and debate in the crypto world. At the heart of the controversy is Srinivasan’s prediction that Bitcoin will reach $1 million per coin within just 90 days. Notably, he made the bold bet on March 17th. So, what happens in the next 30 days while the controversy is brewing?

Our contrasting headlines in two days Bitcoin Price Analysis: BTC Corrects Down at $30,356 as Bearish Activity Takes Hold vs Bitcoin price analysis: BTC Hits $30,497 Level as Bulls Take Charge exhibits Bitcoin’s wild ride due to many factors at play. At this hour, if Bitcoin stagnates again, a bullish breakout could be near.

According to expectations, BTC prices could rise long-term and hit hundreds of thousands. This rise could happen eventually, as, only in November 2021, the price change of one BTC increased significantly. TheBitcoin price needs to rise 300.90% to reach a new all-time high. It could be anybody’s ballgame as new technologies are getting more people into blockchain uses and with them, cryptocurrencies.

How much is Bitcoin (BTC) worth?

Today’s Bitcoin price is $30,468.60 with a 24-hour trading volume of $22,552,695,109 USD. Bitcoin is up 0.43% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $589,455,707,600 USD. It has a circulating supply of 19,346,337 BTC coins and a max. supply of 21,000,000 BTC coins.

The price of Bitcoin has risen by 9.08% in the past 7 days. The price increased by 0.58% in the last 24 hours. In just the past hour, the price grew by 0.02%. The current price is $30,464.03 per BTC at Coinbase. Bitcoin is 55.71% below the all-time high of $68,789.63.

Also Read:

- Bitcoin price analysis: Bulls rejoice as BTC surges above $22,692 support level

- How Can Countries Try To Kill Bitcoin Adoption?

- Standard Chartered Bitcoin price prediction 2023

- Why 1 percent of Bitcoin Controls 27 percent of all Circulating Coins

- Best Bitcoin Wallets In 2022

- The use of bitcoin goes beyond an investment asset

- Analysts predict Bitcoin price to remain bullish after returning to $11000

- Bitcoin Futures: All You Need To Know

What is Bitcoin?

Launched in 2009, Bitcoin is a decentralized digital currency powered by blockchain technology. Satoshi Nakamoto created the coin to overcome the shortcomings of government-issued currencies without requiring a controlling authority.

Bitcoin (BTC) was created out of the need for a cryptography-based e-payment system rather than the conventional trust-based system. Cryptocurrency acts as a store of value and a payment method for any transaction process in the crypto space. It is often dubbed “digital gold.”

Bitcoin’s current cryptography is based on an impenetrable algorithm (SHA-256) designed by the United States National Security Agency (NSA) in 2016, after the collapse of the SHA-1 algorithm. This algorithm makes it impossible to crack the Bitcoin network.

Since the launch of Bitcoin in 2009, its value has risen dramatically, from less than 0.01 USD in May 2010 to over 67,000 USD in November 2021. Bitcoin is expected to attain newer feats in the coming years as more institutional investors and traders continue to turn to cryptocurrency.

What Influences Bitcoin’s Price?

Several factors are responsible for the price movement of cryptocurrencies. These price-determining factors include demand and supply, investor sentiments, availability, economic cycles, adoption rate, functionality, governance & forks, regulations, news, etc. Although Bitcoin is a mainstream digital currency, its price movement is also subject to these factors, as with other currencies.

For instance, the 24 February 2022 sell-off was sparked by Russia’s invasion of Ukraine, which also saw global stocks fall sharply. Bitcoin has been correlated with other risk assets like stocks for several months. More institutional investors get involved, and short-term investors who trade bitcoin like other risk equities have entered the market.

Recently, Bitcoin bottomed at $17,708 (its 52-week low) on June 18, 2022, due to the news about several exchanges, lending pools, and other cryptocurrency companies battling liquidity problems.

Celsius, a DeFi platform and top crypto lender was the source of negative market sentiments in the middle of June 2022. The platform announced that it had paused swaps, withdrawals, and transfers between accounts due to the extreme crypto market conditions – this has been the status quo since June 13.

Three arrows capital (3AC) is another firm that was plunged into bankruptcy because of the meltdown of TerraUSD/LUNA and liquidations by Voyager, Celsius, and BlockFi. Consequently, Bitcoin dipped by about 68% from its current all-time high, affirming the effect of investor sentiments, news, demand, supply, etc.

Bitcoin Challenges

Despite its success, Bitcoin has faced several criticisms, especially its energy-hungry mining system. According to an energy consumption tracker developed by the University of Cambridge, Bitcoin mining was estimated to consume 100 TWh per year, about one-third of the UK’s total energy consumption in 2016.

In addition, BTC’s criminality potential has positioned it for more scrutiny, as it has facilitated numerous dark web dealings, such as acquiring illegal weapons, money laundering, etc.

The most significant and long-standing challenge of Bitcoin is scalability. Bitcoin’s underlying technology limits its performance in terms of transaction completion timeframe, with an insufficient capacity of 3-7 TPS. As more transactions are initiated on the network, processing delays will surface. Several proposals have been put forward to nip this concern in the bud, but a favorable long-term fix remains unclear.

Bitcoin Price Overview

Bitcoin has had a sustained bearish run in the past few months, with its value dipping to as low as $15,730.

BTC 3M graph coinmarketcap

At the time of writing, Bitcoin is trading at $18,085.78, a loss in value of about 74% from its current ATH of $68,789.63. The 24-hour trading range of Bitcoin is $17,337.99 to $18,317.62.

Will Bitcoin sustain the $18k price level and break past the resistance at $18.5k? Have we seen the bottom already, or there’s more to come if BTC falls below support at $17.6K? It remains to be seen where the market goes from here and if this is the right time to invest in Bitcoin long–term or sell short for profits.

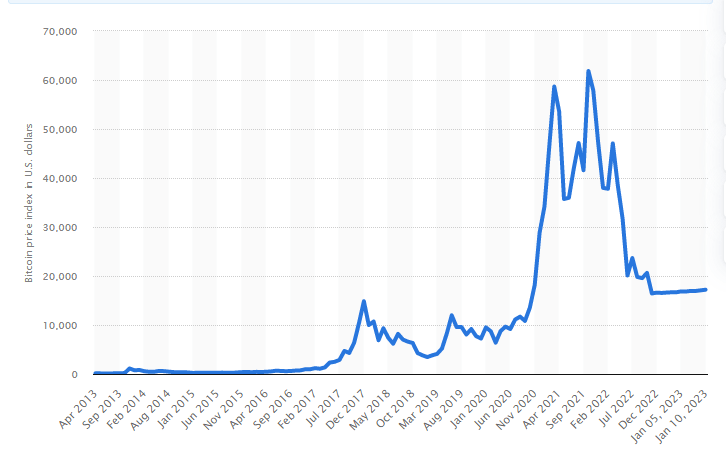

Bitcoin Price History

Source: Statista

Bitcoin’s (BTC) price again reached an all-time high in 2021, as values exceeded over 65,000 USD in November 2021. That particular price hike was connected to the launch of a Bitcoin ETF in the United States, whilst others in 2021 were due to events involving Tesla and Coinbase, respectively.

Tesla’s announcement in March 2021 that it had acquired 1.5 billion U.S. dollars worth of the digital coin fueled mass interest. The market was noticeably different by the end of 2022, however, with Bitcoin prices reaching roughly 17194.91 as of January 10, 2023, after another crypto exchange, FTX, filed for bankruptcy.

Large BTC holders – ‘whales’ – are said to make up two percent of anonymous ownership accounts, and own approx 92 percent of BTC. As most people who use cryptocurrency-related services worldwide are retail clients rather than institutional investors, Bitcoin prices are difficult to measure, as movements from one large whale already have a significant impact on this market.

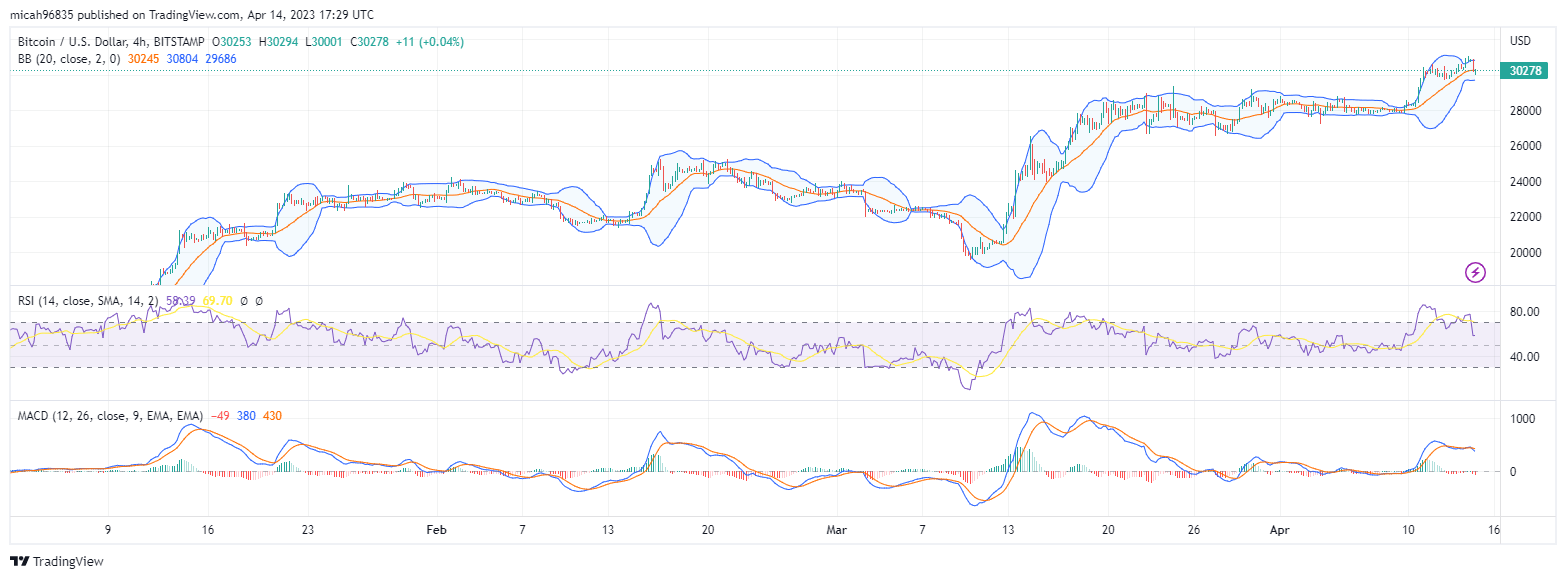

Bitcoin Technical Analysis

Bitcoin (BTC) experienced a bullish momentum on Friday, as traders pushed the price close to the psychological resistance level of $31,000. The BTC/USD pair surged to a session high of $30,848.46, a day after trading at a session low of $30,160.59.

This upward move resulted in bitcoin reaching its highest level since June 7, when it hit a peak of $31,549. The recent price action indicates a bullish trend as bitcoin surpassed its previous resistance level and reached a new higher high. Traders and investors may interpret this price movement as a positive signal, suggesting that the buying pressure is increasing and bitcoin may continue to rise in the short term.

However, the RSI is currently neutral, meaning that the recent price changes may not be strongly skewed towards either bullish or bearish momentum, and the price may be relatively stable or consolidating. Rising interest rates by the federal reserve system in the coming weeks and months as US bank continue to weather the storm in the banking sector will unravel the crypto space; hence, the need to carefully monitor market indicators.

Bitcoin Price Prediction by Cryptopolitan

Bitcoin has recently surpassed the $30,000 mark, marking a potential trend of steady growth since June 2022. Analysts are optimistic about the future of Bitcoin and the overall cryptocurrency market, anticipating new all-time highs in the coming months.

However, it is challenging to ascertain whether this increase in value signifies a recovery or is merely another Bitcoin bubble. Forecasts for Bitcoin’s value in the next decade (2023 to 2032) are highly uncertain and are contingent upon many factors that can significantly impact the market. Here are our projections for Bitcoin (BTC) from 2023 to 2032, taking into consideration market trends.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 38,449.20 | 39,966.60 | 45,367.75 |

| 2024 | 58,362.84 | 60,361.17 | 66,918.39 |

| 2025 | 82,158.96 | 85,177.02 | 100,478.70 |

| 2026 | 117,126.20 | 121,385.05 | 141,944.40 |

| 2027 | 166,449.95 | 171,305.36 | 201,518.04 |

| 2028 | 237,296.63 | 244,148.84 | 284,370.97 |

| 2029 | 329,003.81 | 341,211.26 | 415,415.70 |

| 2030 | 488,404.96 | 505,465.520 | 567,526.85 |

| 2031 | 693,055.28 | 713,273.90 | 841,599.46 |

| 2032 | 977,986.080 | 1,006,517.03 | 1,196,601.36 |

Bitcoin (BTC) Price Prediction 2023

According to our Bitcoin price prediction for 2023, we predict a rise in the value of Bitcoin (BTC), with a maximum estimated price of $45,367.75. This is a significant increase from the average market price, projected to be around $39,966.60, and the minimum expected price, $38,449.20. The cryptocurrency market is widely expected to undergo a recovery in the early months of 2023. If this is the case, these projected prices for Bitcoin could become a reality for investors.

Bitcoin (BTC) Price Prediction 2024

As per our Bitcoin price prediction for 2024, it is anticipated that the value of Bitcoin (BTC) will increase further, reaching a peak price of $66,918.39. This digital currency is forecasted to fluctuate between a low of $58,362.84 and an average of $60,361.17. The driving factors behind this growth are the optimistic market sentiment and an increase in institutional investments, which are expected to persist in the year 2024.

Bitcoin (BTC) Price Prediction 2025

According to our Bitcoin price prediction for 2025, we expect the premier cryptocurrency to experience a significant increase in value, reaching a pinnacle of $100,478.70. Our lower estimate for its price is $82,158.96, with an average expectation of $85,177.02. The expected growth in the value of Bitcoin is attributed to various factors, including but not limited to increased mainstream adoption, positive market sentiment, and a growing number of institutional investments.

Bitcoin (BTC) Price Prediction 2026

According to our Bitcoin price prediction for 2026, it is possible that Bitcoin (BTC) will establish a record high of $141,944.40. Investors in this digital currency can anticipate a minimum price of $117,126.20 and an average price of $121,385.05. This growth is likely to be driven by favorable market sentiments and scalability upgrades. These developments are expected to propel the value of Bitcoin further and establish it as a formidable player in the world of finance.

Bitcoin (BTC) Price Prediction 2027

According to our prediction for the year 2027, it is expected that the value of Bitcoin (BTC) will reach a new peak of $201,518.04, which would be a substantial increase of 554.87% from its current value. Besides this high estimate, we also anticipate that the minimum and average prices of Bitcoin will reach $166,449.95 and $171,305.36, respectively.

Bitcoin (BTC) Price Prediction 2028

According to our Bitcoin price prediction for 2028, Bitcoin (BTC) has the potential to reach a remarkable maximum price of $284,370.97, a significant increase of over $250,000 from its current value. We anticipate that the average price of this digital asset will be $244,148.84, with a minimum price of $237,296.63. The rise in acceptance of Bitcoin as a legitimate currency and investment may play a crucial role in meeting these price targets.

Bitcoin (BTC) Price Prediction 2029

Our prediction for the year 2029 projects that the cryptocurrency market, specifically Bitcoin (BTC), will see more positive gains than losses, leading to a maximum market price of $415,415.70. This represents a significant increase from its current value. Additionally, we anticipate that the minimum price of Bitcoin will reach $329,003.81, and the average market price will be $341,211.26.

Bitcoin (BTC) Price Prediction 2030

According to our Bitcoin price prediction for 2030, we envision a maximum price of $567,526.85 for the leading cryptocurrency. In addition to this high estimate, we also predict that the minimum price of Bitcoin will reach $488,404.96, and the average price will be $505,465.52.

Bitcoin (BTC) Price Prediction 2031

According to our BTC price prediction for 2031, the cryptocurrency is expected to experience substantial growth, reaching a maximum price of $841,599.46 – over 28 times its current market value. Additionally, our prediction estimates that the minimum price of Bitcoin will reach $693,055.28, with an average price that will eventually settle around $713,273.90.

Bitcoin (BTC) Price Prediction 2032

According to our Bitcoin price prediction for 2032, BTC will reach a new high of $1,196,601.36 by the end of the year. This represents a substantial increase from its current value. Additionally, we estimate that the minimum trading price for Bitcoin will be $977,986.08, with an average price of $1,006,517.03.

Despite the potentially impressive profits that may result from these predictions, it is important to remember that investing in cryptocurrencies, including Bitcoin and other asset classes, comes with significant risks. Investing in what you can afford to lose is crucial, and thoroughly researching and understanding the market before making any investment decisions is also very important. If need be, consult financial experts for investment advice.

Bitcoin Price Prediction by Wallet Investor

According to BTC predictions made by Wallet Investor, the market price of Bitcoin is expected to decrease significantly in the upcoming months, potentially reaching as low as 11668.40 USD by 2024. Based on this information, Wallet Investor considers Bitcoin a poor long-term investment opportunity.

Bitcoin Price Prediction by Technewsleader

Technewsleader predicts that the price of Bitcoin will reach $63,078.24 by 2024. This represents a significant increase from its current value. Furthermore, Technewsleader projects that the price of Bitcoin may reach $195,353.70 over the next five years. Their predicting algorithm also suggests that by 2032, the value of Bitcoin might surpass $896,424.69.

Bitcoin Price Prediction by Cryptopredictions.com

According to Cryptopredictions.com, Bitcoin is expected to reach a maximum market price of $33,486.785 in 2023. The forecast for 2024 is a price range of $22,718.061 to $33,408.914. However, the price may fall to a low of $18,859.493 in 2025, with a maximum prediction of $25,002.783.

Cryptopredictions.com predicts that by 2026, there will be a change in the trend toward growth, resulting in a minimum price of $18,063.012 and a maximum price of $27,734.549 by the end of the year. A further increase is anticipated in 2027, with Bitcoin reaching a maximum price of $39,562.759, an average price of $31,650.207, and a minimum price of $26,902.676 by December.

Bitcoin Price Prediction by Market Experts

$30,000 isn’t that significant of a milestone for bitcoin. We’re now at a stage where people are once again engaged in discussions about the importance of bitcoin and cryptocurrency in finance and technology. Most investors are pragmatic in their approach, carefully assessing the potential for bitcoin to become much larger than its current state. Hence the need for the U.S. to recognize and treat cryptocurrency as a legitimate asset class.

Bruno Ramos de Sousa – Head of U.S. markets at Hashdex

More Crypto Online

- Bitcoin’s situation remains bullish, but wave 5 of 3 is not confirmed yet.

- Ideally, Bitcoin should push higher into the 31.5K to 31.8K region.

- Critical support levels should be closely monitored as Bitcoin may experience pullbacks.

Laith Khalaf, a financial analyst at AJ Bell, suggested attempts to forecast bitcoin’s price are futile.

We could be sitting here talking this time next year and it could be at $5,000 or 50,000 it just wouldn’t surprise me because the market is so heavily driven by sentiment

Laith Khalaf

Conclusion

As the crypto market leader, Bitcoin cryptocurrency is one digital asset with massive potential for mainstream adoption. Several businesses already accept Bitcoin as an alternative to fiat currencies, with the latest club member being the Spanish company Telefonica. The telecommunication giant recently partnered with crypto exchanges Bit2Me to enable settlements in Bitcoin, among other cryptocurrencies.

According to our BTC price forecast, Bitcoin’s long-term prospects are looking good, with several possibilities of future price appreciation. Our expectations are also backed by Bitcoin price history. Bitcoin could be a significant portfolio addition for many BTC investors in years to come. However, before you buy Bitcoin or any other cryptocurrency, do remember to conduct your own research, taking into account all risks involved.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD