Bitcoin Retreats To Key Support, BTC Bears Have A Fighting Chance?

Since last week, Bitcoin has lost the critical support that kept the price above $24,000. BTC bears may find their chance to delay what was supposed to be the “end of the bear market” and the taw of the crypto winter, according to several experts.

Bitcoin has lost the momentum that drove the price to a yearly high; with a price decline, bulls will have to stop the drop in the Bitcoin price action to avoid continuing the fall in the price and prevent a collapse to lower levels.

Related Reading: Dogecoin Holders’ Profit Margin Remains High As Most Opt To Hold For Longer

Bitcoin Bears Have The Upper Hand?

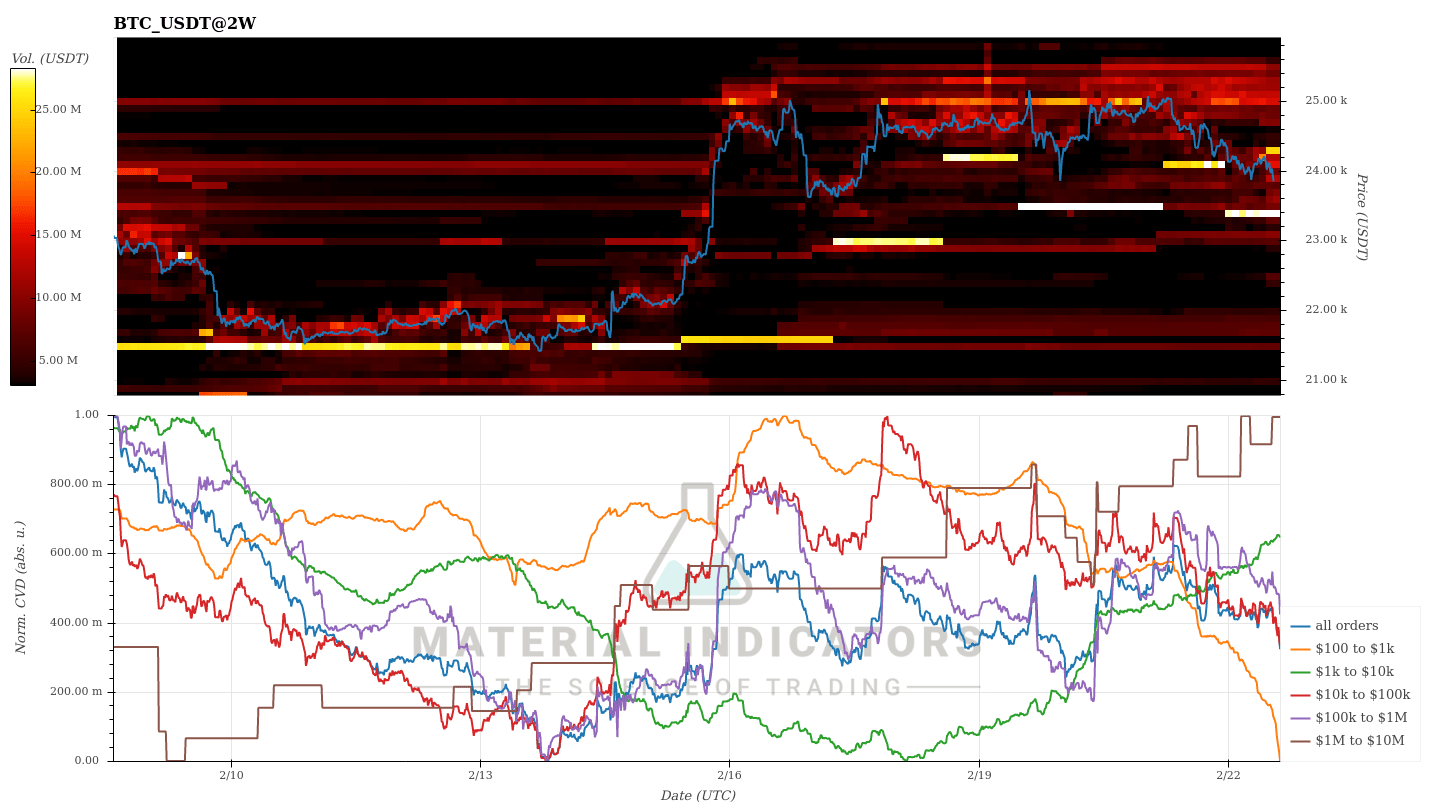

As seen in the chart below, by the research and data analysis firm Material Scientist, the support that held the price above $24,000 has been completely wiped out. Bitcoin has formed a new support floor at the $23,400 level. A resistance wall has now been included in Bitcoin’s range since February 15th at $24,400.

BTC whales have been continuously buying in the order books, as shown in the chart above, and positions between $1,000-$10K. On the other hand, retail investors have been selling Bitcoin and have contributed with BTC testing newly formed support.

According to a recent post published by market-leading research and data analysis firm Bitfinex Alpha, the Bitcoin price action caught market investors off guard, resulting in $155 million worth of short liquidation, which caused the BTC price to move to higher levels. Bitfinex added:

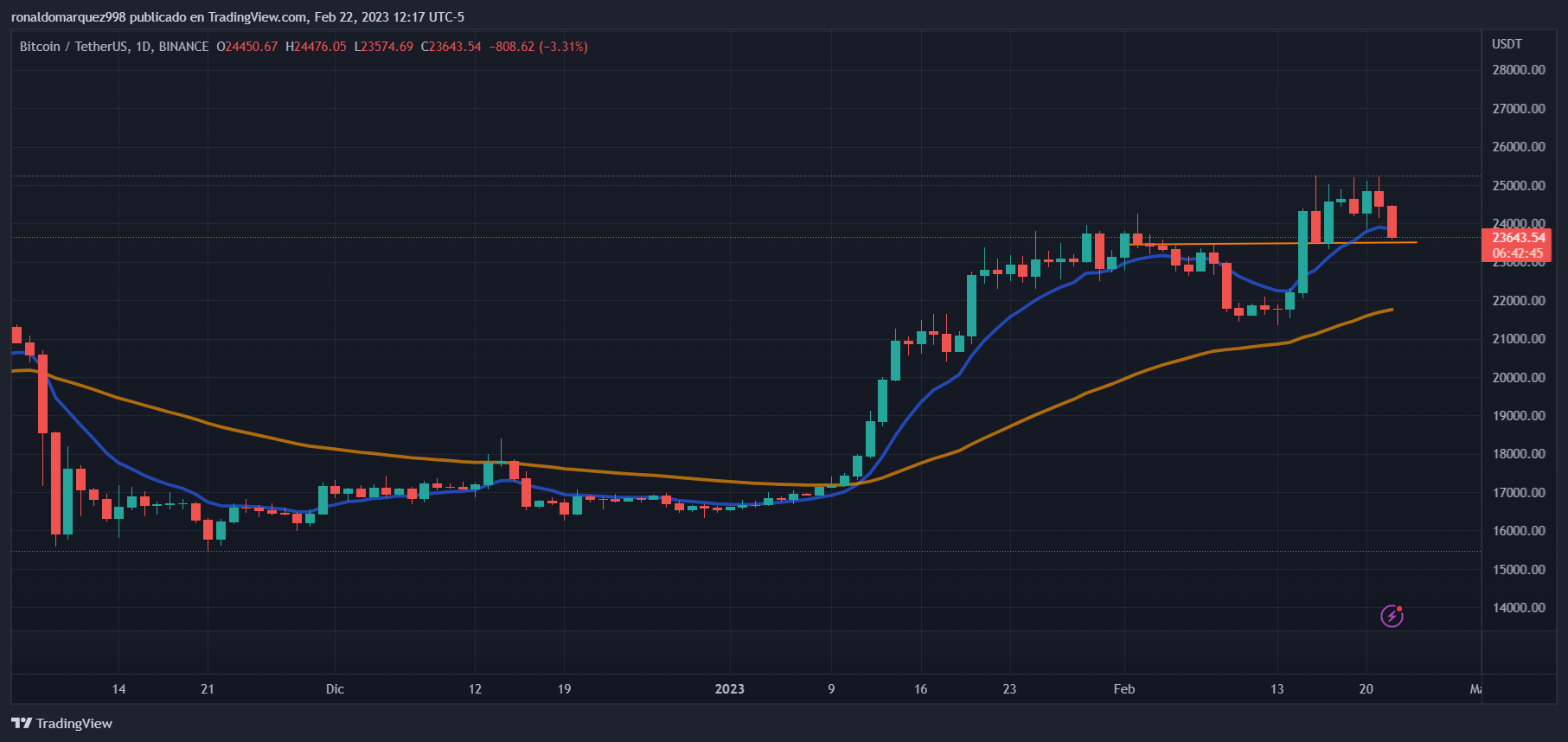

BTC hit an eight-month high in the last seven days, touching $25,000. Massive short liquidations fueled the move. While we failed to close a daily candle above this massive psychological and technical level, this is another significant step forward for the asset as we continue to see out what we believe are the latter stages of a gruesome bear market.

According to Bitfinex’s research, this type of price action, where longs and shorts are wiped out simultaneously, has historically resulted in a range formation. In addition, the most likely move for BTC is to partially liquidate positions and wait for the range to form without a strong directional bias.

In addition, BTC bulls can hope for a range formation without further price declines. With a strong bid wall forming at the $23,400 level, Bitcoin can absorb the selling pressure, creating a new fundamental support level.

BTC is trading at $23,600, down 3.1% in the last 24 hours. In the seven-day time frame, Bitcoin is still in the green with a gain of 6.5%. Over the past 30 days, BTC’s gains have slowed significantly, with a slight 4% profit.

Related Reading: Bitcoin Rally Fueled By USD Coin (USDC) Rotating Into BTC: Santiment

If Bitcoin fails to hold the next support, it could drop to the $20,000 zone, which could be a win for the BTC bears in the near term, as future rate hikes could be more aggressive in the upcoming Federal Reserve (FED) meeting, causing a further downtrend.

Featured image from Unsplash, chart from TradingView.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur