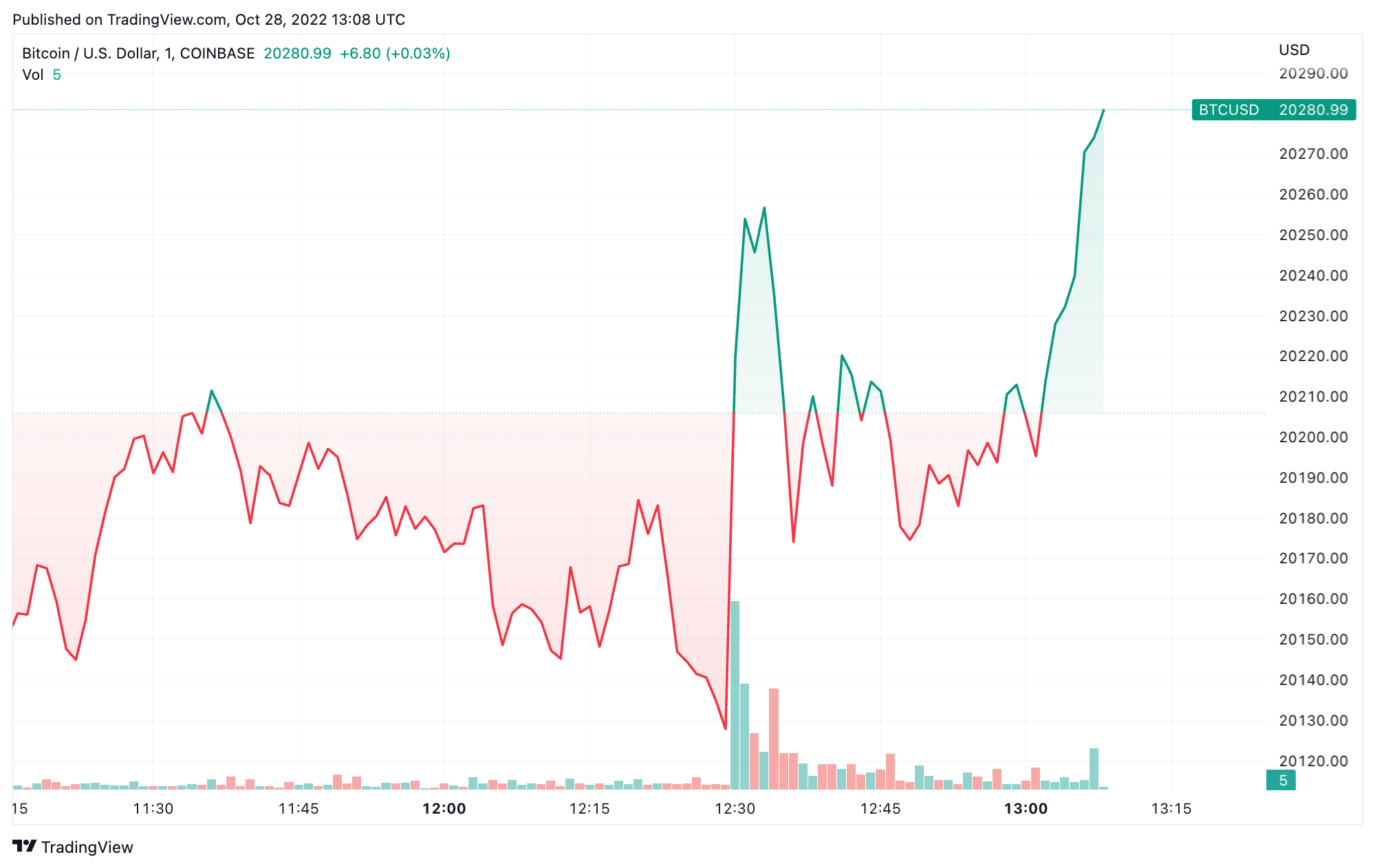

Bitcoin spikes then whipsaws as U.S. PCE data in line with expectations

Bitcoin traded up following consumer spending data in the U.S., before surrendering these gains as the market digested the latest economic data.

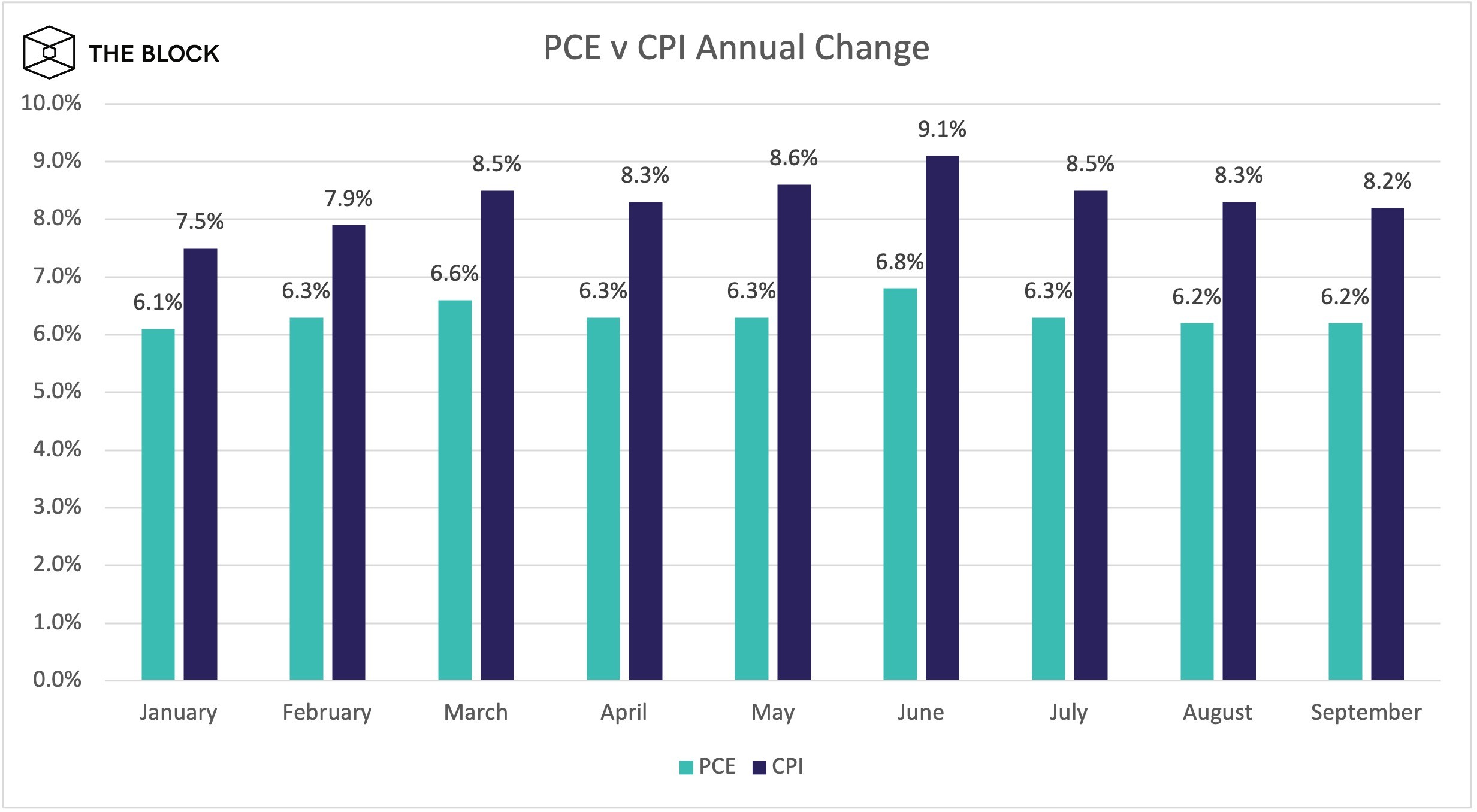

The monthly personal consumer expenditures (PCE) was 0.5%, in line with the consensus before release. The annual change in PCE was 6.2% in September.

Bitcoin was trading at $20,280 following the release. The leading cryptocurrency by market cap briefly spiked before trading lower, then rising again. Economic indicators have driven crypto prices over the past few months.

BTCUSD chart by TradingView

PCE measures the price people in the U.S. pay for goods and services, or those buying on behalf of others. The index captures inflation, or deflation, across a range of consumer goods.

It is seen as the Fed’s preferred measure of inflation, because it can reflect changes in consumer behavior, thus giving a more comprehensive overview of the inflation picture than the consumer price index (CPI). CPI was hotter-than-expected in September, up 0.4% month-on-month and 8.2% year-on-year.

source: bea.gov

Today’s economic indicator follows yesterday’s better-than-expected GDP data. The U.S. economy grew by 2.6% in the third quarter, countering suggestions by «doomsayers» that the economy was underperforming, according to President Joe Biden.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD