Bitcoin surpassed $28k again while crypto market cap went down

Bitcoin (BTC) has had many ups and downs around the $28,000 mark for the last three weeks. The fluctuations come while the global crypto market cap drops by roughly $23 billion in less than a week.

BTC is trading at $28,300 at the time of writing, up by 1.4% in the past 24 hours. The bullish momentum as the amount of non-zero bitcoin addresses reached an all-time high (ATH) of 45.5 million, according to data provided by Glassnode.

The recent surge in price action has propelled the number of Non-Zero Addresses to an ATH of ~45.5M, with only 96 / 5206 data points recording a larger 14d change in absolute terms.

This suggests the degree of on-chain activity is currently improving.

? https://t.co/YQ3P6gDVbL pic.twitter.com/5PGLCFDAB7

— glassnode (@glassnode) April 7, 2023

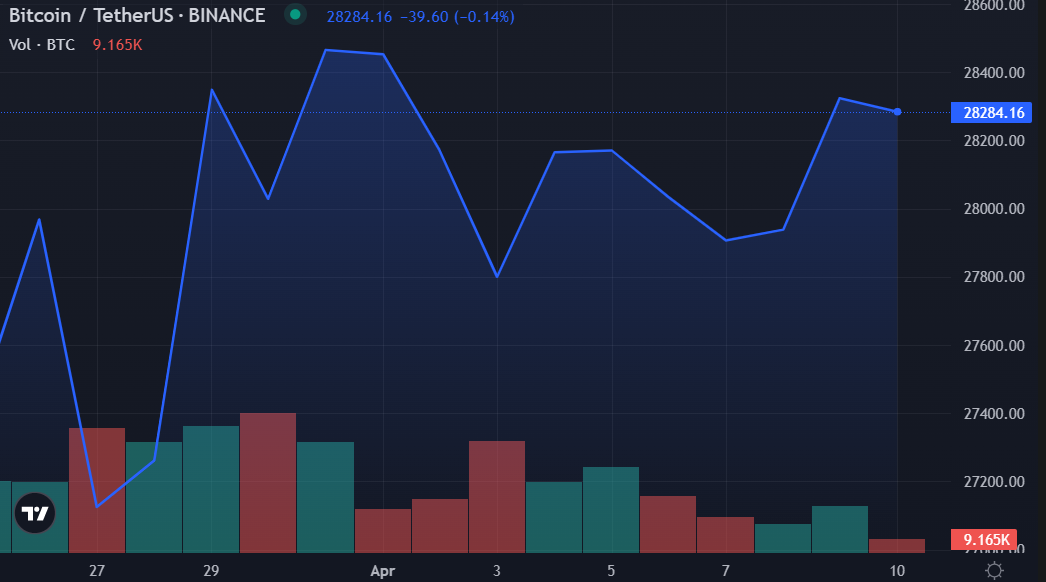

Bitcoin price – April 10 | Source: crypto.news

Per the data provider, the on-chain activity of BTC is “improving.” On the other hand, the Bitcoin Miner Outflow has reached 52.418 BTC, marking a one-month low, which is also a bullish sign, according to Glassnode.

You might also like: Bank of England assembles 30 experts to design the digital pound

Data shows that around $3.6 billion worth of bitcoin has moved into the exchanges, while over $3.5 billion coins were withdrawn over the last seven days. This shows a positive $52.2 million flow to the platforms.

? Weekly On-Chain Exchange Flow ?#Bitcoin $BTC

➡️ $3.6B in

⬅️ $3.5B out

? Net flow: +$52.2M#Ethereum $ETH

➡️ $2.8B in

⬅️ $2.7B out

? Net flow: +$115.2M#Tether (ERC20) $USDT

➡️ $4.5B in

⬅️ $4.5B out

? Net flow: -$14.3Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) April 10, 2023

While BTC has been on a bull run, the total crypto market capitalization has dropped from its local high of $1.207 trillion on April 5, to $1.184 trillion at the time of writing, a $23 billion loss, according to CoinMarketCap (CMC) data.

Currently, bitcoin has a 46.2% share of the total market cap, while ethereum (ETH), the second-largest crypto asset, has an 18.9% stake.

Read more: Crypto’s silver lining: How slow US job growth could boost markets

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren