Bitcoin Technology: 5 Bitcoin Network Developments You Should Know About

Bitcoin technology has evolved significantly since its launch. Bitcoin is continuously being developed as the community strives to improve privacy and scalability. The original Bitcoin client, Bitcoin Core, is currently on version 23.0, indicating that a lot has been happening behind the scenes — there were a total of 37 Github releases at the time of writing.

Read on to learn about five Bitcoin technology developments geared toward helping Bitcoin achieve its full potential.

Top Bitcoin Technology Developments You Should Know About

Over the years, many Bitcoin Improvement Proposals (BIPs) have been presented to the community proposing various ways to improve the network. Some have been approved and implemented, while others have been rejected. Bitcoin Core developers and more than 800 contributors participate in the development process of Bitcoin.

Here’s a list of the top five Bitcoin technology improvements you should know about.

SegWit

Segregated Witness (SegWit) is a Bitcoin upgrade that was implemented in August 2017 through a soft fork. It addresses transaction malleability and increases the rate of validation by storing more transactions in a block. SegWit paved the way for the Lightning Network and the Taproot upgrade.

SegWit was proposed in 2015 by Bitcoin developer Peter Wuille. The SegWit upgrade elicited a “war” within the Bitcoin community before it was even activated. Community members that were against this change forked the Bitcoin blockchain to establish Bitcoin Cash (BCH).

SegWit takes out the “witness data” from within a block, minimizing the transaction size and creating more space within a block. Therefore, blocks can hold about 2,700 transactions after SegWit in contrast to an estimated 1,650 transactions before the upgrade. Witness data is the second part of a transaction that comprises transaction signatures. The first part of the transaction contains the wallet addresses of the sender and receiver.

SegWit also fixed transaction malleability, a term that refers to the possibility that part of a transaction can be altered “after a transaction has been signed without invalidating the signature.” The second phase of this upgrade, SegWit2x, was not initiated because it was rejected. The goal of SegWit2x was to raise the block size to 2MB. SegWit adoption rose sharply in 2021 and has been steadily rising since. At the time of writing, SegWit adoption on the transaction level was 84%.

The Lightning Network

The Lightning Network (LN) is a layer-2 payment protocol built on top of the Bitcoin blockchain. It was proposed by researchers Thaddeus Dryja and Joseph Poon in 2015. Their paper was based on Satoshi Nakamoto’s ideas on payment channels and the forum discussions he had about them. In 2016, Dryja and Poon built Lightning Labs, a company that would focus on the development of LN. They released the beta version of LN in 2018.

The Lightning Network uses smart contract functionality, enabling users to make instant microtransactions off-chain. Payments take place inside payment channels (multi-signature contracts), allowing two parties to transact with each other. LN offers remarkably low fees because transacting and settling occur off-chain. It can potentially handle billions of transactions per second, thereby solving Bitcoin’s scalability problem.

The Lightning Network isn’t perfect, though. It has issues that are continuously being solved. Some of the solutions in progress are route blinding and trampoline onion routing. Route blinding, for example, aims to improve the recipient’s privacy.

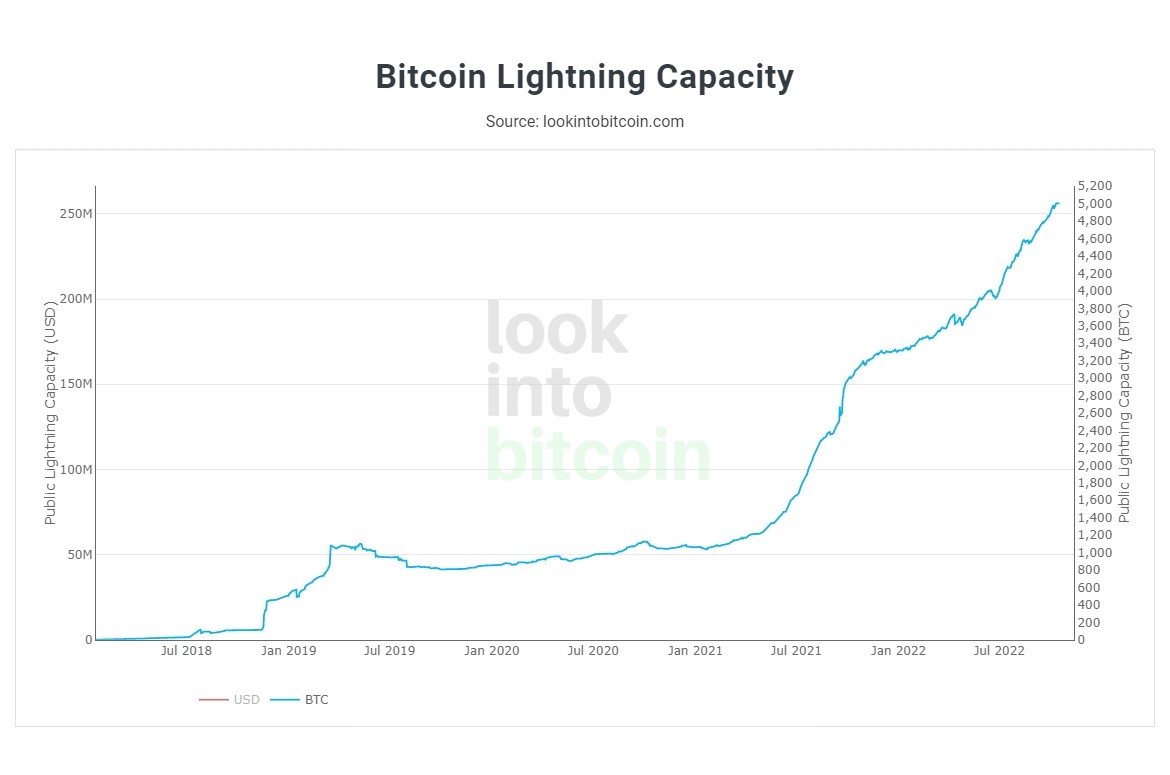

LN’s capacity has grown in 2022 despite the bear market. It surpassed 5,000 BTC in October 2022. This is the cumulative capacity that all LN nodes hold. Companies are also investing a lot of money in the Lightning Network. For instance, Strike, an LN digital payment provider, raised $80 million in a fundraising round led by Ten31.

Source: Look into Bitcoin

Taproot

Taproot is a Bitcoin upgrade deployed in November 2021 via a soft fork. It enhances privacy, reduces fees, improves smart contract functionality, and makes Bitcoin transactions cheaper, more efficient, and more private. Taproot was proposed by software developer Gregory Maxwell in 2018.

Thanks to the upgrade, multisig transactions — transactions that require two or more parties to sign off for them to go through — can be batched together and verified. This boosts the time it takes to validate complex multisig transactions, which were notoriously slow before Taproot was implemented.

Also, the Taproot upgrade benefits Lightning users by easing network congestion on the Bitcoin base layer. LN transactions are verified on the Bitcoin blockchain, which could cause congestion. With Taproot, however, the Lightning Network becomes more efficient in processing transactions.

Taproot offers privacy because it can disguise multisig transactions as single-signature transactions. This makes it difficult to identify the participating parties on the blockchain. The use of Taproot is optional, which means its adoption will grow gradually. As of this writing, only about 1% of all Bitcoin transactions were using Taproot.

The Liquid Network

The Liquid Network is a Bitcoin sidechain that enables private Bitcoin transactions targeted at large counterparties in the Bitcoin ecosystem. It also permits the settlement and issuance of stablecoins, security tokens, and other financial assets on a sidechain that is tied to Bitcoin’s blockchain. Blockstream is the company behind the Liquid Network, which went live in 2018.

A federation of distributed members operates Liquid. These members range from exchanges and financial institutions to Bitcoin-focused companies. A few of the members listed on the Liquid website are Xapo, Wyre, Bitfinex, CoinShares, Huobi, Ledger, and Paymium.

Users peg BTC to redeem it for L-BTC (which is backed by BTC on a 1:1 ratio), enabling them to perform confidential transactions and enjoy faster transaction speeds and low-cost fees. Unfortunately, the low adoption of the network reduces the effectiveness of the privacy feature because there’s virtually no crowd using it. Also, the federated model is somewhat centralized, giving the Liquid Network set of trust assumptions that are different from Bitcoin.

FediMint

Federated Mint (FediMint) is a Bitcoin sidechain that solves the privacy and custody problems with Bitcoin.

Privacy is minimal because Bitcoin transactions are visible to everyone, and most people are still storing their BTC with third parties like exchanges, putting their funds at risk. The open-source protocol FediMint solves these two challenges by providing privacy and a lower-risk custody solution.

It uses the Byzantine Fault Tolerant (BFT) consensus algorithm for security purposes, and trust is split over several parties in a federated mint. When users send BTC to these mints, they receive Ecash tokens. They can then send the tokens to other users within the mint privately because other members will not know which parties are transacting with one another.

FediMint permits users to give federated mints custody over their BTC. They can do this by trusting certain members of the mint to act as guardians. The role of guardians is to offer custody services via FediMint servers.

FediMint development is still in progress. The project has garnered support from Ten31, Blockstream, Spiral, and the Human Rights Foundation. FediMint is interoperable with the Lightning Network.

FediMint privacy can be improved by Flexible Round Optimized Schnorr Threshold (FROST). This is a new type of multisig that provides privacy while making federations more flexible. It was introduced in a 2020 paper by Chelsea Komlo and Ian Goldberg.

The Bitcoin technology developments discussed above could expand Bitcoin’s potential considerably, thereby making the cryptocurrency more useful in the near future. The developments are also a reminder to Bitcoin newcomers that there’s more to this project than simply buying and holding coins for a potential profit.

Bitcoin developers are working to build sound money that anyone across the globe can access and use digitally without censorship or bureaucratic barriers to entry.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur