Bitcoin trades above $17,000 as Coinbase leads sell-off in crypto stocks

Crypto prices were up on Friday, while most related equities sank. Block bucked the downward trend, adding 2.4%.

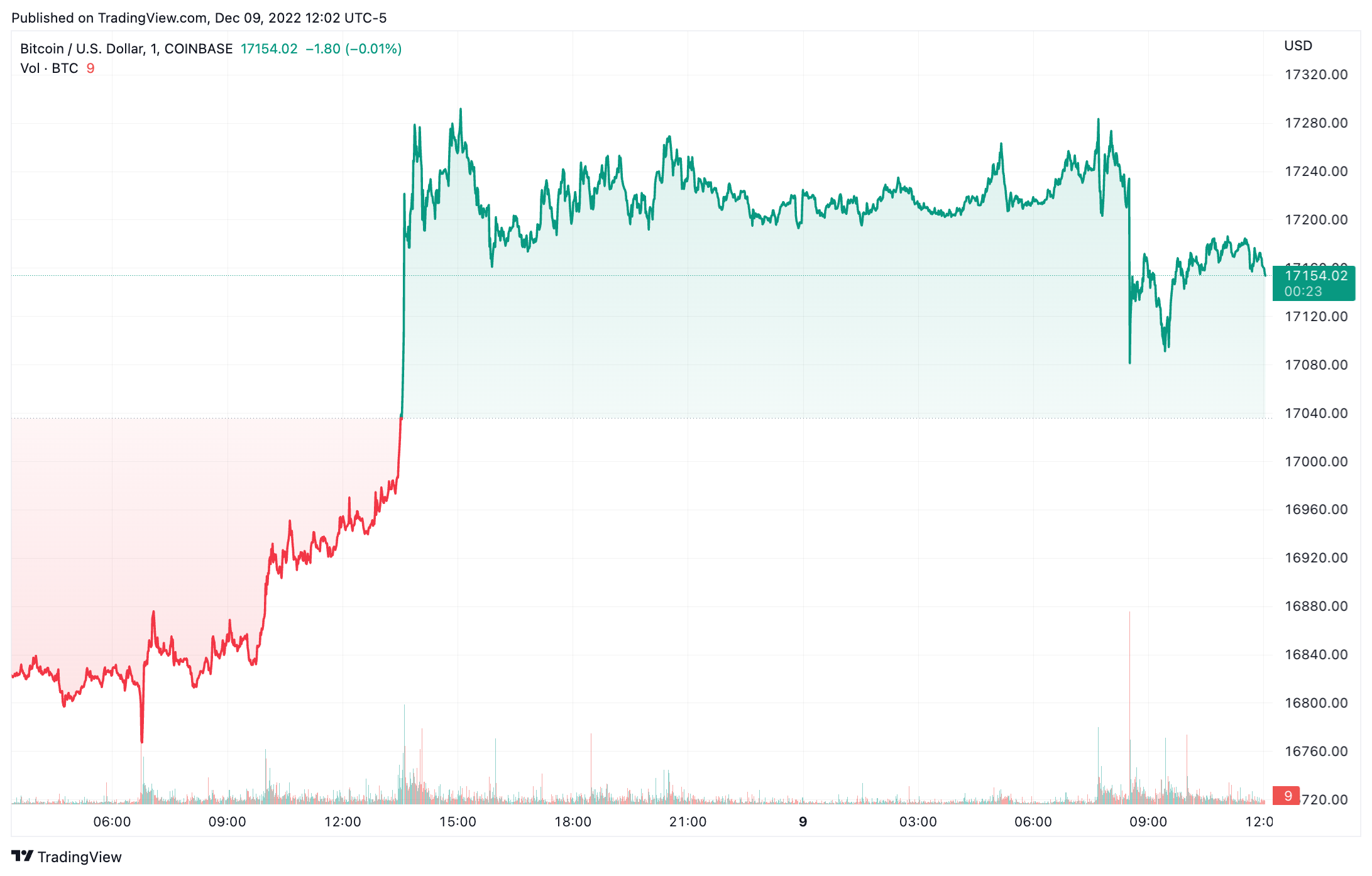

Bitcoin was changing hands for $17,154 at noon EST on Friday, according to TradingView data. That’s an increase of 1.4% over the past 24 hours. It had been trading above $17,200 before hotter-than-expected data for November’s producer price index (PPI), which rose by 7.4% year-on-year in November. A Refinitiv poll of economists expected it to increase by 7.2%.

BTCUSD chart by TradingView

PPI measures the wholesale price of goods and services paid by businesses before they reach consumers. The hotter-than-expected reading raises concerns surrounding the Fed’s next interest rate decision.

Meanwhile, ether was trading up 2% at $1,275. Binance’s BNB rose 0.6%, and Polygon’s MATIC jumped 1.4%.

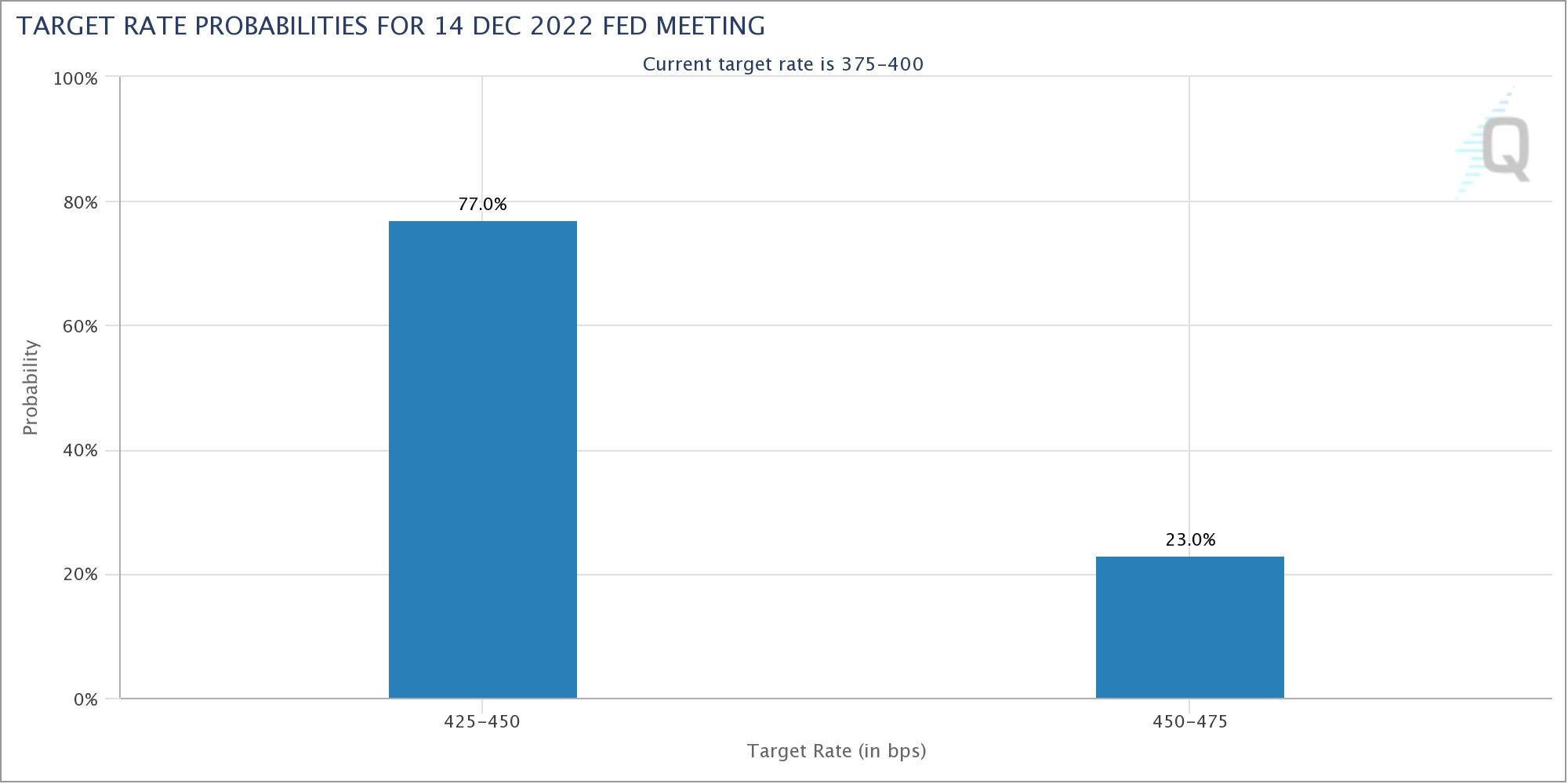

The Fed’s Federal Open Market Committee (FOMC) is expected to announce an interest rate increase of 50 basis points, with a Fed fund target rate range of 4.25% to 4.5%. The CME’s group’s FedWatch tool — which analyzes Fed funds futures pricing data — sees a 77% probability of a 50 basis point increase.

FedWatch by CME Group

Looking ahead to next week’s inflation data (CPI) in the U.S. for November — dropping at 8:30 a.m. EST on Tuesday — could also dominate moves in crypto. October inflation came in below estimates at 7.7%. QCP Capital said these events are the «last remaining hurdles for the rally into year-end.»

The crypto trading firm noted the inflation figure will «yet again be ‘the most important CPI release ever,’ this time because the market has set it up to be with its epic 2-month short squeeze rally.» A disinflationary print could see the rally continue through the end of the year, its latest market update added.

Crypto and structured products

The S&P 500 and the Nasdaq 100 were trading down marginally on Friday, falling 0.3% and 0.5%, respectively.

Coinbase was trading down 2.5% on Friday at $41.76. Silvergate shares sank to $22.95, down 0.5%. MicroStrategy shares were lower by 1.4%, trading around $200.

Block bucked the downward trend in crypto-related stocks on Friday. Shares in Jack Dorsey’s firm jumped 2.6% by midday on Friday to trade at $65.

The discount on Grayscale’s GBTC to net asset value (NAV) continued to widen, reaching 47.9% on Thursday. Its previous low was 47.3% on Wednesday.

The discount means shares in the fund trade at a discount of over 47% versus the value of the bitcoin the fund holds.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Dash

Dash  Zcash

Zcash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur