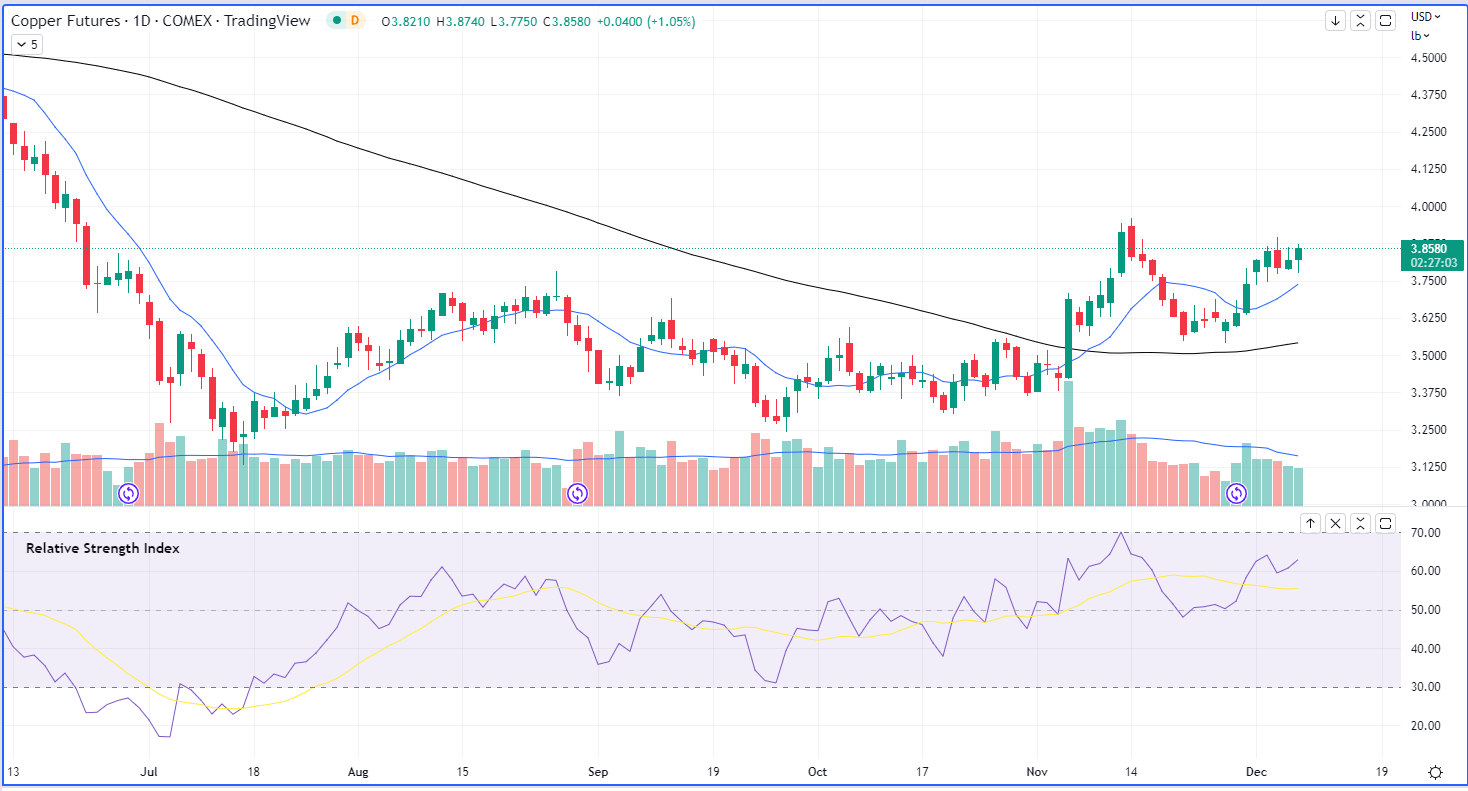

Bitcoin’s High Correlation to Copper Does Not Bode Well for Short-Term Investors

Bitcoin’s price now correlates more strongly to copper futures than to traditional equity indexes.

BTC’s correlation coefficient relative to copper has risen to 0.84 from 0.27 a month ago, reaching its highest mark since August.

The correlation coefficient measures the pricing relationship between two assets, ranging from -1 to 1. The former indicates an inverse relationship, while the latter implies a direct pricing relationship.

The tightening relationship poses a couple of questions.

- Analysts often view copper as a proxy for overall economic growth, affectionately calling it “Dr. Copper” for its professorial ability to forecast trends. Does this imply that the macro narrative within the digital asset space will continue?

- Why has traditional equities’ relationship with copper weakened over the last two months? As early as Oct 6, the S&P 500’s correlation was as high as 0.86 before falling to its current level of 0.14.

On question one, I would say, yes. Absent a black swan or negative contagion event specific to a centralized entity, digital assets still seem very much connected to macroeconomic developments.

But, notably, yields for the federal funds rate, U.S. three-month and two-year Treasurys exceed the yield of 10-year Treasurys.

On point two, equities may be trading at an unjustified premium at the moment. A CoinDesk article on Tuesday highlighted how equities trading has been unaligned to fundamental data, decoupling from its normal relationship with the two-year Treasury bond yield.

Given the decoupling and the price of copper itself, traders may be expecting a reversion to equities, and may place trades accordingly.

Unfortunately, bitcoin traders currently don’t have much cause for optimism about short-term price appreciation.

Prices have been noticeably range-bound for the last 30 days, and appear poised to continue that way.

Sentiment has followed the same pattern, and the Crypto Fear and Greed Index, which has occupied extreme fear and fear territory for months, aligns with September figures.

For long-term accumulators of bitcoin, however, this is likely their season. The increased connection to macro factors has provided stable (if not sluggish) price activity for the asset, providing investors with additional opportunities for accumulation.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur