BTC Analysis: Bitcoin Continues 20-Day Range After Closing Monthly Candle Beneath Previous ATH — Where Next?

Key takeaways:

- Bitcoin is down by a sharp 25% from the August highs of $25,200

- BTC/USD closed the September monthly candle beneath the previous all-time high price

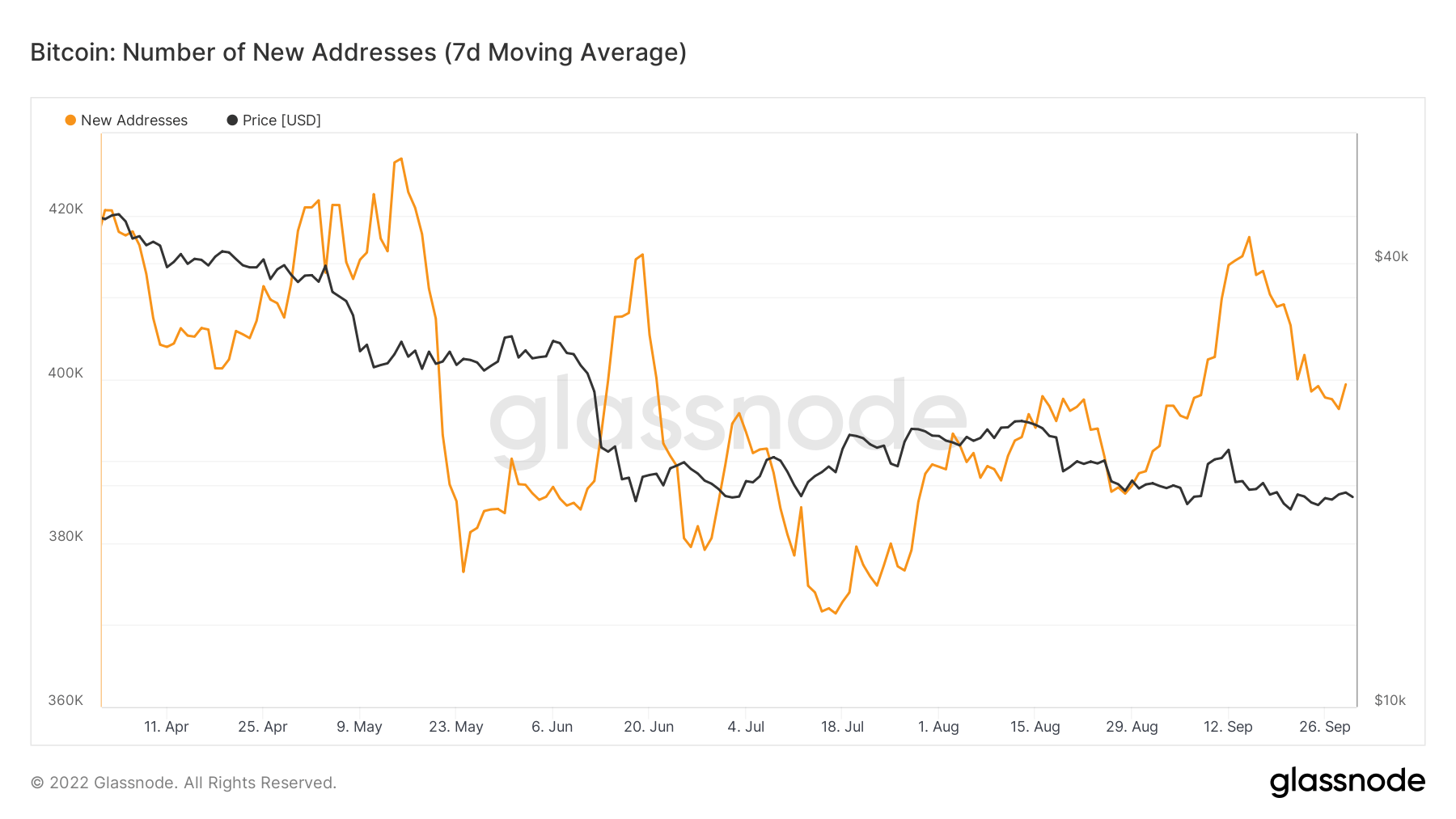

- Despite the bearish sentiment, there is a slight uptick in the number of new addresses

| BTC Price | $19,255* |

| Key Support Levels | $19,000, $18,585, $18,400, $18,000, $17,830, $17,160, $16,615, $16,000, $15,700, $15,315 |

| Key Resistance Levels | $19,575, $19,720, $20,000, $20,500, $20,700, $21,000, $21,600, $22,650 |

*Price at the time of publication

Bitcoin is now down by a total of almost 25% from the August highs of $25,200 as the cryptocurrency continues to battle in a tight range between the low at $18,160 and the September high at $22,800. In fact, the upper angle of the range has been much tighter over the previous nineteen days as BTC failed to post a daily closing candle above the $20,000 resistance.

The bearish sentiment is largely a result of the overarching narrative regarding inflation, with the US Federal Reserve continuing to hike interest rates in September by another 75 BPS, bringing the current US Fed Funds Rate to 3.25%.

This narrative has consistently plagued the market with bearish pressure as investors continue to wait on the sidelines for further clarification on how high-interest rates might go. Most traders continue to keep their eyes on the Consumer Price Index, hoping to see a reduction to indicate that inflation is starting to fall, with the next CPI announcement scheduled for October 13th.

The inflation narrative is sending shockwaves throughout the financial sector, with major indices such as the SP500 and the NASDAQ losing crucial ground last week and creating fresh new lows for 2022.

Although BTC/USD is still yet to create a fresh new low for 2022, the monthly candle for September closed beneath the previous all-time high price seen toward the end of 2017, creating doubts that the weekly 200-SMA at $18,000 will hold moving forward. This was noted by prominent analyst Cyber David Trading, who has over 60,000 members in his group. David is now targeting $14,000 if the $18,000 support fails to hold.

If BTC continues to plummet, traders will continue to look at the weekly 200-SMA for support. The weekly 200-SMA supported the market during the May price collapse, and traders are now looking back to the level for support moving forward. It currently sits at $18,000.

Image source: TradingView

Despite the overall bearish sentiment, there are few analysts that are starting to release some potentially positive outlooks. For example, InvestAnswers recently reminded his 440,000 YouTube subscribers that October is historically a bullish month for BTC. The average monthly return is 28.42%, pushing BTC up between $25,000 and $26,000 if the same returns were to play out. According to previous returns, October is the third-best bullish month and is commonly referred to as “Uptober”.

Lastly, one more interesting metric to keep an eye on is the fact that the number of new addresses is up from mid-July, which shows that there might be some retail interest within the market.

Image source: Glassnode

Nevertheless, if the CPI reading for October comes out pretty high, it could send more bearish pressure throughout the market and potentially send the market beneath $18,000.

With that in mind, let us take a closer look at the charts and see the potential support and resistance areas moving forward.

Bitcoin Price Analysis

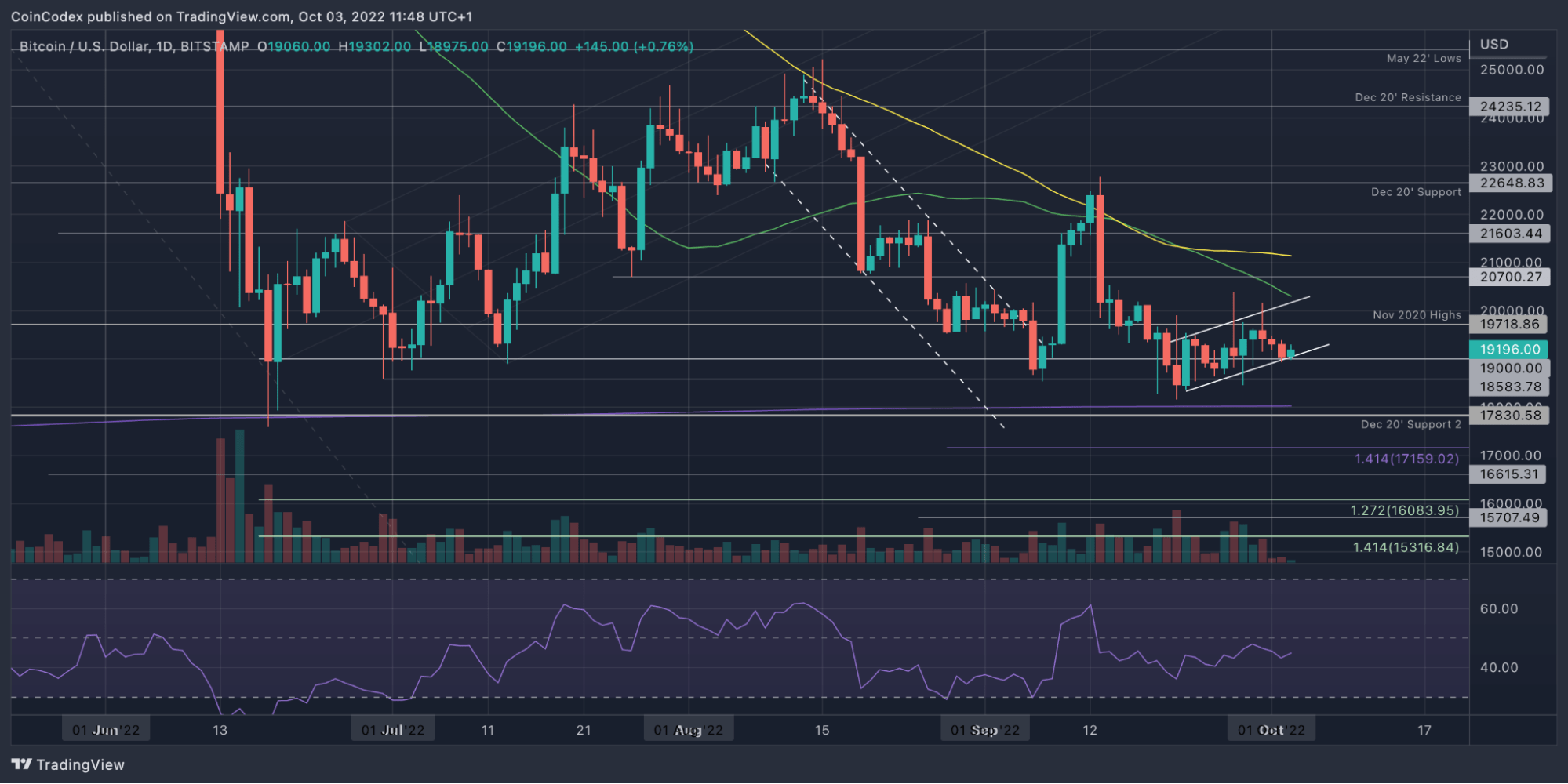

BTC/USD — DAILY CHART — MEDIUM TERM

Image source: TradingView

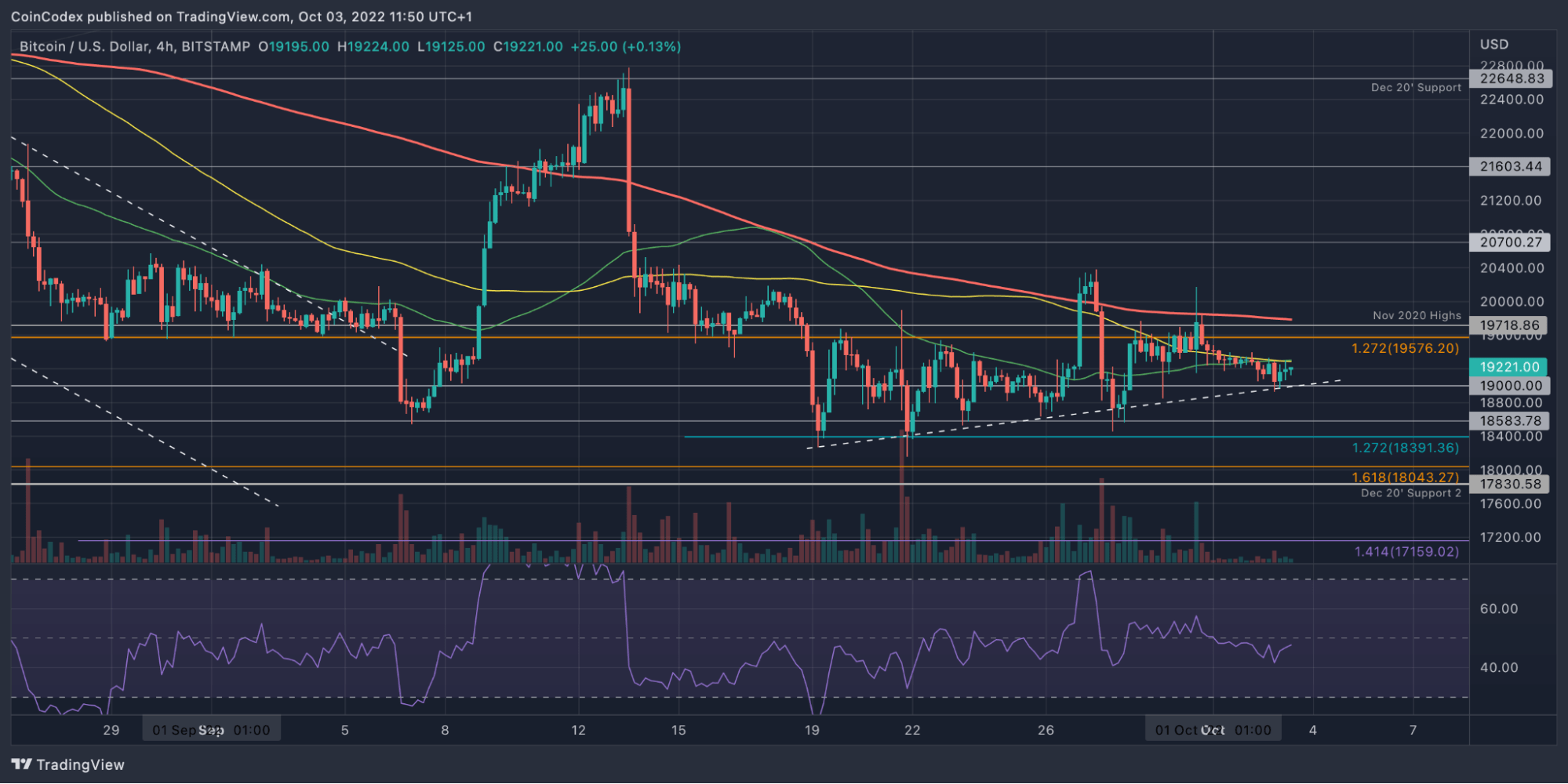

BTC/USD — 4HR CHART — MEDIUM TERM

Image source: TradingView

What has been going on?

The daily chart above shows that BTC is trading inside somewhat of a bearish flag and is battling the lower boundary of the channel. A break beneath this flag will likely send BTC plummeting to the next major level of support, located at the weekly-200 SMA level at $18,000.

The market did witness a brief bullish push higher at the beginning of September, allowing BTC to reach as high as $22,650 during the move. However, BTC fell from there and has been trapped within a range between $20,000 and the September low of $18,160 for the past 20-days or so.

BTC will need to break out from this range to dictate the next direction for the market. Despite the range-bound trading, it could be seen as slightly optimistic as it hasn’t created a fresh 2022 low like the major economic indices (SP500 & Nasdaq) did last week.

Bitcoin price short-term prediction: Bearish

In the short term, Bitcoin is now considered bearish. To turn neutral, we need to see BTC rising above the $20,000 level. A break beneath the long-term support at $18,000 would send BTC in a bearish spiral down toward $15,000.

On the other side, Bitcoin would have to break above the resistance at $22,650 to kick-start another short-term bullish trend. A break above the August highs above $25,000 would confirm a bull trend that could be sustained over a longer period of time.

So, where are we heading next?

Unfortunately, there is no new information about where BTC might be heading next until the breakout of the current range. However, if BTC does manage to close a daily candle above $20,000, this could be considered a good short-term bullish signal in the eyes of some retail traders.

Nevertheless, the CPI reading is October 13th (10 days away), which could result in sideways action until then.

Looking ahead, the first level of resistance lies at $19,720 (Nov 2020 highs) — BTC has not managed to close above this level for the past 19-days. Above this, resistance lies at $20,000. If buyers can move up to break $20,000, resistance is expected at $20,700, $21,000 (100-day MA), $21,600, and $22,000.

Additional resistance is located at $22,650 (Dec 2020 support), $23,000, $24,235 (Dec 2020 resistance), and $25,000.

On the other side, the first level of support lies at $19,000 (the lower boundary of the current flag). Beneath this, support lies at $18,585, $18,000 (weekly-200 SMA), $17,830 (December 2020 support), and $17,160 (downside 1.414 Fib Extension).

Additional support lies at $16,615, $16,000, and $15,700.

According to our automatic BTC price prediction algorithm, the world’s largest crypto could drop to as low as $13,950 in the next three months. However, the long-term outlook looks far more promising, with the price of BTC reaching $37,800 in the next 12 months.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur