BTC’s Price Spiked to Major Resistance Level in Last 24 Hours

The crypto market leader, Bitcoin (BTC), is one of the cryptos in the green for today. Data from CoinMarketCap indicates that the crypto king is currently worth about $23,687.99 after a 2.03% increase in price over the last 24 hours. The crypto was also able to reach a high of $23.919.89 and a low of $23,177.13 over the same time period.

BTC’s weekly performance is also looking rather well as the crypto is up by more than 4% over the last seven days. The crypto king did, however, weaken against its biggest competitor, Ethereum (ETH), by about 0.24% over the last day.

Also in the green zone is BTC’s 24-hour trading volume which currently stands at $25,760,424,629 after a more than 46% increase since yesterday. The market cap for BTC currently stands at $456,321,619,211.

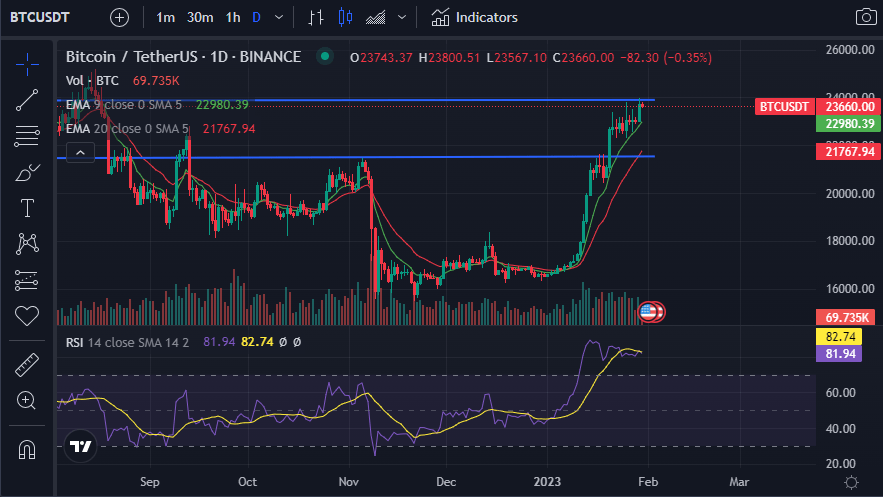

Bitcoin / Tether US 1D (Source: CoinMarketCap)

The daily chart for BTC is looking bullish as the 9-day EMA line finds itself positioned above the 20-day EMA line. This medium-term bullish cycle has seen BTC’s price rise to the current resistance level at around $23,900.

The daily RSI indicator hints that the market leader’s price may overcome this resistance level as the daily RSI line is looking to cross bullishly above the daily RSI SMA line. In addition to this, the daily RSI line is sloped positively towards the overbought territory, which is another bullish sign.

One thing that investors and traders need to take note of is the fact that the daily RSI is already in overbought territory. As a result, the market may begin selling a portion of its BTC holdings to mitigate the potential risk of BTC’s price dropping. Should this happen, then BTC’s price will most likely retrace to the 9-day EMA support level at $22,970.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur