Bitcоin

Case for Bitcoin Weakens as Global Stockpile of Sub-Zero Bond Yields Vanishes

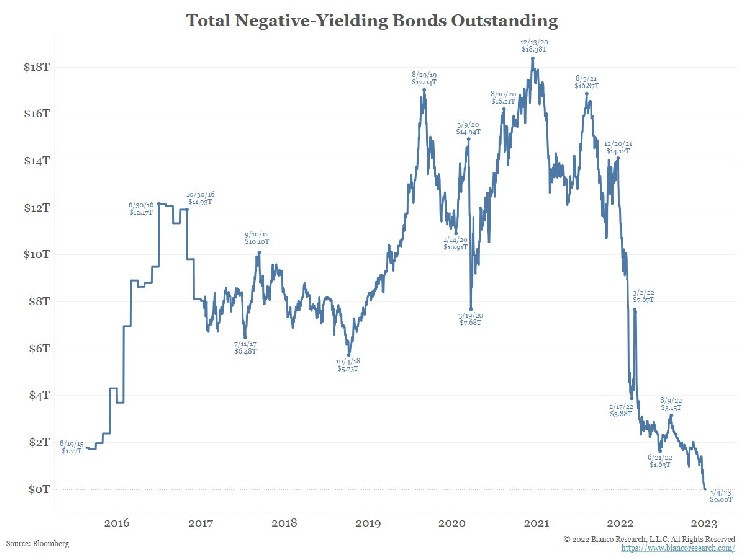

With the global central banks raising interest rates at a record pace to combat inflation, the global stockpile of negative-yielding bonds has vanished, weakening the case for harvesting returns from risky alternative assets like cryptocurrencies.

- The value of the Global Negative-Yielding Debt Index from Bloomberg and Barclays has dropped to zero from the record $18.4 trillion in December 2020.

- A negative-yielding bond offers less money at maturity than the original buying price.

- The amount of negative-yielding bonds rose sharply following the coronavirus-induced crash of March 2020 as central banks injected record liquidity via rate cuts and bond purchases to cushion markets and the economy from the adverse impact of the pandemic.

- The resulting hunger for yields saw investors rotate money out of fixed-income securities and into bitcoin (BTC) and technology stocks.

- Bitcoin chalked up a six-fold rally to record highs above $60,000 in the six months to April 2021.

- Bond yields remain negative when adjusted for inflation, as measured by the consumer price index. However, it remains to be seen if that helps bring more money into the bitcoin market.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Click to rate this post!

[Total: 0 Average: 0]

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  NEM

NEM  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur