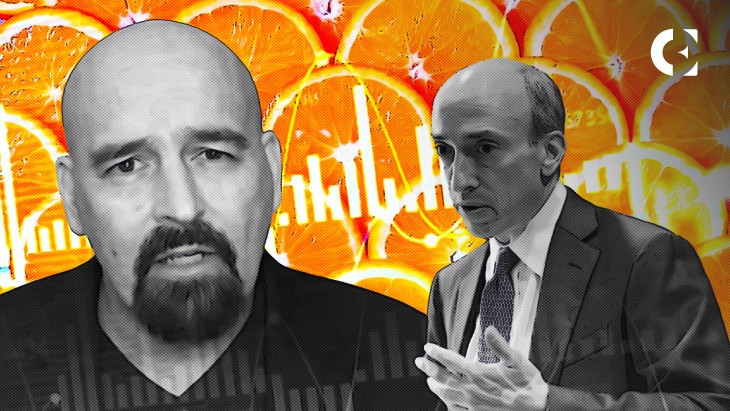

Crypto Lawyer Lashes SEC Chairman for Considering ETH Security

Today, crypto lawyer John Deaton made mocking statements to the chairman of the US Securities and Exchange Commission (SEC), Gary Gensler. Deaton criticized the chairman, saying Gensler would sue even an orange seller if the seller sought additional investment funds from outside investors for their fruit business.

Specifically, the crypto lawyer argued:

Under Gary Gensler’s application of Howey, if an investor took possession of the oranges from his orange grove and worked out a deal with a local grocer to get more money than all the other Howey investors, the orange would still be a security.

Deaton commented while reacting to a tweet that said the chairman of the US SEC considers the act of staking Ethereum token a security contract.

Even worse, when the Grocer sold the ?to a customer who had no connection to Howey or the Howey investor but only purchased it from the Grocer, the customer would still be holding an unregistered security. Gensler would also sue or tax the Grocer for selling a security – the ?

— John E Deaton (@JohnEDeaton1) January 8, 2023

In September last year, after the Ethereum network migrated to the efficient proof-of-stake (PoS) consensus, the SEC chairman said the native assets of PoS blockchains, which allow holders to earn returns through staking passively, could pass the Howey test.

According to a Wall Street Journal report, the Howey test determines whether an asset qualifies as an investment contract, subjecting it to federal security laws. Under the test, a purchase is considered an investment contract if investors pledge their money to fund an enterprise to make profits from its efforts.

Gensler claimed that PoS cryptocurrencies, including Ethereum, Cardano (ADA), and Solana (SOL), could pass that test. However, crypto lawyer Deaton argued that staking involves third parties independent of the investment promoter.

Over the last two years, the Ripple blockchain has suffered repeated court proceedings after the US regulator charged it for selling XRP, which it considers a security contract.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD