Crypto Netizen Tweets BTC Range: $10K Bottom and $23-$24K Top

Crypto Analyst Profit Blue tweeted that $10,000 was a likely bottom for Bitcoin (BTC) and that the range $23,000-$24,000 was a valid top. The netizen made this statement by sharing the price behavior of Bitcoin since 2017.

$10k is still the likely bottom area and $23k-$24k is now a very valid new top.#Bitcoin pic.twitter.com/9n9Ma6UegK

— PROFIT BLUE (@profit8lue) January 27, 2023

When considering the time frame July 2020-July 2021, of the chart shared in the tweet, it could be seen that BTC formed double tops (M-pattern), with the right shoulder reaching a slightly higher value than the left. Moreover, the neckline falls between the $30,000-$32,500 price range. Additionally, the right arm is higher than the left. The formation of double tops indicates a bearish sentiment.

Interestingly, BTC is testing $23,075 level for the second time, when the July 2022-January 2023 time frame is considered. This prompted Profit Blue to call it a valid top. Meanwhile, when considering Profit Blue’s statement from a different perspective, it is not clear as to whether he made this statement to reprimand the Bitcoin supporters who are overly optimistic with its price.

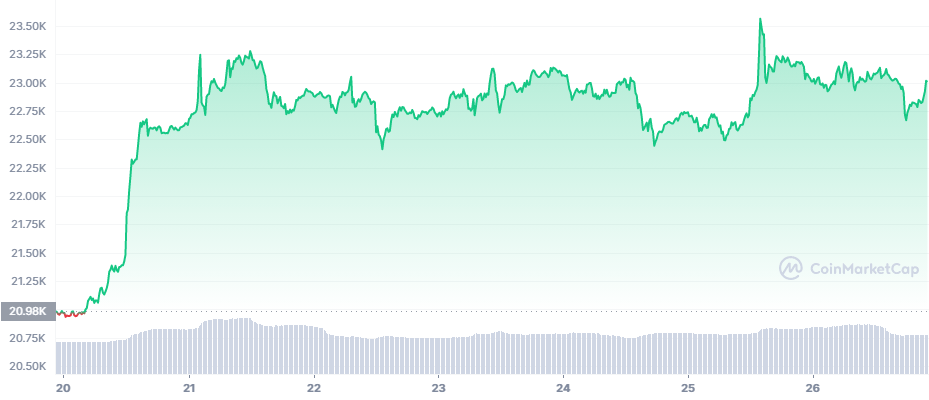

BTC/USDT 7-day Trading Chart (Source: CoinMarketCap)

As shown in the chart above BTC opened the week with its price at $20,980. Halfway through the first day of the week, the bulls pushed BTC from $21,385 to $22,646 within a few hours. Thereafter, BTC has been fluctuating in the $22,500-$23,250 range. During the week, BTC reached its maximum price of $23,565.

Notably, although the trading volume decreased over time, BTC’s price did not increase with the reduction of supply. This depicts that the market is saturated. It could be that the sellers are holding BTC hoping for another surge and are holding.

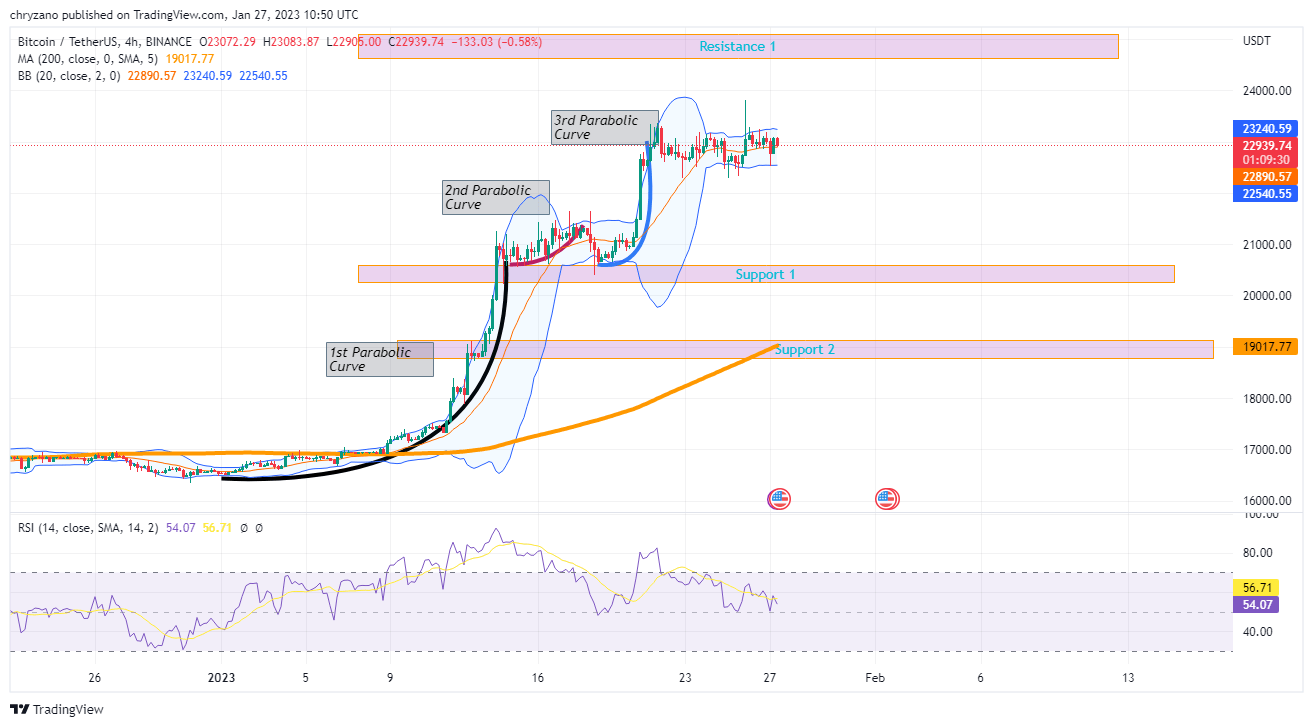

Meanwhile, when considering the chart below, just after BTC broke out of the first parabolic curve (black) it started to form the second curve (pink). However, this did not last for long, as it dismantled out of the second curve, it tanked lower.

BTC/USDT 4-hours Trading Chart (Source: TradingView)

BTC bulls have been relentless and they formed the third parabolic curve (blue), however, that too came to an end as BTC touched the upper Bollinger. Notably, all the parabolic curves were dismantled after BTC touched the upper Bollinger band.

Currently BTC is moving sideways as the Bollinger band is contracting, hence, there could be less volatility. But the question that arises is: Is this the calm before the storm? Will BTC have another rally and an exponential rise?

If there’s a rally and the bulls run rampant BTC will hit resistance 1 in no time. However, if the bears control the bulls, there would be sideways movement. Contrastingly, if the bears are dominant, BTC will crash on support 1.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Decred

Decred  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur