Data Shows Bitcoin Still Highly Correlated With Stock Market

Data shows the Bitcoin correlation with the stock market has been high in recent months as the crypto has been closely following S&P 500 and NASDAQ.

Bitcoin Has Continued To Mimic Movements Of The US Stock Market In 2022

As per the latest weekly report from Arcane Research, while BTC has been more volatile than the stock market, the crypto’s movements have still been pretty close to the latter.

In the year 2022 so far, both the stock market and Bitcoin have found it hard. However, year-to-date, BTC is down 51% while S&P is 14% and NASDAQ 22% into the red, much less than BTC’s losses.

Here is a chart that shows how these assets have fared against each other, and gold, in the first seven months of this year:

Looks like Gold has been the strongest out of these assets during the period | Source: Arcane Research’s The Weekly Update — Week 30, 2022

As you can see in the above graph, Bitcoin’s movements during the year so far have been all very similar to those of S&P 500 and NASDAQ.

Though, it’s also apparent from the chart that many of BTC’s price moves have been much bigger in scale than those of the stock market assets.

Related Reading: Bitcoin Trading Volume Remains Close To 1-Year Highs

From this, it can be concluded that the correlation between the crypto and the stock markets has been pretty significant this year.

The main reason behind the highly correlated markets is the increased presence of institutional investors in Bitcoin.

During times of macro uncertainties, such investors aim to turn down their risk and thus pull out of markets like BTC. The ever-increasing inflation has been one of the recent events behind the crypto observing decline with the stock market.

Related Reading: UK Based Football Club Oxford City Embraces Bitcoin As Payment For Match Tickets

The report notes that the rising significance of monetary and fiscal policy has also strengthened the correlation between not only BTC and the stock market, but also most other financial assets.

Interestingly, Gold has weathered the year the best out of the assets in question, seeing only a 4% drawdown over these first seven months.

BTC Price

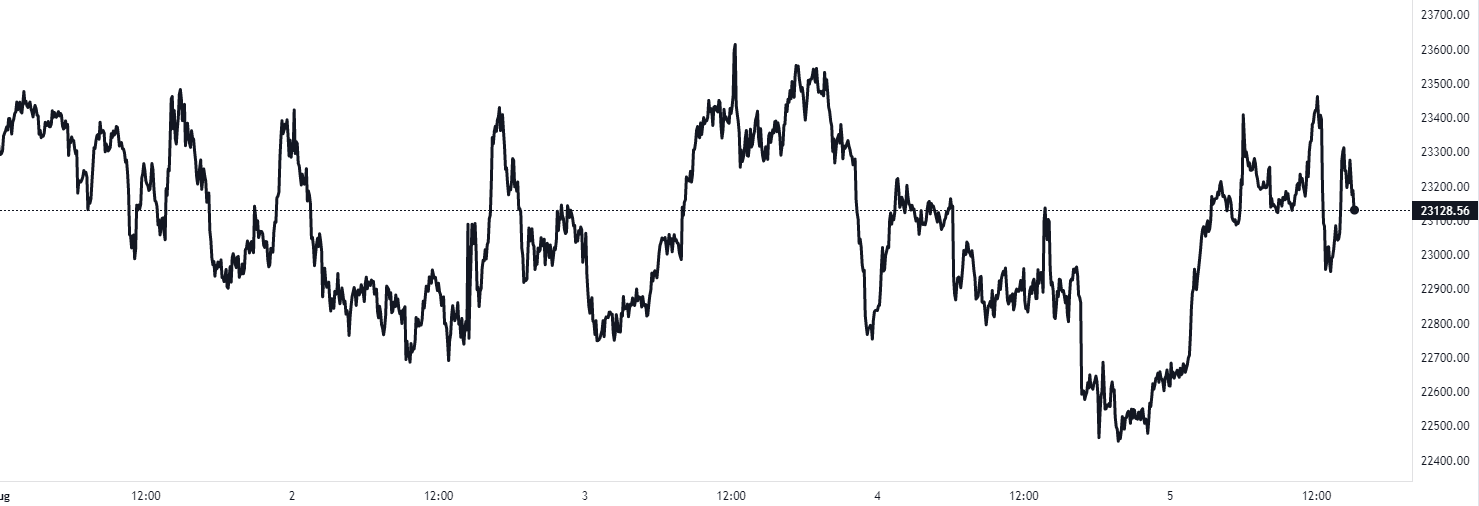

At the time of writing, Bitcoin’s price floats around $23.1k, down 3% in the last seven days. Over the past month, the crypto has gained 14% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have been moving sideways during the last few days | Source: BTCUSD on TradingView

In recent days, Bitcoin hasn’t shown much price movement as the crypto has mostly been consolidating sideways around the $23k level.

Featured image from Quantitatives on Unsplash.com, charts from TradingView.com, Arcane Research

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond