Deep dive into top public BTC miners following 82% YoY increase in hash rate

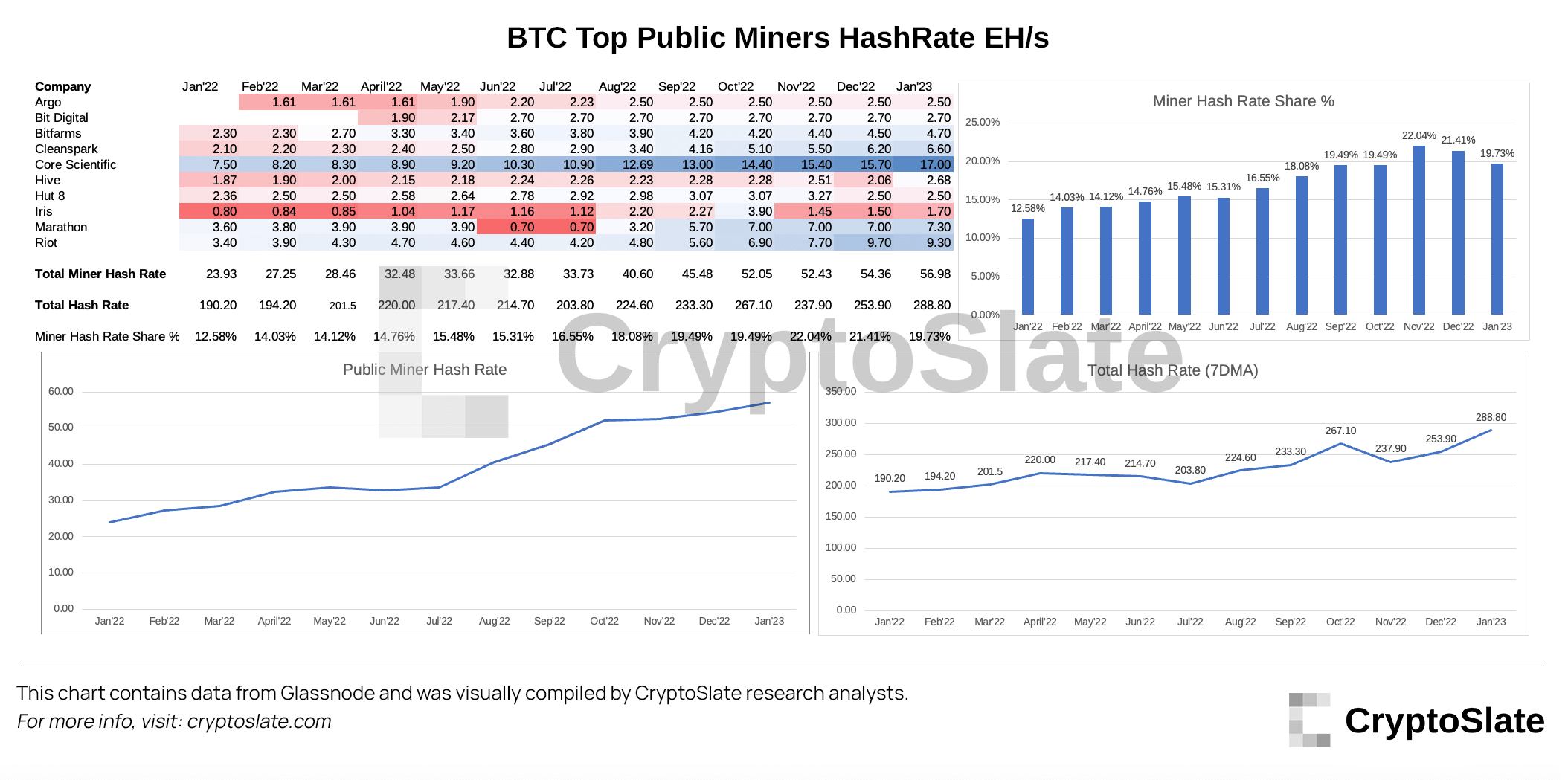

Bitcoin (BTC) mining from public companies has grown exponentially in recent years, with the hash rate share of the top mining companies increasing from 23.93 EH/s to 56.98 EH/s between Jan. 2022 and Jan. 2023. The increase represents a staggering 82% growth in hash rate YOY.

Top public miners

CryptoSlate analyzed ten of the top public Bitcoin miners and their hash rates to gain further insight into this growth.

Leading the pack is Core Scientific, which has approximately 30% of the hash rate share. Riot and Marathon come in second and third place, respectively. Combined, they account for almost 60% of the hash rate share taken up by public companies. The majority of the ten public miners on the list have either increased or equaled their hash rate share YOY.

These ten companies hold approximately 60 EH/s, which accounts for roughly 20% of the total hash rate over a seven-day moving average (7DMA,) an indicator that measures the average hash rate over a 7-day period. Although the percentage has decreased slightly in previous months, it has increased by almost 50% YOY from just 12.58%.

It is worth noting that the hash rate share of public miners is likely to be closer to 25%, as only the top ten mining companies were included on this list, and the hash rate has already exceeded 300 EH/s.

Hash rate & difficulty increase

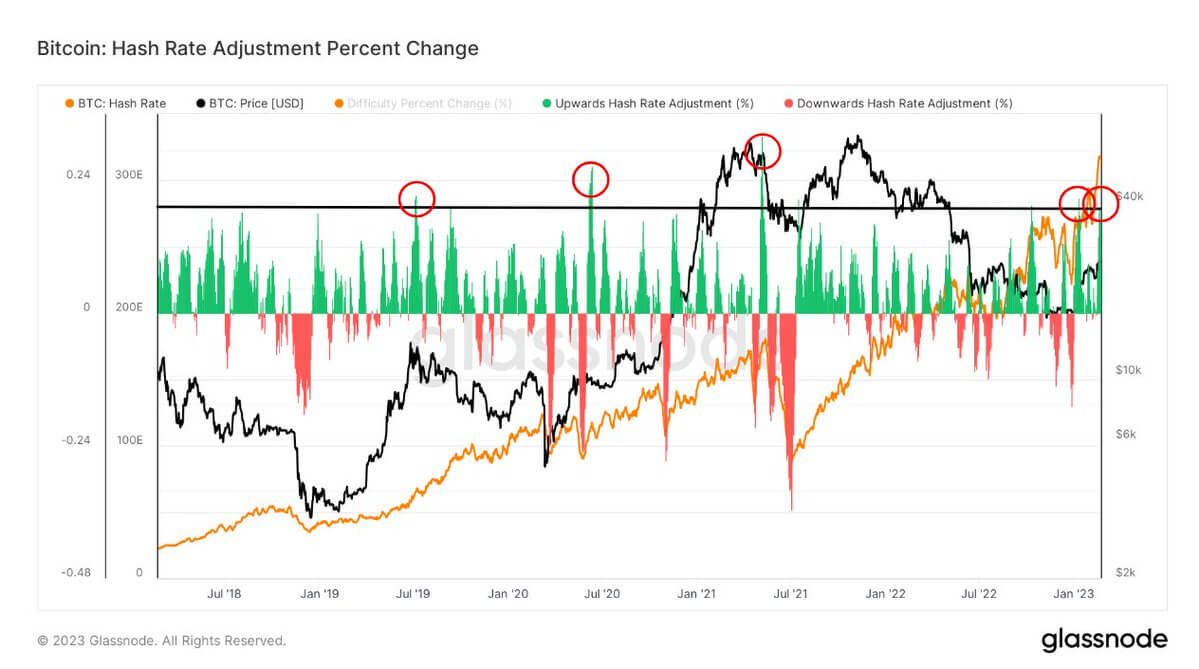

The increase in Bitcoin’s hash rate is depicted in the chart below, with the orange line showing a solid positive trend line since July 2021 following the China mining ban.

The exponential growth in hash rate has had a knock-on effect on mining difficulty. Due to this growth, the mining difficulty is set to adjust by over 10% on Friday, Feb. 24, marking the biggest positive adjustment since Oc. 2022 and Sept. 2021.

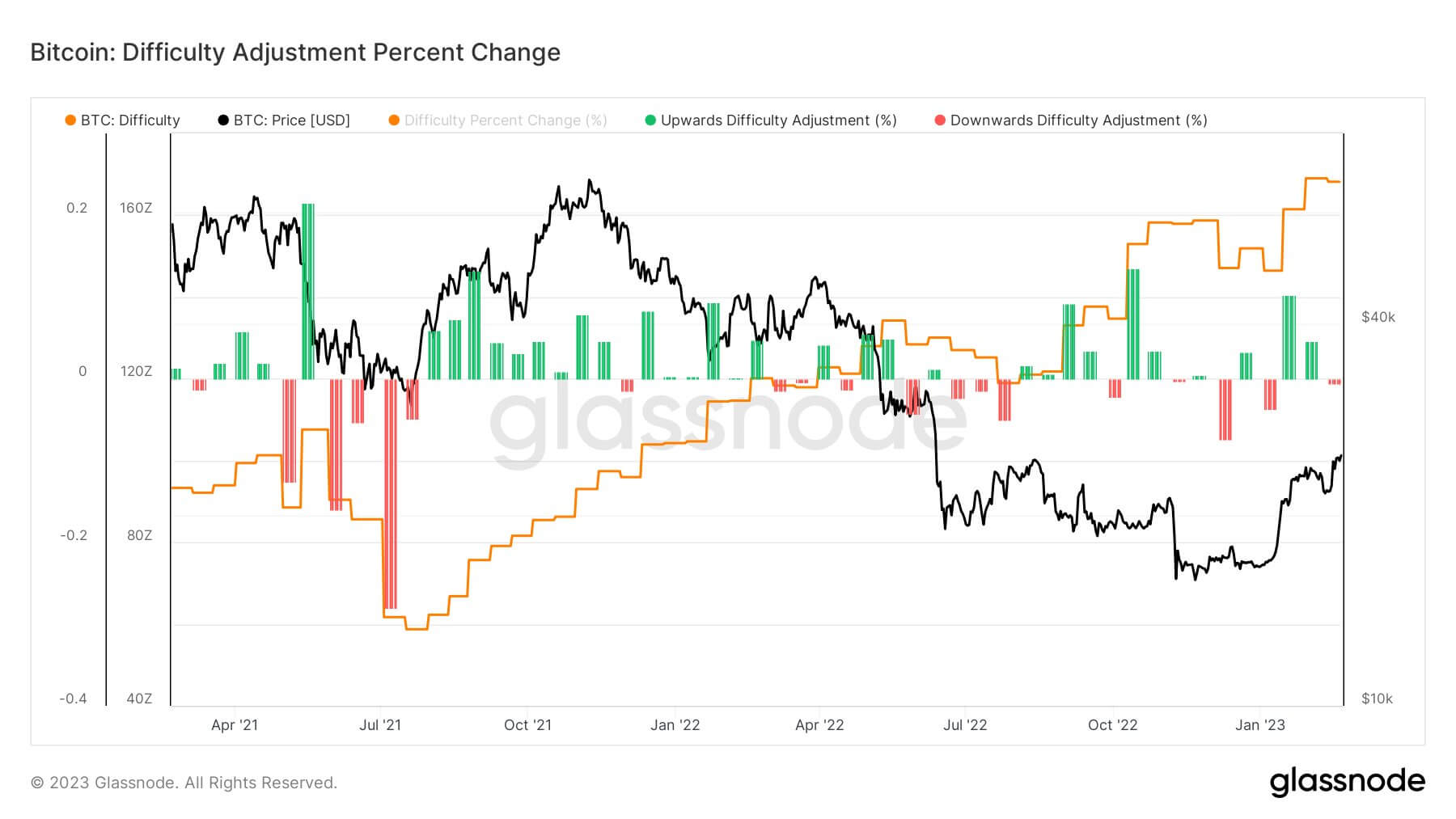

The growth in difficulty indicates the ever-increasing demand for Bitcoin and the technology that underpins it. Furthermore, higher difficulty means the security of the network is also more robust. The chart below depicts the stark rise in BTC difficulty since Jul. 2021, with just 13 negative difficulty adjustments out of the last 32.

In addition, a recent analysis of BTC public miner holdings found that they are in better health than last year, distributing Bitcoin to exchanges at multi-year lows.

In conclusion, the continued growth of the hash rate, coupled with positive adjustments in mining difficulty, demonstrates that Bitcoin is in a strong position. Public mining companies are playing a significant role in this growth, and their increasing hash rate share reflects the growing demand for Bitcoin.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Zcash

Zcash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur