DeFi Total Value Locked on Ethereum and Other Chains Decreasing to ‘Alarming’ Levels: DappRadar Report

A new DappRadar report is sounding the alarm over the sharp decrease of capital residing in the decentralized finance (DeFi) subsector.

The report highlights that the total value locked (TVL) in the DeFi space witnessed a massive 70% decline in just eight months.

According to the data acquisition and analysis firm, DeFi’s TVL hovered around $250 billion at the start of the year. The report says that DeFi’s TVL now stands at $74.21 billion, which it notes is an ‘alarming decrease.’

The TVL of a blockchain represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

The DappRadar report points to the sanctions imposed by the US government on crypto mixer Tornado Cash as a catalyst for the decline in DeFi’s TVL.

“(August) has been particularly difficult for the market because of the Tornado Cash crisis, and the TVL fell 10.47% month-over-month, losing about $8.7 billion.”

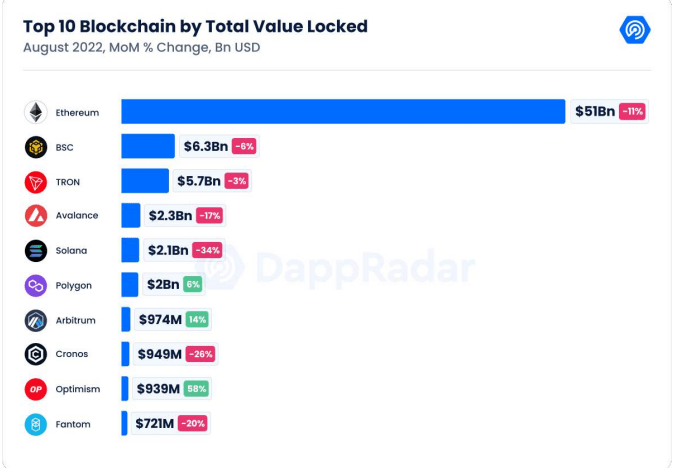

Standing out among its peers, Ethereum (ETH) remains the most popular chain, the report says.

“Ethereum continues to be the most prominent chain, controlling 69% of the DeFi TVL with $51.47 billion, which is 11% less than last month and 56.63% less than August 2021.”

The report also provides updates on the performance of other layer-1 chains in terms of TVL.

“BSC (Binance Smart Chain) has also decreased by 6.44% month-to-month and by an alarming 75.67% year-over-year. As a result of the wallet attack, Solana TVL dropped by 27% in the first four days of August, continued to decline by 6% for the remainder of the month, and is now valued at $2.11 billion, a loss of about $1 billion.”

Source: DappRadar

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Zcash

Zcash  Decred

Decred  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur