DeFiLlama Reports DeFi on Solana Is Basically “Wiped Out”

The total value locked (TVL) across major DeFi protocols has seen major dips following the FTX meltdown. Although the effects of this event have been jarring, data from DeFiLlama illustrates how FTX’s demise is starting to spread into decentralized markets.

Several DeFi projects on Solana were affected by the FTX drama. Most notably, the lending protocol Solend saw its TVL drop by 63.21% over the last two weeks.

Solana DeFi and TVL (Source: DeFiLlama)

Altcoin Daily took to Twitter on November 20 with information that further proves how much Solana was affected by the FTX collapse. According to the post, DeFi on Solana is now almost completely “wiped out”.

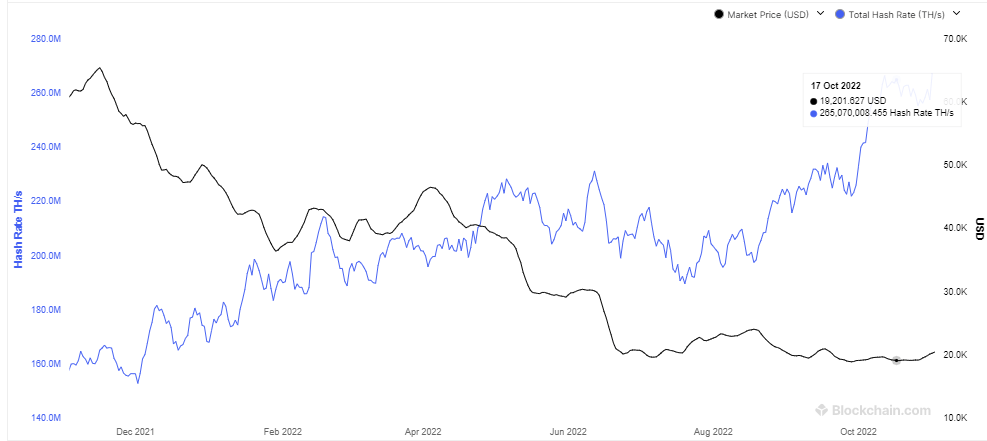

SOL / TetherUS 1D (Source: CoinMarketCap)

According to the crypto market tracking website CoinMarketCap, SOL is currently trading hands at $11.78 after a 9.48% drop in price over the last 24 hours, and after reaching a low of $11.61 over the same time period. In addition to this, the altcoin is also still in the red by more than 16% over the last week.

Over the last day, SOL also weakened against the two biggest cryptocurrencies in the market, Bitcoin (BTC) and Ethereum (ETH) by about 6.27% and 2.41% respectively. SOL’s 24 hour trading volume, however, is in the green by more than 50% to now stand at $543,270,323.

With its market cap of $4,278,294,445, SOL is currently the 16th biggest cryptocurrency in terms of market capitalization. This places SOL right behind Litecoin (LTC) in the 15th position and in front of UNUS SED LEO (LEO) in the 17th position.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur