Does Bitcoin’s Halving Cycle Affect Market Psychology?

Institutions are showing the green light, equities have rallied, Ether is waking up ahead of the fabled Merge, so where is Bitcoin among all this positive activity?

Regarding talk of sizable institutions showing interest in crypto, there is no larger asset manager than Blackrock, which recently announced that it was partnering with Coinbase to offer a private bitcoin trust for its institutional clients, enabling direct exposure to the prime digital asset.

For a couple of years now, a growing narrative around bitcoin has been that the institutions are coming. This has implied that when bitcoin starts to be accepted as a legitimate asset class, large investment entities will see it as requisite to include bitcoin allocation in their assets under management.

Having said that this should then create a snowball effect, or become game theory in action, as bitcoiners like to say (also referring to adoption by nation states), whereby no large buyer wants to be the last one on the board paying premium rates for its stack. On top of that, throw in retail FOMO, and the proposed view would then consist mainly of surging green candles and rampaging bulls. Or so the stories go.

Relatedly, we have bitcoin’s correlation with equities, which had, prior to crypto tanking heavily in June, become stronger than ever, suggesting that bitcoin might be migrating towards the financial mainstream.

Turning to Ethereum, we see a great deal of hype and anticipation around the Ethereum Merge, which will see the number two blockchain by market cap switch to a proof-of-stake protocol.

This is a long-anticipated event that is expected, potentially, to shake up and stimulate the crypto world, in which rising sentiment lifts all blockchain boats. Indications that the Merge will go ahead in September have been accompanied by a substantial recovery in the price of Ether.

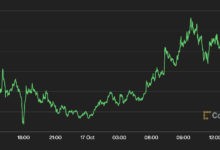

All of this means that bitcoin prices might be expected to rise, and to be clear, there has been upward movement. However, performance has not matched that of either equities or Ether, and, in general, has not tallied with bullish takes, taking into consideration the news of Blackrock and the extent to which such stories can sometimes move the market.

A Self-Enforcing Pattern

So, what does this indicate? Is the bear phase so deep, the macro still so bleak, and public interest so subdued that bitcoin’s response to ostensibly positive developments is tangible but heavily muted?

That doesn’t seem fully accurate, as the macro environment is not worse than it was earlier this year, crypto is moving on from the great unraveling of entities, such as Celsius and Three Arrows Capital, and market fear has calmed to an extent. As such, it is plausible that a further contributing factor in the equation may be the lore that has accumulated around bitcoin’s well-documented four-year halving cycles.

According to this received wisdom, bitcoin goes parabolic after its halvings (which occur roughly every four years), then crashes and slumps along, wounded, for a year or so, before starting to rally and resuscitate, leading to the next halving, and the cycle repeats.

Up to now, that pattern has held true, but let’s not forget that there have only ever been three bitcoin halvings, and during the first two of those (and arguably the third one too), bitcoin was such a fringe, nascent asset as to be massively sensitive and prone to enormous leaps up and down in price.

But, should we expect this four-year pattern to hold true forever? That seems a stretch as the asset gains weight and becomes progressively less likely, contrary to the warnings of naysayers, to disappear into tech obscurity like the Esperanto of finance.

However, what might contribute to holding the four-year halving pattern in place for longer, is crowd psychology, meaning that the pattern will strongly persist because, and only as long as, enough people believe that it will strongly persist, and act accordingly.

Currently, we perceive that macro is not good, but equities are coping and Ether is shrugging it off. In the case of bitcoin, is market hesitancy predominantly because of economy-induced caution, or is it because the doctrine of the four-year cycle is so somberly observed and adhered to that all rallies must be restrained as we bide our time waiting for the appointed season?

Changing Trends and Crypto Decouplings

It has been the case up to now that bitcoin leads and the rest of the crypto cohort, Ethereum included, follows on its tails, running up and then correcting in a delayed, reflected process.

However, Ethereum maxis have long talked about a crypto fable known as the flippening, which is when, theoretically, Ethereum’s market cap will exceed that of bitcoin. This has always sounded like an unlikely prospect, although Ether does currently appear nimble and good for takeoff.

What looks more plausible than a full flippening is simply that Ethereum can separate from bitcoin’s cycles and the two become less correlated with regard to price movements and surrounding sentiment, and in terms of what functions they are expected to perform (perhaps as a tech platform rather than as a currency, in Ethereum’s case).

And, if Bitcoin and Ethereum each separate off on their own, then some altcoins, particularly larger players with distinctive roles, can potentially do the same and start to perform according to their own individual merits.

For now, bitcoin’s established cycles hold, and crypto correlations between bitcoin, Ether and altcoins persist. Looking forward to the rest of this decade though, it seems likely that current crypto market characteristics will fade or be replaced as the blockchain sector continues to expand and make a meaningful mainstream impact on the world.

Critics have often labeled bitcoin as unpredictable, but that’s a misconception, as, in fact, its cycles up to now have been distinct and readable. Perhaps we should enjoy that cyclical clarity while it lasts, because bitcoin’s halvings may not function as such defining landmarks on the crypto map for much longer.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Zcash

Zcash  NEM

NEM  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur