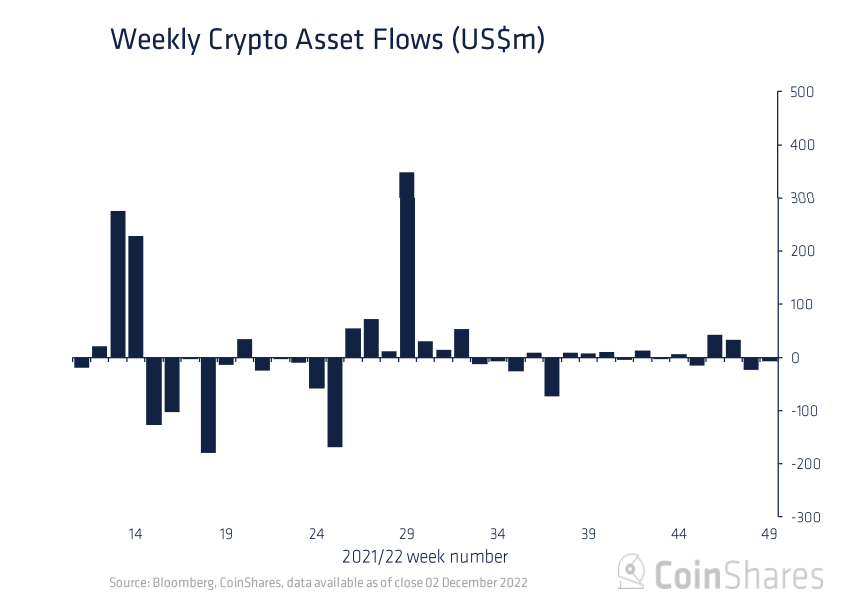

Dropping outflows across short-Bitcoin products indicate positive sentiment

The decreasing outflow volumes across short-Bitcoin products could be an indication of improving fundamentals as opportunistic investors rush to buy the dip.

On the other hand, digital asset investment products (mostly comprising short products) saw outflows totalling $7.5 million, while long products recorded $3.3 million.

Despite weeks of ravaging capitulation and negative Bitcoin sentiments triggered by the collapse of FTX, BTC investment products saw inflows totalling $11 million. Therefore indicating improvement in sentiments around the leading coin.

According to the data by Coinshares, Solana and Polygon recorded inflows totalling $0.2 and $0.3 million respectively, while Litecoin and Polkadot recorded $0.9 and $0.4 million in total outflows, respectively.

Unfortunately, Ethereum data showed substantial outflows ($4 million) for the third consecutive week, which could have stemmed from uncertainties on the right time for transitioning to proof-of-stake.

The data also recorded inflows across major regions where Canada led the pack with $12 million, followed by Germany with $3.2 million. On the other hand, the United States recorded the largest outflows totalling $15 million, for which about 75% comprised short investment products.

Reducing outflows across short-Bitcoin products is a good sign which often denotes investors are not looking for shorting opportunities but instead accumulating more digital assets for the long term. When these investors are short, they are betting the price of Bitcoin is going to record further declines.

As of this writing, BTC is trading at $16,950 and has been struggling to break a pivot resistance at $17,494. This shows Bitcoin has already plunged and retracing downwards below the current price could signal an imminent bottom. According to previous reports by CryptoSlate, the aSOPR indicator flashed alerts for a new Bitcoin bottom.

»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur