Research: Only 150K Bitcoin remain in Future OI as switch to risk-off fast approaches

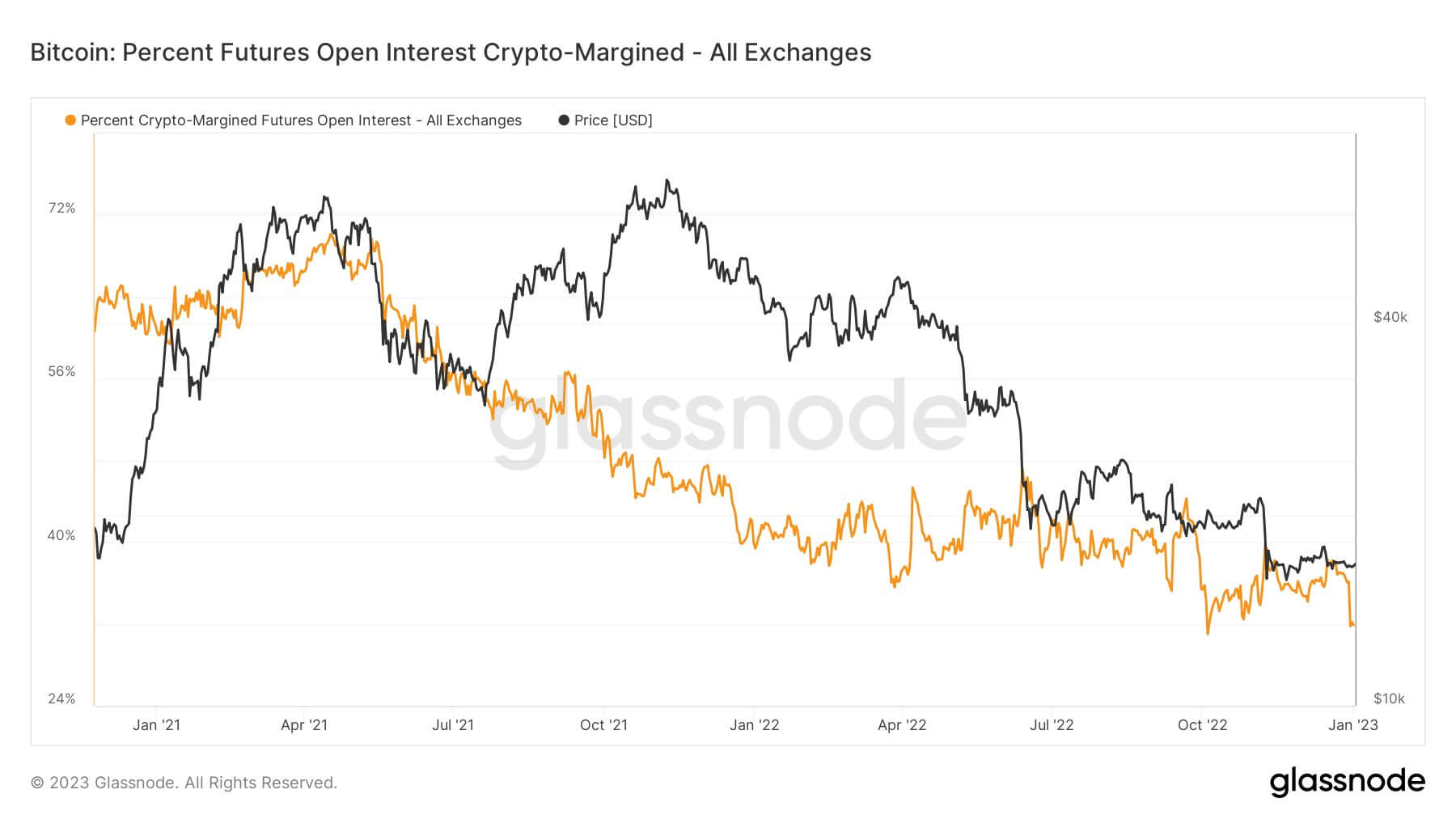

Bitcoin (BTC) began the year risk-off — as seen in the Futures Open Interest (OI) Crypto-Margined metric displayed below.

The decline in BTC Futures OI percentage seen from July 2021 into 2022 portrayed a recovery into a risk-on narrative throughout 2022. However, starting at almost the lowest point in two years, risk is coming off the table fast as we begin 2023.

Throughout 2021, over 60% of Futures contracts were using BTC as the underlying asset — lending to the risk-on narrative as BTC is more volatile compared to a stablecoin.

Meanwhile, in 2022, crypto-backed margin remained relatively flat in the 35% to 40% range — lower than 2021, but suggestive of stability returning. However, a 15% adjustment to the downside as we begin 2023 indicates that risk is coming off fast into the first quarter.

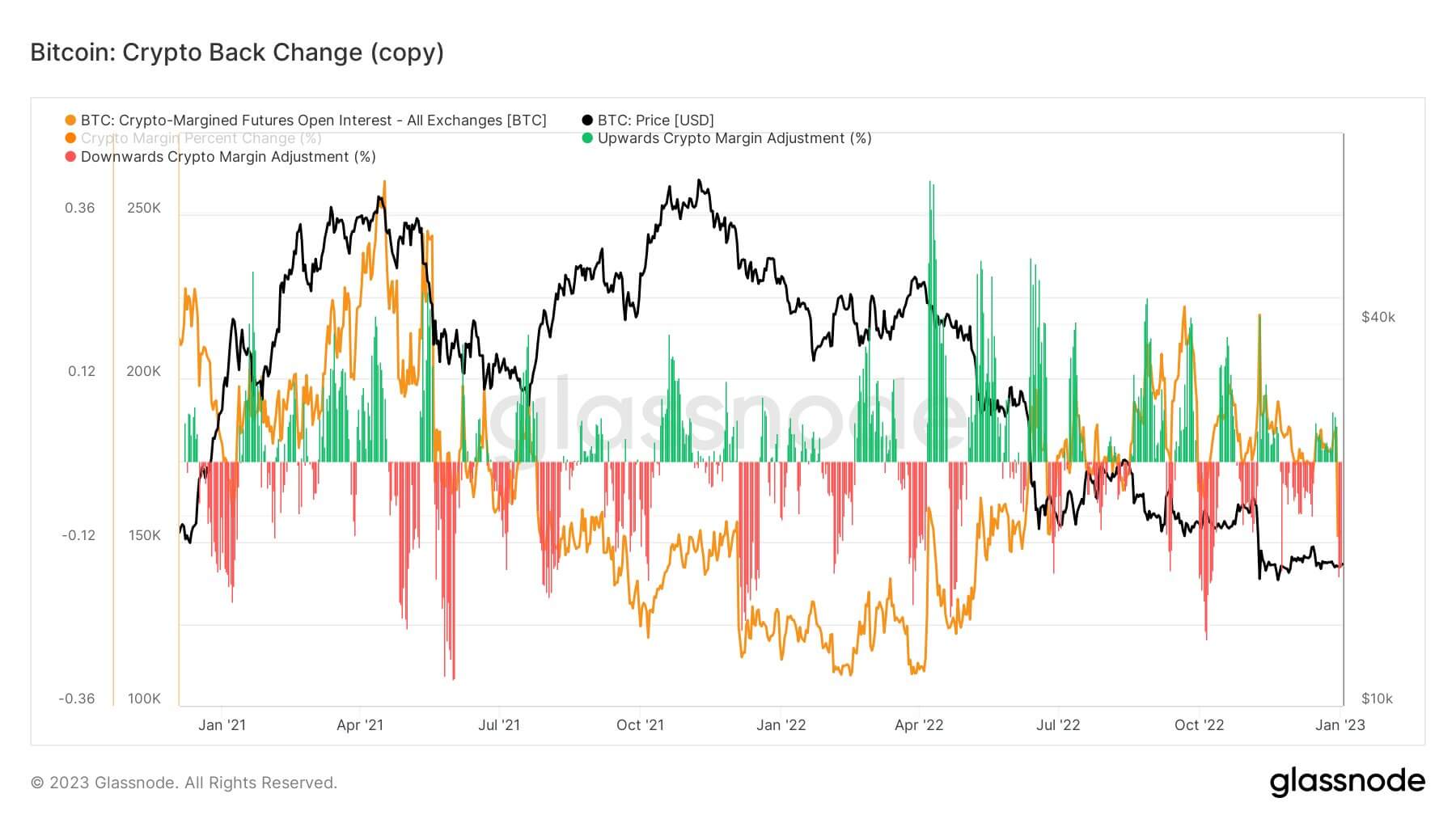

Crypto-backed margin also fell similarly on four previous occasions:

- In May 2021 following the China ban on crypto

- Between November and December 2021 just after the all-time high (ATH)

- In April 2022 around the Luna collapse

- In October 2022 with the lead up to the FTX collapse entering a rocky Q4 from a macro standpoint.

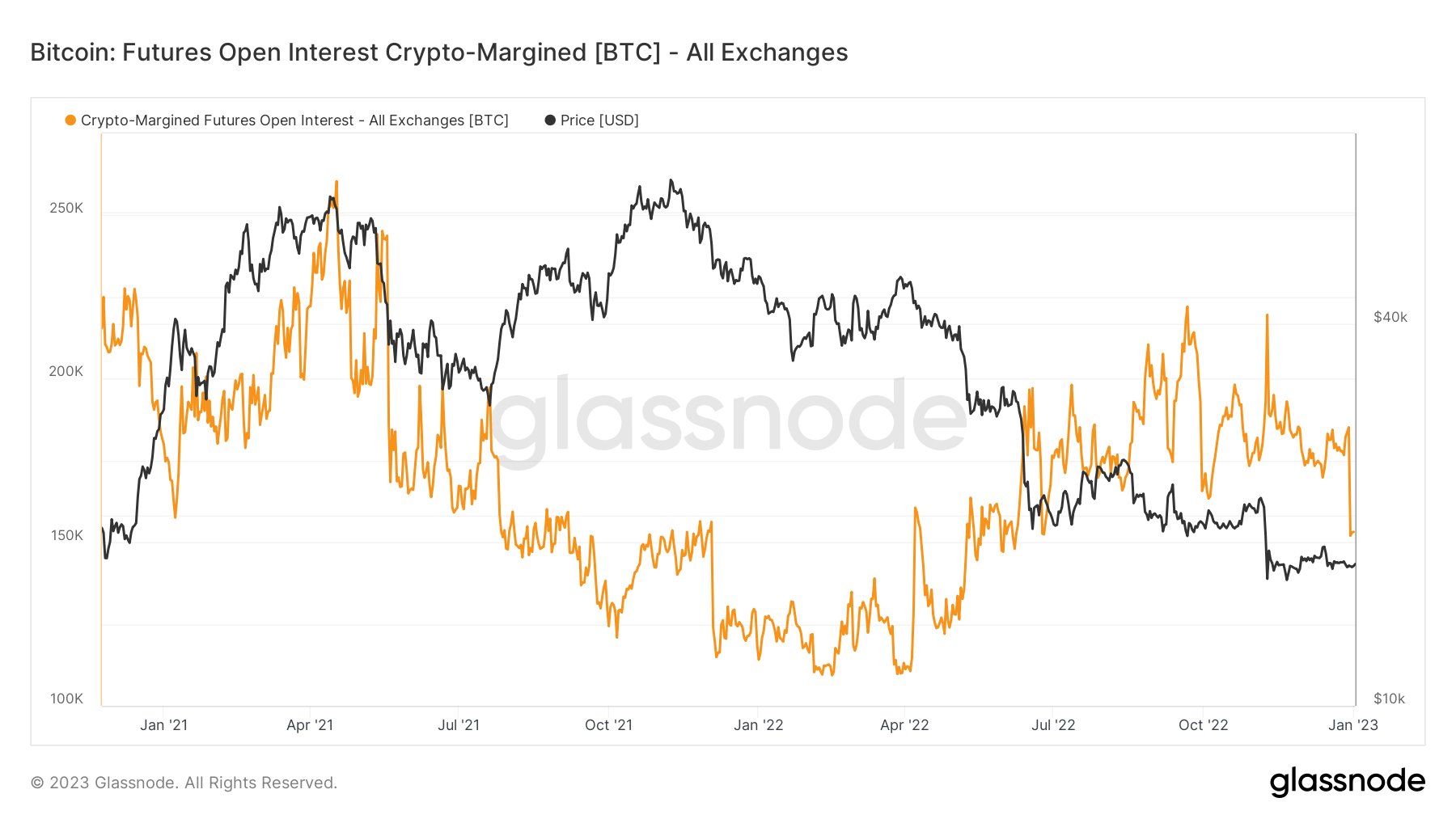

Approximately 150,000 BTC remains in Futures OI — its lowest levels since April 2022 — as the risk-off trend decline continues to emerge.

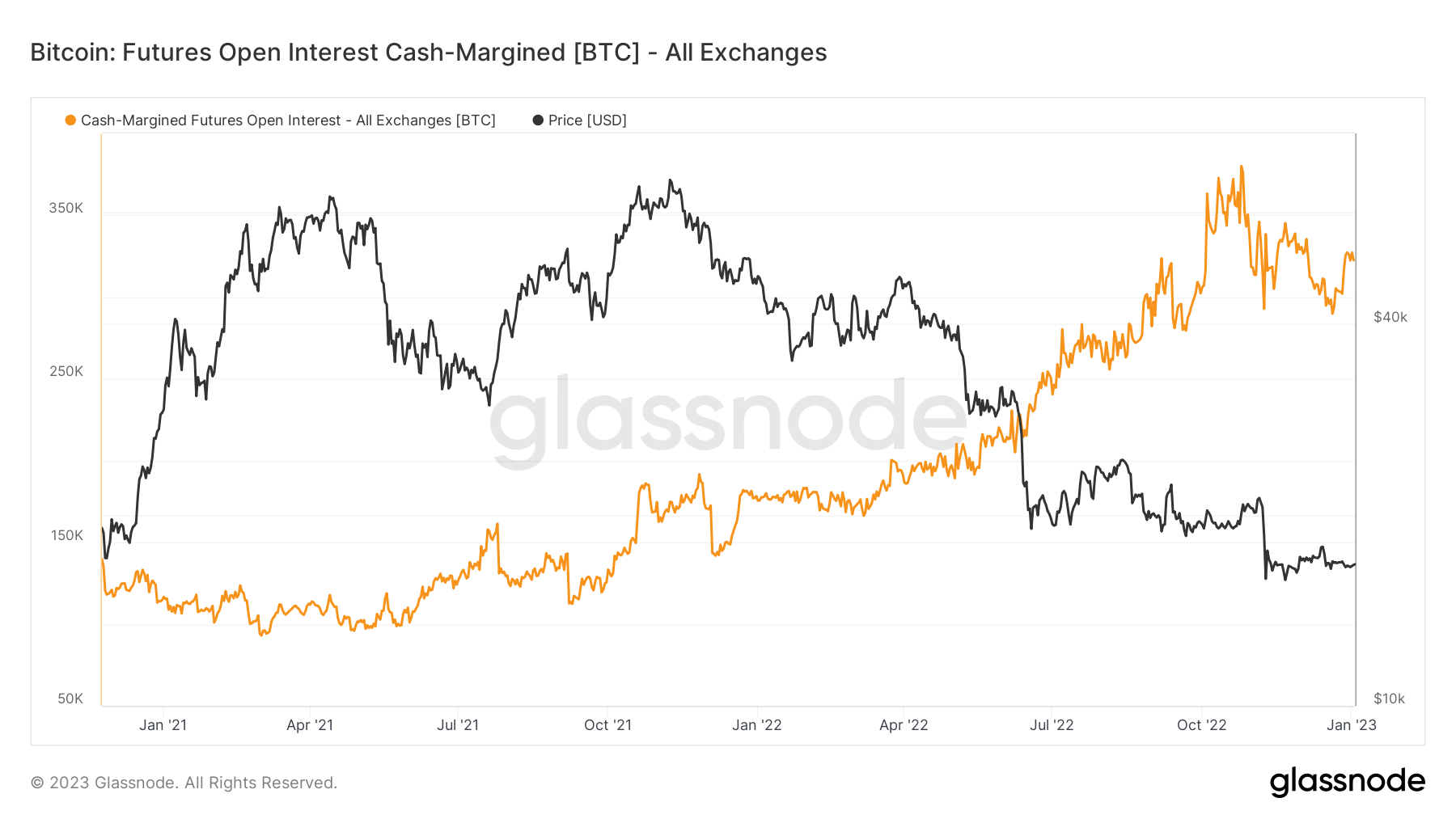

To further reveal the distinct switch away from BTC to risk-off and cash, the ‘Cash-Margined’ metric shows a constant incline since April 2021 to a current level of 327,000 BTC — backed by cash as the underlying asset.

Disclaimer: The levels displayed only represent exchanges covered in Glassnode data.

»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Dash

Dash  Ontology

Ontology  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur